INVESTMENT Comments on companies mentioned:

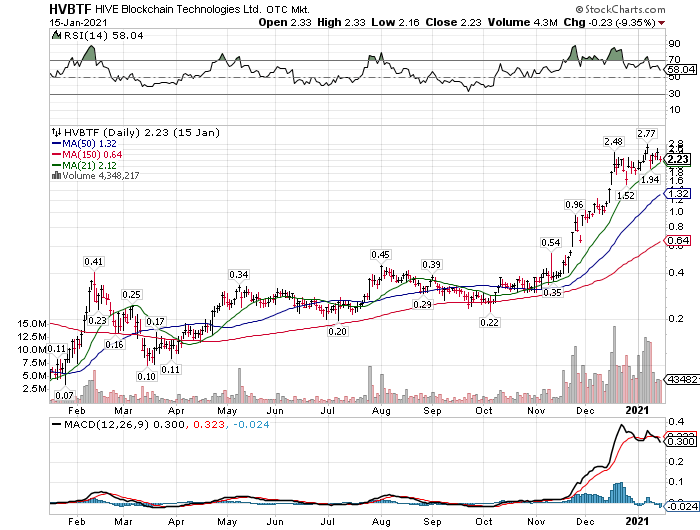

- HIVE Blockchain (HVBTF) $2.23 – Short-term Hold or Accumulate slowly

- US Global (GROW) $5.73 – Short-term Hold

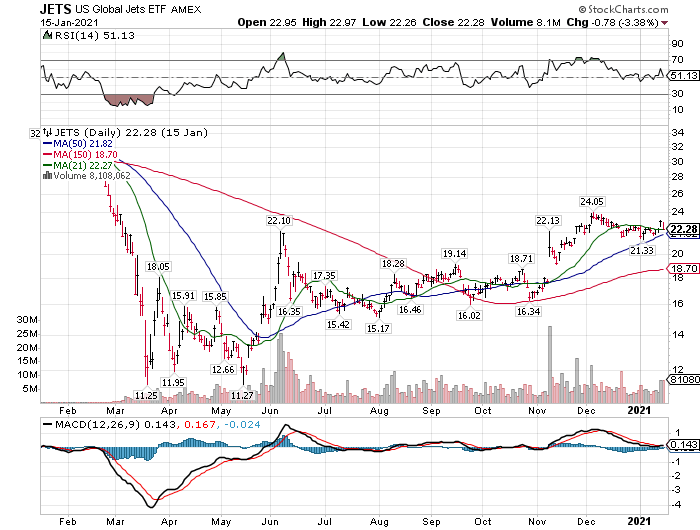

- ETF JETS $22.28 – Short-term Buy

- Mining Industry – Accumulate slowly

- Crypto Currency – Accumulate slowly

- Linked below is a Kitco interview with Frank Holmes, Interim Executive Chairman of HIVE Blockchain and Chief Executive and Chief Investment Officer at U.S. Global Investors. U.S. Global specializes in natural resources and emerging markets investing.

Frank talks his book (where he invested) in the following areas:

- Go Green because that’s where governments around the world have incentives to do so.

- Mining Industry – Cannot “Go Green” without minerals – Silver, Copper, Nickel, Cobalt

- Digital Economy – Blockchain and Crypto

The green economy will be the outperforming sector of 2021 says Frank Holmes

Kitco Jan 14, 2021 – 14 minutes

Frank’s Comments are on Minerals and Miners in the Government led Green Economy. About half of the conversation is his excitement about alt-energy sources for Data Centers, Blockchain & Crypto.

Press Release:

Nov 13, 2020 HIVE Blockchain has entered into an Agreement to buy GPU.One’s New 50 MW Campus of Data Centres in New Brunswick

HIVE Blockchain (HVBTF) $2.23

- 365 fully diluted shares outstanding

- Market cap – $857 million

We are not suggesting HIVE as an investment… … We like HIVE, they seem well managed – Frank Holmes is a known quantity with a good reputation in the gold, silver and investment management world. The share count outstanding at HIVE is higher than we like, but that can be changed with a reverse split. I like the data center move HIVE is doing. It is similar to what MKTY is doing. It is a long-term plan and more stable than a company that is a crypto miner only. We follow the company on our Small Crypto Miner List. We still are cheering for MKTY (Market Cap $50 million) to reach the Market Cap HIVE has.

Holmes” asset management company is of interest to us. U.S. Global Investors (GROW) $5.73. I also have an interest in their ETF JETS – FUND DETAILS Data as of 01/15/2021.

GROW: Asset Management company in Mining Digital Economy Blockchain

HVBTF: Crypto Alt-Energy Data Centers

ETF JETS: Airlines Airports and Support Industries for the Air Transport Industry

TECHNICAL COMMENT – JETS – HVBTF – GROW: We are looking at the 1) MACD, 2) (RSI) Relative Strength Indicators and Chart Pattern.

- RSI: We see a falling indicator when the reading is above 70% and then falls below 70% – all three stock have done this.

- MACD: Two of the three have negative reading with falling signal GROW and HIVE. JETS is in early rising signal.

- CHART PATTERN: JETS appears to be consolidating a rising chart pattern – a positive. HIVE Appears to be in a rising chart pattern but extended. Possibly a topping pattern but too early to tell. GROW– Extended – Right industry at the right time but could be entering a deeper correction phase. We suggest monitoring for a lower price entry point.

We would buy JETS at this time but wait on the other two for now.

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()