Companies:

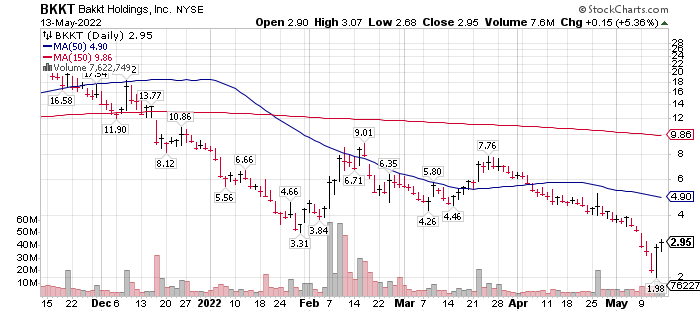

Bakkt (BKKT)* $2.94 – Slower revenue growth than expected but a relevant company for the future.

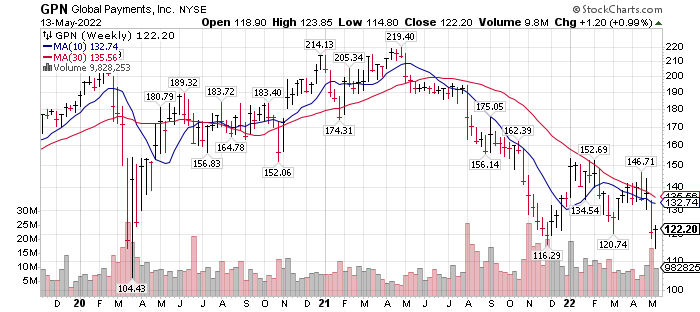

Global Payments (GPN) $122.20 – Back to March 2020 pricing and modest forward P/E of 11.

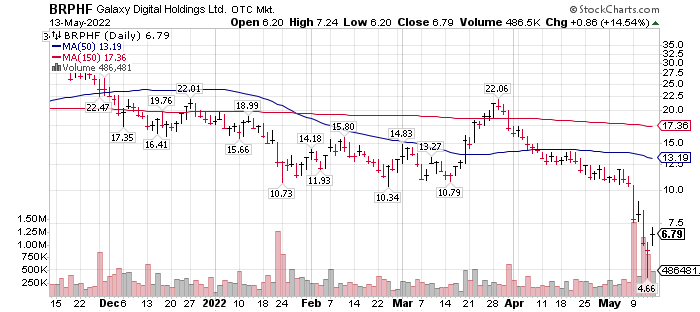

Galaxy Digital (BRPHF)* $6.79 – Price target from analyst BTIG, is still $28.00

-

Bakkt (BKKT)*

LOTM: BKKT signed another major global company as a distribution partner. This addition adds to the likes of Mastercard (MA), Fiserv (FISV). Crypto for payments is having a difficult time how ever finding its niche in the payment world. Revenue is growing slower than projected. That is the negative story at the current time. Blockchain, however, is speeding up the processing time for banks and payment companies. The question is will people part with their Bitcoin or Ethereum for pay for something. Probably not. I would not. To me, crypto is an asset not currency. As the US government introduces its own digital currency, this technology appears very relevant. Related story at Barron’s link. BKKT.

In the meantime, Bakkt lines up partners.

Bakkt Holdings, Inc. (NYSE: BKKT)*, a trusted digital asset platform that enables consumers to buy, sell, send and spend a range of digital assets, and Global Payments (NYSE: GPN), a leading payments technology company delivering innovative software and services to customers globally, today announced a strategic alliance. As part of the agreement, Global Payments and Bakkt will collaborate on use cases starting with enabling cryptocurrency redemption in customer loyalty programs offered by bankcard clients, expanding its banking-as-a-service offerings to include consumer access to cryptocurrency, and ultimately leveraging issuing technologies for linking virtual, debit, credit and prepaid solutions. In addition, Bakkt will broadly partner with Global Payments on multinational merchant payments acceptance. https://finance.yahoo.com/news/bakkt-global-payments-announce-strategic-130700447.html

Based on 15 Wall Street analysts offering 12 month price targets for Global Payments in the last 3 months. The average price target is $181.20 with a high forecast of $222.00 and a low forecast of $145.00. The average price target represents a 48.28% change from the last price of $122.20.

LOTM: GPN is trading back to where it was in March 2020! Looks too cheap as a dominant company in the payments industry and trading at forward P/E ratio of 11.

- Galaxy Digital (BRPHF)*:

LOTM: Stock buy-back up to 10% of float approved and possible – possible meaning there is no mandate to do execute the fully approved amount.

May 11, 2022 /CNW/ – Galaxy Digital Holdings Ltd. (BRPHF) (“Galaxy Digital” or “the Company”), a financial services and investment management innovator in the digital asset, cryptocurrency, and blockchain technology sectors, today announced that the Company has received approval from its Board of Directors to commence a normal course issuer bid (a “Bid”) and intends to submit a notice to the Toronto Stock Exchange (“TSX” or the “Exchange”) for the Bid to purchase up to approximately 10.6 million ordinary shares (10% of the Company’s public float).

The Company may use the program opportunistically at times when it believes that the current market price of its shares does not reflect their intrinsic value and that purchasing its own ordinary shares is consistent with the objective of creating long term shareholder value. Galaxy Digital intends to continue driving long-term value for shareholders by (i) investing in its business lines and growing its capabilities, (ii) supplementing its capabilities through disciplined strategic investments and acquisitions, and (iii) opportunistically optimizing its capital resources, amongst others. The Company has ample liquidity to execute on its objective.

Additionally, in light of recent market conditions, the Company confirmed that year-to-date:

- Galaxy Digital Trading (“GDT”) experienced no operational or execution-related disruptions.

- The GDT counterparty loan and yield portfolio has experienced zero defaults, credit degradations or liquidations. Moreover, average collateralization levels remain well-over 100%.

Investor Concerns About Galaxy Digital’s LUNA Exposure Are Overblown, BTIG Says

Michael Bellusci, MSN – May 12, 2022

Investor concerns about Galaxy Digital (GLXY.TO) being subject to significant losses given its exposure to Terra’s LUNA token are “clearly unwarranted,” BTIG equity research analyst Mark Palmer told clients in a note Thursday.

Shares of Galaxy have plunged more than 40% this week and were down over 20% on Wednesday. They were falling 1.6% to $8.02 on Thursday.

In its recent management discussion and analysis filing for the quarter ending March 31, Galaxy said that the largest contributor in the quarter to the $355 million in net realized gains on its digital assets came from sales of LUNA. Galaxy had previously said in its fourth quarter earnings release that it held $407.6 million worth of LUNA as of Dec. 31.

“Our takeaway from GLXY’s disclosures regarding its LUNA exposure is that it appears that the company had sold all or most of its position at a healthy gain during 1Q22, reflecting the token’s strong appreciation during 2021,” Palmer wrote.

Galaxy did not immediately respond to a request for comment.

Algorithmic stablecoin TerraUSD (UST) recently lost its 1:1 peg to the U.S. dollar, while Terra’s native LUNA token extended its precipitous decline this week.

BTIG reiterated a buy rating on Galaxy with a C$37 ($28) price target.

Galaxy said earlier this week it had won approval from its board to buy back up to 10% of shares in light of current market conditions.

Galaxy Digital Q1 2022 conference call link dated May 9, 2022.

LOTM: Personally, I do not know what the internal financials are at Galaxy, but an analyst (BTIG above) and the company itself have stated financials are fine and not stressed. I accept their statements as true. The $28 price target published May 12, 2022, is significant Vs the current price of $6.78. An account related to LOTM added shares on Friday May 13.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()