- Too Rapidly a Rising US Dollar – The Milkshake Theory

- Rapidly Rising Dollar increases Inflation outside the United States

- Rapidly Rising Inflation Causes Civil Unrest from food and energy shortages.

- This is still the decade Commodities until it is not.

- Nat Gas favorites – EQT & VET

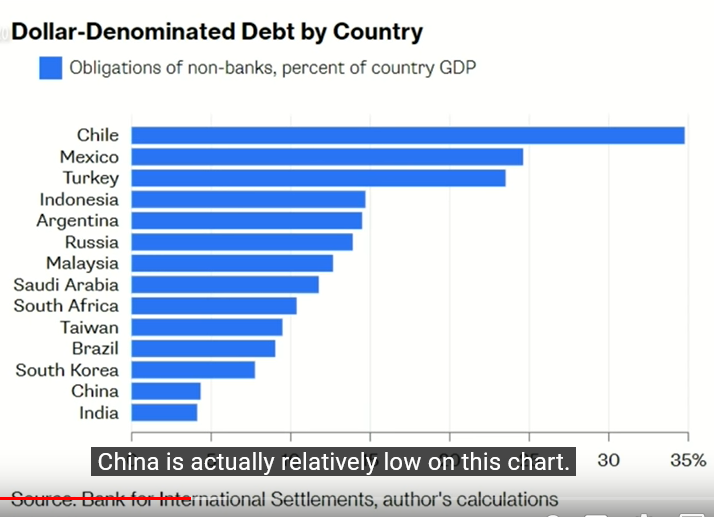

A rapidly rising US Dollar is shaking up financial markets around the world. It causes problems in other countries through a shortage of US dollars to make payments on US Dollar denominated debt, for the purchase of imports and resulting inflation.

- The Dollar Milkshake Theory Explained in six minutes September 7, 2021

In the Dollar Milkshake Theory, the US dollar rises so fast that other countries that use US dollars as the global currency reserve, have to print more of their currencies to meet the financial obligations created by the rapidly rising US dollar. This causes the local inflation to rise. It also causes the US Dollar to spiral higher as other countries buy US$ to their needed uses.

In this way the United States exports its inflation to other governments. Not so bad for us, but a big problem for others and it eventually rolls back to the United States. Eventually we (the world) could have a currency crisis somewhere.

This rapidly rising US Dollar has happened before in 1985. The United States and the remaining G5 countries got together and did the Plaza Accords. This was repeated in 2016 with many in the current administration participating. Basically, at these meeting governments colluded to weaken the US Dollar. We might need something like this again to prevent global financial distress from happening.

Here are some global comments as to what is starting to unfold

- Why are there protests in Peru 2022? – Wikipedia 2022

The protests occurred amid rising fertilizer and fuel prices resulting from Western sanctions against Russia following the 2022 Russian invasion of Ukraine, beginning in the days after an effort to impeach President Castillo failed.

- Rising Social Unrest Over Energy, Food Shortages Threatens Global Stability – Forbes July 10, 2022

The nation of Sri Lanka has an almost perfect ESG rating of 98.1 on a scale of 100, according to WorldEconomics.com. But the government which had forced the nation to achieve that virtue-signaling target in recent years collapsed over the weekend because it led the country into self-declared bankruptcy, leaving it unable to purchase adequate supplies of fuel and feed its population. Is this the beginning?

According to the Verisk Civil Unrest Index Projections, 75 countries will likely see an increase in protests by late 2022.

Many governments are too indebted to cushion the blow to living standards. Around the globe: ALMATY, COLOMBO, ISTANBUL, KAMPALA, LIMA AND TUNIS –“My money is worthless.”

The culprits of the unrest – Food, Energy & Fertilizers:

The LOTM Theme for the near future has been 2020 decade is the decade of Commodities.

- Nat Gas stocks are favorites

- Fertilizer stocks aren’t favorites but worth consideration.

- Various ETFs with a mining or farming theme for more general investing.

- Longer-term we have a suggestion for a cure for the shortage in base-load energy. That cure is Nuclear Power and our suggestion in Uranium.

Expect more food shortages, higher energy prices, lower crop yields, and eventually going Nuclear will produce higher uranium prices.

Timing:

As you well know by the price of commodities, Crypto and small company equities – down sharply in the past three to five months – the rising US$, fear of a recession, and fear of a liquidity squeeze, have been painful to put it mildly. I believe the Plaza Accords in 1985 were public and therefore got its named. The 2016 meetings were private so it is likely, if or when there is a coordinated effort to bring the US Dollar lower, you and I will probably not know about it. Therefore, we might want to watch the dollar on a weekly basis. Once the US$ backs off, we are back into a risk on market for growth and likely bonds. Since accounts related to LOTM did not exit the market for cash, we are in a slow accumulation mode on existing positions as we get cash to add to the market. The miners are exceptional cheap and can be slowly added to on weakness. I am not afraid of them though one can never rule anything out.

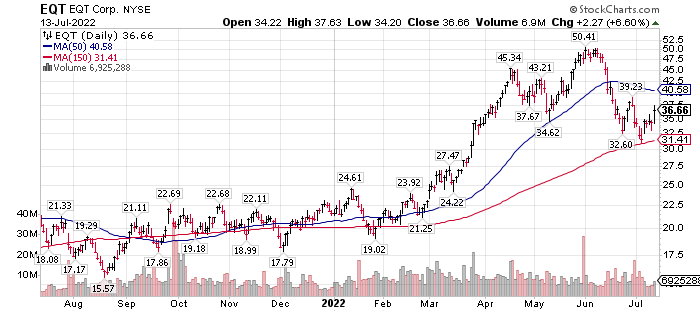

Here are two ideas that could have a nice rally into the spring of 2023. They are part of the regular LOTM conversation. They are strong players in the Nat Gas and energy arena. One is the US industry leader by volume of Nat Gas sold – EQT Corp (EQT)* $36.66.

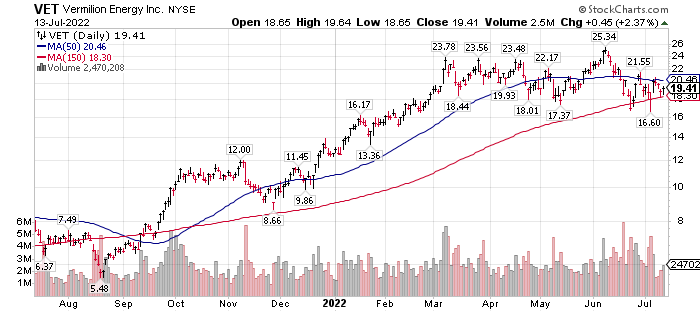

The other (below) is a smaller, but still an international player in oil and gas, with Nat Gas fields in Eastern Europe. Perfect to benefit from Nat Gas shortages if they happen in Germany next winter. This of course is Vermilion Energy (VET)* $19.41

Both of these companies have stated that they plan to increase dividends and do share buybacks as ways to return capital for shareholders.

Both stocks give one the opportunity to buy into weakness and sell into sharp strength or simply accumulate on weakness. I like this at this time for a buy for the winter heating season and owning longer term as core energy positions.

EQT: TipRanks target price: $53.00 Fwd P/E of 5.8 – dividend 1.36%, expect it to increase.

VET: TipRanks target price: $28.38 Fwd P/E of 3.02 – dividend 1.24%, expect it to increase.

A currency problem might originate from this list of countries.

Source linked here. Video by Brent Johnson who names the Milkshake Theory. Dated November 2020

Written July 13, 2022, by Tom Linzmeier / #LivingOffTheMarket.com

Key words #milkshaketheory #EQT #VET #inflation #dollardebt #Naturalresources #naturalgas #stocks #equities

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()