Why Bitcoin, Crypto & Blockchain?

Shared in this report are Ten crypto/blockchain ETFs. Each has a different objective and investment profile. Some are passively managed, and some are actively managed. Some are concentrated and focused and some modeled after specific indexes. The focuses cross through blockchain applications, AI data centers, crypto miners and crypto surrogates.

The performance range for the last twelve-months, ranges from a low of plus 54% to a high of plus 123%. Multiple ETFs in this sector were above 100% annual return. This industry is still in its early stage of application and growth. It is volatile so expect wide price moves. One can use a trading strategy or an investment approach. If choosing the investment approach with a long-term capital gain holding period goal, applying dollar-cost averaging for risk management is a way to level the volatility and still capitalize on the above average growth of Crypto and Blockchain.

We are presenting this comparison to help you align your interests within this industry. The last 18-months have seen this industry as one of, if not the best, performing industry sector.

It’s Not Over Yet – from Third Party Views:

-

Mathematically Forecasting Peak Bitcoin Price For The Next Bull Cycle

Bitcoin’s Bull Cycle Price Predictions: What Historical Patterns Tell Us About the Next Peak.

Authored by Matt Crosby, published in Bitcoin Magazine, Nov 1, 2024

-

Bitcoin forecast to hit $200K by end of 2025: Bernstein Research

Bernstein’s report is the latest in a series of bullish forecasts from institutional market researchers ahead of the November US presential election. Authored by Alex O’Donnell, published in CoinTelegraph, October 23, 2024.

TEN CRYPTO/BLOCKCHAIN ETFs:

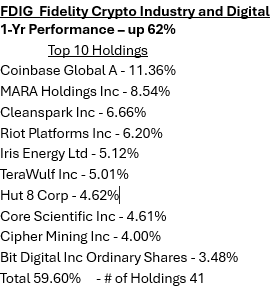

FDIG:

- The fund seeks to provide investment returns that correspond, before fees and expenses, generally to the performance of the Fidelity Crypto Industry and Digital Payments Index. Normally investing at least 80% of assets in equity securities included in the Fidelity Crypto Industry and Digital Payments Index and in depositary receipts representing securities included in the index. The Fidelity Crypto Industry and Digital Payments Index is designed to reflect the performance of a global universe of companies engaged in activities related to cryptocurrency, related blockchain technology, and digital payments processing. Passive Management approach.

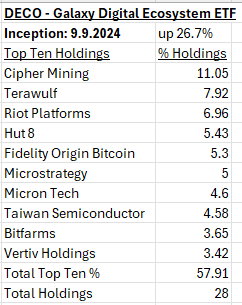

DECO:

- The SPDR® Galaxy Digital Asset Ecosystem ETF (DECO) seeks to provide long-term capital appreciation through the selection of companies that stand to benefit from the growing adoption of the blockchain and cryptocurrency industries, as well as cryptocurrency exposures through ETFs and futures.

- Galaxy Digital Capital Management (Galaxy) will use its deep understanding of the digital asset ecosystem and expertise in blockchain technology to actively manage the portfolio.

- DECO is an actively managed solution from a leader in the digital asset economy that enables investors to pursue potential growth from the further adoption of digital assets. Active Management Approach.

CRPT:

- Under normal market conditions, the fund will invest at least 80% of its net assets (plus any investment borrowings) in the common stocks and American Depositary Receipts (“ADRs”) of Crypto Industry Companies and Digital Economy Companies. Under normal market conditions, the fund will invest at least 50% of its net assets in Crypto Industry Companies. The remainder of the fund’s net assets used to satisfy the 80% test set forth above will be invested in Digital Economy Companies. The fund is non-diversified. Active Management approach.

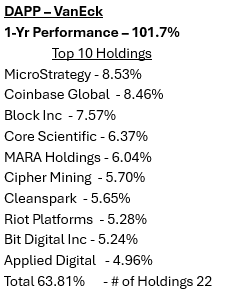

DAPP:

- VanEck Digital Transformation ETF (the “Fund”) seeks to track as closely as possible, before fees and expenses, the price and yield performance of the MVIS Global Digital Assets Equity Index (the “Index”), which is intended to track the performance of companies that are participating in the digital assets economies. Passive Management approach.

ARKF:

- ARKF is an actively managed Exchange Traded Fund (ETF) that seeks long-term growth of capital. It seeks to achieve this investment objective by investing under normal circumstances primarily (at least 80% of its assets) in domestic and foreign equity securities of companies that are engaged in the Fund’s investment theme of financial technology (“Fintech”) innovation.

Fund Description

- A company is deemed to be engaged in the theme of Fintech innovation if (i) it derives a significant portion of its revenue or market value from the theme of Fintech innovation, or (ii) it has stated its primary business to be in products and services focused on the theme of Fintech innovation. The Adviser defines “Fintech innovation” as the introduction of a technologically enabled new product or service that potentially changes the way the financial sector works, which ARK believes includes but is not limited to the following business platforms:

BITQ:

- Invest in the companies leading the new crypto economy. BITQ tracks an index designed with Bitwise’s industry expertise to identify the pioneering companies that generate the majority of their revenue from their crypto business activities. It’s a traditional ETF. Search “BITQ” in your brokerage account or speak with your financial advisor. BITQ uses a Passively Managed approach.

ARKD:

- The fund is an actively managed exchange-traded fund. Under normal conditions, the fund seeks to invest 80% of its net assets (plus any borrowings for investment purposes) in investments that provide exposure to the blockchain and in securities issued by companies principally engaged in the blockchain industry and/or digital economy (the “80% Policy”). The fund is non-diversified. It is the only ETF that combines equities and direct exposure to Bitcoin and Ethereum through the futures market.

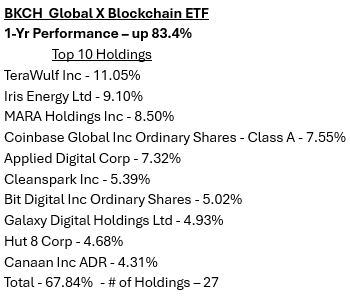

BKCH:

- The Global X Blockchain ETF (BKCH) seeks to invest in companies positioned to benefit from the increased adoption of blockchain technology, including companies in digital asset mining, blockchain & digital asset transactions, blockchain applications, blockchain & digital asset hardware, and blockchain & digital asset integration. The Global X Blockchain ETF (BKCH) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Blockchain Index. This uses a Passively Managed approach.

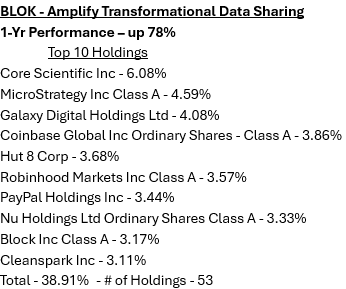

BLOK:

- The fund is an actively managed ETF that seeks to provide total return by investing at least 80% of its net assets in the equity securities of companies actively involved in the development and utilization of “transformational data sharing technologies”. It may invest in non-U.S. equity securities, including depositary receipts.

WGMI:

- WGMI is pure-play access to North America’s leading Bitcoin mining industry, a crucial component of the Bitcoin ecosystem. WGMI provides targeted exposure to the companies at the forefront of transaction verification, ensuring transparency and security on the blockchain. Crypto miners are now considered an infrastructure play. They are diversifying from their original focus on crypto mining and moving into alt energy Data Centers for Artificial Intelligence computing. WGMI uses an Active Management approach.

ETF descriptions are taken from the ETF’s respective web sites.

Here is our LOTM approach to selecting ETFs in this sector. It is only a suggestion offered to stimulate your thinking and approach to the industry. Have fun.

- Active management above Passive management.

- Owning two or three ETFs whose styles are different

Suggestion of differences include

- Alt-Energy Crypto Miners and AI Data Centers as one selection

- FinTech Transaction based ETF focused on multiple crypto & blockchain applications.

- Any of the actively managed ETFs whose profile is different the a) and b) just above as the third option.

Owning three ETFs with the above descriptions would give one broad exposure to the crypto, blockchain and infrastructure as it relates to AI Data Centers and Crypto/Blockchain industries. It would also provide exposure to new applications that use blockchain technology. Blockchain applications are in the early years of will be a decade or longer application growth phase.

![]()