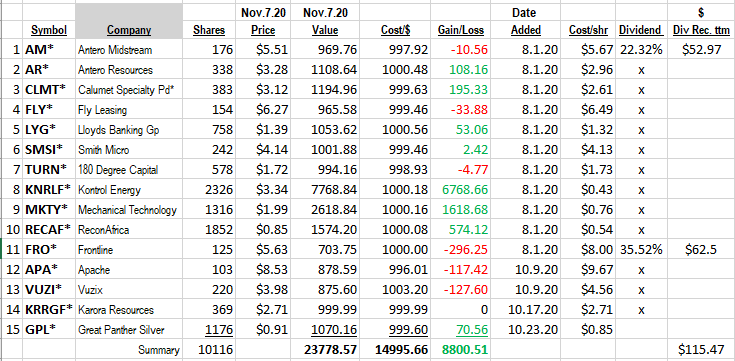

Ten Under $10 for the Double was started Aug 1, 2020.

Ten under $10 for the Double:

- Reminder that this is a dynamic list so we will hold positions greater or less than ten in the portfolio. During neutral and positive trending markets, we will expand this list. However, when the over-all trend begins to decline, we will shrinking this list and will add to the companies we consider “core” positions. This strategy is not for the weak of heart or stomach. It has produced big gains over multiple market cycles for our accounts. This strategy is part of our risk management policy. Weed out the weak and rally around (buy) the fundamentally strong when the price is weak.

Selling Some Name this week:

This week we will exit FLY* (Fly Leasing) and Lloyds Banking Group (LYG)*. We do not see a catalyst in these companies that we can identify as happening in less than one year. They are healthy enough financially for us but as in the case of Smith Micro, they are lumpy quarter by quarter and though

In the case of Lloyds, we expected the dividend to be reinstated shortly after or during Q1 2021. That seems unlikely now based on comments from the government. In addition, the second wave outbreak of COVID-19, seems likely to delay the economic recovery and keep the housing / mortgage market weak. Lloyds is the largest mortgage company in England. We have no doubt in the ability of Lloyds to double in price, but we lost clarity on the “when”. We will move Lloyds to the back-up watch list and monitor for a reason to return to them.

Fly Leasing is a more distinct sell. Leasing rates were trending downwards before the Covid outbreak. Now they are renegotiating and/or delaying payments. The outlook is also unclear so we will set this company back to the watch-list as well. We have other Leasing companies on out jet plane leasing watch list so you might see them pop up when we see technical or fundamental reason to get the “when” answered.

This week, we will add/buy, MNRL (Brigham Minerals) $9.02 dividend of apx 8% this week on Monday. We see the current sell off in the oil patch as opportunist buying opportunity.

- Balance sheet: Pure, by that we mean debt free.

- Shareholder friendly: The company’s founder and chairman, Bud Brigham is focused on survival first. The oil and Gas industry is a boom bust industry one uses the bust period to expand and the Boom period to prepare for the opportunity during the bust period. There for we expect MNRL top become more aggressive during this bust period. But the company has not forgotten its shareholders. Because they are prepared for the industry bust, they have declared that they will pay 95% of free cash flow to shareholders as a dividend. For the second quarter of 2020 they paid $0.14 Vs $0.37 in Q1. For Q3 MNRL will increase the dividend to $0.24. Nice.

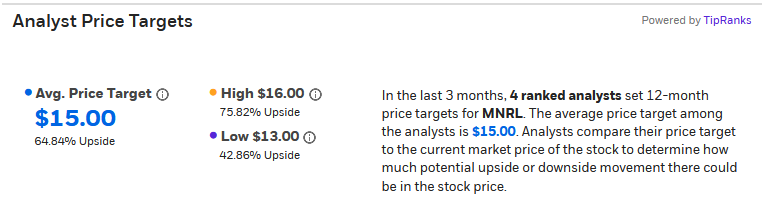

- Catalyst for a Double: Debt free and cash flow positive MNRL is ready for the recovery. When will that happen? Yes, that is uncertain. Goldman Sachs is suggesting the Vaccine for Covid-19 will emerge in Q1 2021. This will allow the return to more normal activity thus increasing the demand for energy. At the same time the industry will not begin exploration and development until oil is above $50 at a minimum. This will cause oil & gas prices to rise. The when second half of 2021. Not that far away. The average price target for MNRL that has been issued in the last 90 days is $15.00. That’s not a double, but it is a Strong Buy and significantly higher price than todays. With minimal risk. Debt free with a higher than normal dividend.

Next week is an exciting week:

Calumet (CLMT)* $3.12

CLMT experienced a Bear Raid on Friday dropping from $3.64 close on Thursday to $2.70 on Friday. No negative news in its earnings report with two large divisions under consideration for sale. Too Cheap. If you can buy this on Mondays opening under $3.00 we believe it is a good deal! Our long-term target price is above $10.00

Mechanical Tech (MKTY)* $1.99

The earnings release will allow publicity to get out MKTY’s growth initiative in Alternative Energy, Crypto Mining, Bitcoin and Data Centers. Our target for MKTY is $100 million market cap on 17 million shares outstanding. That would allow for a potential, 5 million share secondary in 2021. Therefore, our target price is $5.88. With excitement and greed, the price could go higher which I expect.

180 Degree Capital (TURN)* $1.72

Turn is trading with a price of $1.72 and an anticipated NAV (net asset Value) of close to three dollars to be announced this week. That is too big a discount. TURN is a closed end fund (like) assets management company. A 20% discount to NAV would be more normal. That would present a very short-term (next couple of weeks) target price of $2.40.

Consider signing up for our free daily noted for more comments on these and other stock ideas at www.LivingOffTheMarket.com

Questions? Send an email to Money@LivingOffTheMarket.com

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()