Beam (BEAM)* is the leading performer in the Genetic / BioScience sector. Since June 13th Bean has moved from $28 to its current price of $52 per share. Beam in our opinion has great potential but is still a story stock until revenue is flowing – which it is not now. This move is strictly technical in nature IMO. At this stage we’d be a bit careful and treat Beam as a trading number and work it technically only. You can check the fundamental stats page linked here.

It appears Beam (genomic stocks) could be a “risk on trade” as anticipation is building that the commodity price collapse will cause the Fed to at pause its interest rate hikes following the anticipated July hike.

- Check the Cotton chart here Check the Copper chart here

- Check the Lumber chart here Check the Corn chart here

The sharp drop in commodity prices “should” allow the inflation numbers to drop in August and September. I expect Nat Gas to be a very strong performer this winter as shortages could appear during the winter heating season. Buy your Nat Gas stocks this summer on the Nat Gas price weakness as a side comment.

Look for a few more days of weakness in Beam towards the $46 – $48 level for a trade. It could retreat and test as low as the 45-day moving average around $38, but you might start staging in for a trade with another 5% to 7% retreat from the current price of $51.

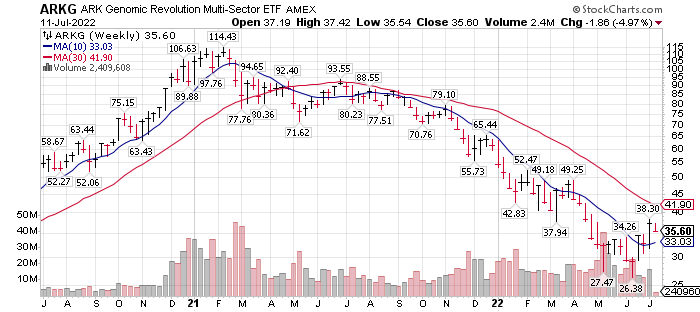

While Beam is the performance leader of the genomic pack of companies, ARK Genomics (ARKG) ETF is a secondary and less volatile way to play the group. I would call on ARKG as a way to get exposure to the sector for a longer-term play in the industry. I am still leaning into expecting more rate hikes after the November elections. Therefore, the Genomics group is a trade for me at this time. One can never say for sure, however.

Six month daily Chart:

Two year weekly chart:

It is always goo to see the perspective of short and long term patterns even it short-term trading. A 5% correction in ARKG is about right for an initial trade position. NOTE: I always like to make three purchases even when day-trading to average out my cost. My stop loss price is then based on the average cost of the three purchases. This is a probabilities game so anything you can do to increase your probability of success helps. Guessing is not as productive or consistent as a disciplined strategy. The market is more random than a disciplined strategy so consider that you have to be the constant in the randomness of market action.

That’s about it. Trading suggestions as long as we have a risk on market.

Have a great day! Tom.

Written by Tom Linzmeier @ #LivingOffTheMarket.com on July 11, 2022.

Keywords: #stocks #genomicstocks #biotech #bioscience #riskonstocks #growthstocks #marketstrategy

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()