Calumet Specialty (CLMT)* $12.94 was added to the LOTM: Ten Under $10 at a price of $2.61 in August 2020. The goal od Ten Under $10 is a double in price in one to two years. Calumet is running better than most Ten Under $10 picks, but it is not our best stock pick.

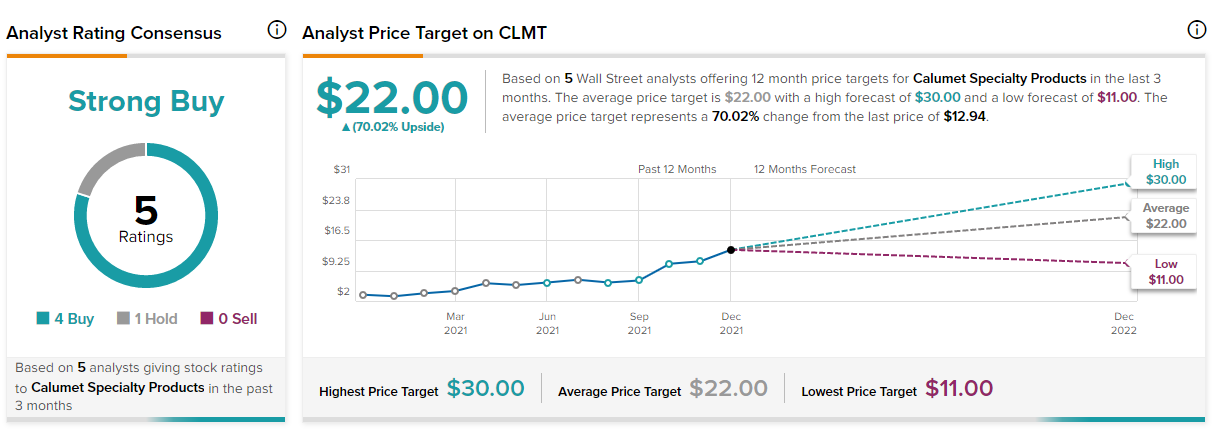

CLMT is on a promotional tear with two brokers picking $22 and $30 price targets. That would be great from the posting price in the Ten Under $$10 price of $2.61 wouldn’t it.

Here is what Zacks says about CLMT: There are several stocks that currently pass through the (Zacks’) screen and Calumet Specialty Products Partners, L.P. is one of them. Here are the key reasons why this stock is a great candidate.

Investors’ growing interest in a stock is reflected in its recent price increase. A price change of 45.6% over the past four weeks positions the stock of this company well in this regard.

While any stock can see a spike in price for a short period, it takes a real momentum player to deliver positive returns for a longer time frame. CLMT meets this criterion too, as the stock gained 98.3% over the past 12 weeks.

Moreover, the momentum for CLMT is fast paced, as the stock currently has a beta of 2.57. This indicates that the stock moves 157% higher than the market in either direction.

Given this price performance, it is no surprise that CLMT has a Momentum Score of B, which indicates that this is the right time to enter the stock to take advantage of the momentum with the highest probability of success.

In addition to a favorable Momentum Score, an upward trend in earnings estimate revisions has helped CLMT earn a Zacks Rank #2 (Buy). Our research shows that the momentum-effect is quite strong among Zacks Rank #1 and #2 stocks. That’s because as covering analysts raise their earnings estimates for a stock, more and more investors take an interest in it, helping its price race to keep up.

Most importantly, despite possessing fast-paced momentum features, CLMT is trading at a reasonable valuation. In terms of Price-to-Sales ratio, which is considered as one of the best valuation metrics, the stock looks quite cheap now. CLMT is currently trading at 0.42 times its sales. In other words, investors need to pay only 42 cents for each dollar of sales.

So, CLMT appears to have plenty of room to run, and that too at a fast pace.

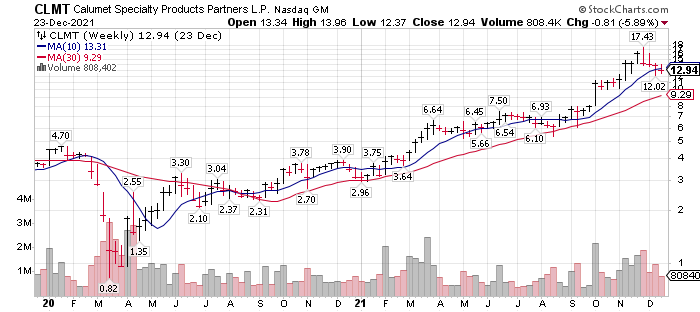

Two year weekly chart:

I would like to see the share price touch its 30 week moving average before buying more but that is only a downward, wishful thinking, momentum price target. Fundamentally the company is set to have an outstanding 2022 and ’23. If you don’t own CLMT, you might buy a little and dollar-cost-average into weaker prices. I understand I am breaking a stated rule of technical analysis – never averaging down. I have to say, I have made far more money dollar-cost-averaging than I have using stop losses. So, here is a compromise. Make at least three equal dollar purchases with the first one being your highest price. After three equal dollar purchases, average your cost. Place a 12% stop loss on your average cost. One more thing – don’t buy just because it is a lower price than your first purchase – look at support lines and moving average lines and buy at their support. Since the price is just now at the 10 week average (support) we are comfortable buying the first third now.

What does Calumet do?

- It is a specialty products refiner from oil and bio-fuels feedstock. Calumet has both branded product and component products to companies like WD-40 and L’Oreal. Calumet is transitioning from Refiner classification to being a Specialty Chemical company. This will help in the valuation factor as Specialty Chemical companies trade at higher multiples that Refiners.

Why is Calumet getting attention? Multiple reasons.

- Most of the rally phase in Calumet share price coincides with the rotation out of Growth stocks to Value stocks.

- In addition, Calumet is a commodity based refiner. Refining companies are also gaining rotational favor. There has also been a rotation into commodity stocks. Perhaps these are one and the same reasons.

- Calumet is converting one of the most modern oil refining operations (Great Falls, Montana) in the USA to a combination Oil and Bio-fuel refining operation. This will expand an already strong cash flow situation for Calumet.

- Calumet is seeing strong demand in its higher profit margin Branded Specialty Oils business.

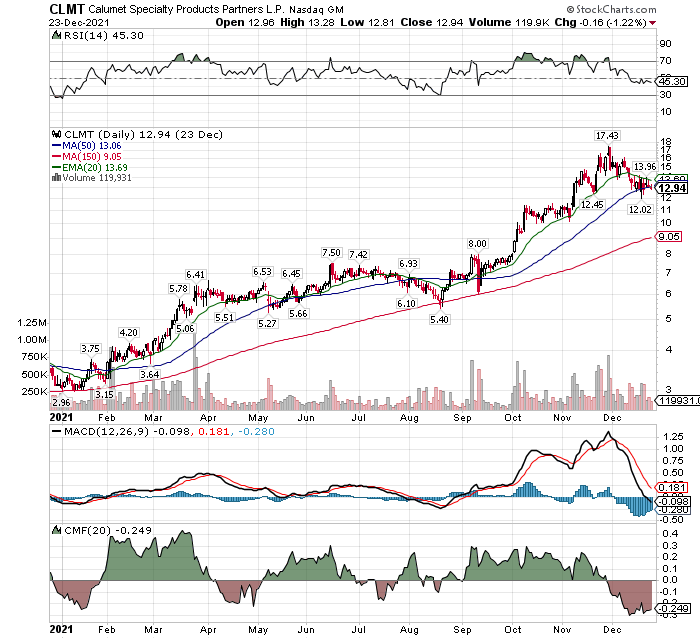

Technical position:

- Calumet is deep into stage-two price phase. The price at $12.94 is up more than four fold since August 2020 and more than 13 fold from its low price March 2020. It is true we like to buy positions in stocks when they are in late stage one chart phase – the basing phase but the trend for fundamental development is still early and we believe there is room for one more double. Unfortunately, we now have broker/analysts now saying the same thing. To us that is late in the price movement game when looking for three to five-fold moves. Never-the-less the compounding factor on the $2.94 price in a further move from $12.94 to $25 is a powerful compounding feature. We do think this stock fits a traders/momentum players profile than a deep values. Never the less, the price to twelve months cash flows are still very low.

One year chart:

The stock is a bit over-sold. Expect a rally back into the $15/$17 area. Watch out for a double top near the recent high. If So, this would lead to a longer, deeper correction (not a forecast but a possibility). Other than that we believe strong cash flows will lead to dividends, stock buybacks and debt reduction. Looking forward two to four years we can value a $40 to $50 price valuation on Calumet.

You can Read, you can watch Videos, but nothing beats Personal Interaction for accelerated learning.

This game has levels of understanding that could take a lifetime of Trial and Error to learn.

Available for Coaching, Training or Mentorships

Contact Tom through the LOTM website or by email

Rate: $150 per hour / Monthly Retainer, Lowers Rate

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()