Important Points to Valuation:

- Net Asset Value is $9.81 with cash & publicly traded securities only, NAV is at $7.38

- With the stock price at $6.25, shares are trading at a discount to cash/public NAV of 15.3% and overall NAV of 29.9%.

- Total AUM is $68 million. “The Plan” as expressed by Kevin Rendino, Chairman & CEO, is to pay an annual, “special year-end dividend” of between $0.50 and $1.00 once UAM crosses $100 million.

- Insiders buying is impressive and constant over years of time. Management has made a commitment to accumulate shares. Scroll to the bottom of the page linked here to see insider buying since 2019.

- Key Stats:

- Shares outstanding: 10.37 million – Float: 9.51 shares

- Employees: 7

- Ownership: 25% by Institutions – 7.8% by Insiders

- Price to Book: 0.58 – An exceptional number when considering the high degree of liquidity of the assets.

- Negative Features:

- Small float makes the stock volatile and difficult to exit at times at favorable prices in bear markets.

- Subject to sector classification “micro-cap value” being out of favor at times.

- Positive Features:

- In times of bear market panic liquidations, the price of TURN could fall to an incredibly low price and rebound quickly. While volatility is high, risk is low as it is a portfolio of companies are ready owned by TURN as deep value opportunities. Assets could be bought at fire sale prices with low risk.

- Price discount to NAV of 30% is attractive now.

- Management is deeply aligned with shareholders.

- Low risk (but could be volatile)

Press Release on most recent quarter.

4:05 PM ET 5/11/22 | GlobeNewswire

180 Degree Capital Corp. Reports $9.81 Net Asset Value Per Share, an 8% Decline From the Prior Quarter, and Cash and Securities of Public and Related Companies of $64.2 Million, or $6.19 Per Share, as of March 31, 2022

Pro Forma Cash and Securities of Public Companies Including Proceeds From the Sale of Petra Pharma Milestones and TARA Biosystems First Payment of $76.6 Million, or $7.38 Per Share.

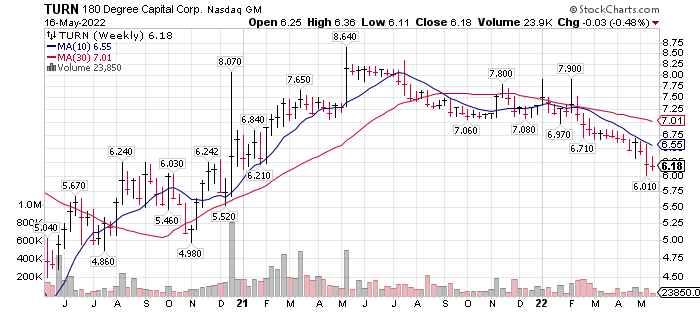

Long-term price history:

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()