- Chart & Technical Comment

- Underwriting at Soluna to Close on October 26

- Preferred and Common stock – expectations

- Logic at play

- Soluna Management

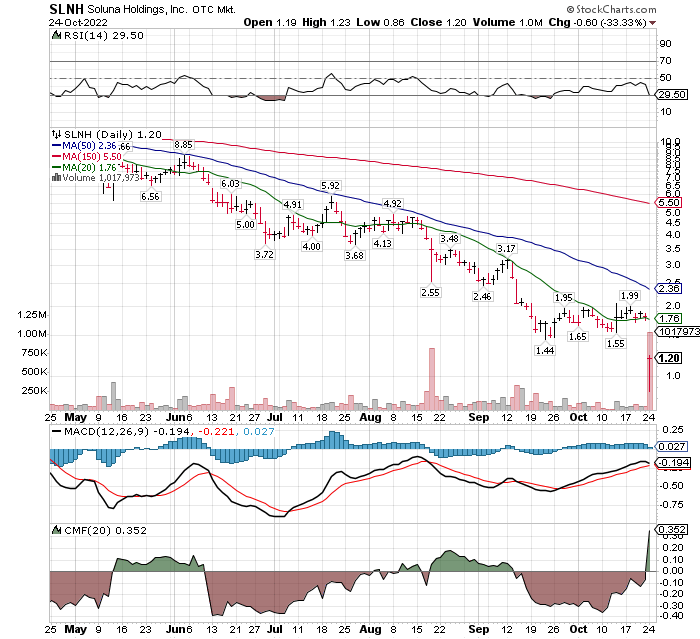

Chart & Technical comment:

RSI: In oversold area. Negative

Price below all moving averages.

No rising moving averages. All trending down.

MACD: still bullish but likely to turn negative unless we get above $1.70 in a day or two.

CMF: Strongly bullish on a day where volume was

Conclusion: Technicals are negative. Positive action in the CMF, suggests the shares are over-sold from a fundamental valuation perspective and attracted buyers.

Underwriting

The $2 million dollar total offering price set on Monday, was $1.44. The deal closing is Thursday, October 26, 2022. This deal will provide working capital and debt relief through debt conversion to equity. The underwriting was about 12% dilution. In terms of total shares outstanding – this is not a significant factor in share dilution. Not counting warrants exercisable at prices above $5.00 per share Soluna has less than 20 million shares outstanding. Conclusion: Soluna lives to fight another day.

Preferred and Common stock – expectations

Common Shares: From the discount to the offering price of $1.44 Soluna common shares are oversold. I suspect the shares can trade up to the $2.00 to $3.00 area in the next six weeks. This assumes that the Texas operation named Dorothy, will receive ERCOT approval and the dividend on the preferred is paid on October 30, 2022. These are events still to happen. Managements credibility has been shaken, so prices above that are not expected at this time. We also have tax loss selling between now and year-end as well. An account related to LOTM purchased common shares of Soluna on Monday the 24th of October 2022.

Preferred Shares: the preferred shares are cumulative. This means Soluna owes you the dividend even if they do not pay on time. If someone buys Soluna, dividends also would be owed to preferred shareholders. I expect but cannot assure you that the October dividend will be paid. I am not a lawyer or an analyst, but it is my view that the biggest risk to the preferred is restructuring through an Chapter 11 or Chapter 13 bankruptcy. I do not anticipate this at this point in time. Since there is no maturity or expiration date on the preferred, the only redemption of the preferred is the company’s ability and right to buy the preferred from preferred shareholders after August 2026 at a price of $25 per share. The monthly dividend is $0.1875 per share. That is an annual payout of $2.25 per share. With the shares priced at $3.75 and a 60% annualized dividend rate, the market obviously has issues with its belief that Soluna will continue to pay the dividend. This is an issue you will have to decide for yourself. An account related to LOTM purchased share of the Soluna preferred today. Personally, I find the preferred more attractive than buying the common shares, though Accounts related to LOTM, bought both share classes today.

Logic at play – Someone was willing to pay on a secondary stock offering and swap debt into Soluna common at $1.44 per share, yet shareholders sold the shares as low as $0.86 on Monday’s news. A discount of 40% of what professionals were willing to pay. Think about that. Professionals who supposedly know what they are doing, swapped debt and bought with cash, shares at $1.44. Yet the general public sold on the news, shares at a discount to the offering price. In the Technical indicator CMF, someone thought the prices were too low and the bigger trades, likely in the second half of the day, bought in bigger share amounts, quantities than was being sold. This reinforces the LOTM attitude that the price was oversold.

Management:

My personal assessment is that management at Soluna is more talented and skilled as investment bankers than they are at operational management of a company. There were event earlier this year that were unexpected and caused issues at Soluna. 1) A surprise surcharge for electricity from the TVA combined with the inability to pass this along in the lease contract to a tenant. 2) unexpected delays in ERCOT of Texas in approving Dorothy in the time frame Management expected. 3) The attitude that management of a company raises money when they can (market & price conditions) not when they need to. One such event is forgivable. Three items in succession raises questions. Time and performance is needed to rebuild confidence in this team going forward. On a positive note, a less skilled team might have lost the company under these conditions. The company, on a razors edge, is still moving forward and lives to have an opportunity to build a excellent business.

Consider subscribing to LOTM Daily Ideas and not missing any issues of our Blog!

We will go behind a pay wall, November 1, 2022.

The cost is a one-time payment of $239 for 14 months, ending Dec 31, 2023. That is a Monthly rate of $17.07.

Sign up through 1) Substack or

2) send a check payable to Access Vietnam Group.

Mailing address: Tom Linzmeier, 339 Summit Ave #4, Saint Paul, MN 55102.

3) Direct deposit by Zelle to US Bank, Access Vietnam Group, phone 651 245 6609.

Written October 24, 2022, by Tom Linzmeier, for Tom’s Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()

Pingback: LOTM: Ten Under $10 for the Double - update October 26, 2022 -