Dow Holdings (DOW) $51.32 – 5.7% dividend – 5.7 trailing P/E ratio

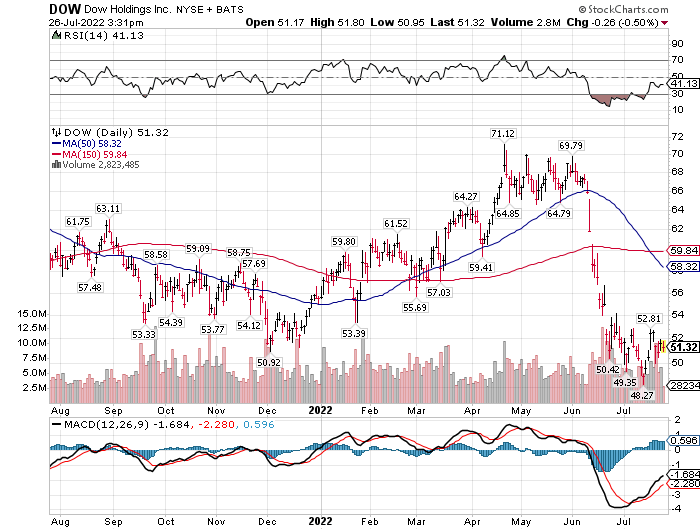

Let’s get the technicals out of the way.

Based on Price, the technical signal is Sell / Avoid

Based on Relative Strength (RS), a leading indicator, Dow is gaining strength from over-sold Vs the general market.

Based on Moving Average Convergence Divergence (MACD), Dow is on an early trading Buy signal.

- Overall Technical: sell or avoid. Price over-rides leading indicators until

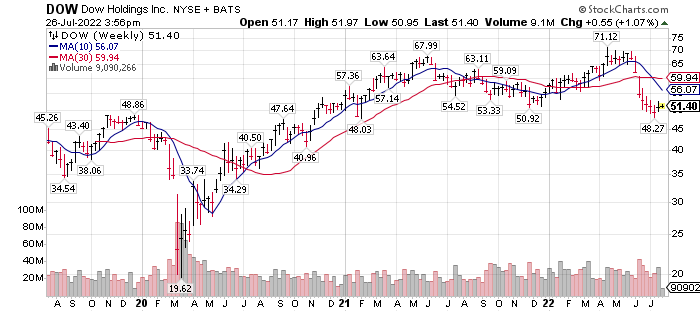

Three Year weekly chart The high price of $48.86 in December 2019 will act as a support level just below the current price.

The high price of $48.86 in December 2019 will act as a support level just below the current price.

Fundamental Basic Stats for DOW plus competitors:

Catalyst:

- Germany has an Energy problem, One Company that will benefit is DOW Holdings

The majority of Nat Gas that Germany imports from Russia goes to their petrochemical industry as feed stock. BASF is the largest petrochemical company in Germany. Any increase in price or shortage of Nat Gas supply will cause an issue for BASF. The most likely company to benefit is Dow Chemical. Feed stock of Nat Gas will certainly be less expensive and more available in the USA in the coming year than it will be for BASF in Germany.

- Perter Zeihan 15 minute interview on the break-up of the supply chain as we have known it and impact on different regions of the world linked here. At the nine minute, thirty second mark, Zeihan talks about Nat Gas, Germany and Russia. This is a Catalyst for Dow Holdings.

- A follow up on the Zeihan series of interviews, should he be right, and this is the breakdown of globalization and international trade, then perhaps we need to consider investing in regional companies that dominate their region. International companies might be able to be strong within strong regions but will have a drag on operating margins from areas that are weak in domestic commerce or in conflict with their neighbors. Ukraine and Russia certainly come to mind. Perhaps less international exposure and a more “local” focus. More National Tribalism! That is a whole other discussion.

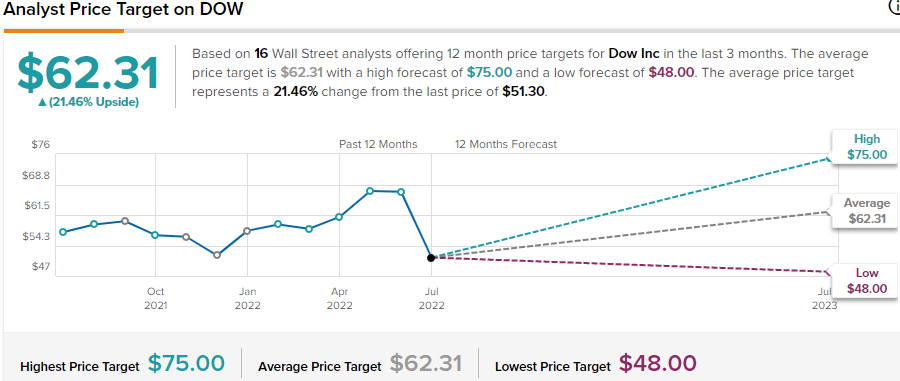

The potential for DOW to benefit from German Nat Gas issues is not priced in the stock. Here is the view on DOW from analysts at this time. From TipRanks.

Fundamental Summation: If Dividend + Valuation is palatable and you believe the Catalyst of a major competitor having difficulties over-rides the oncoming inflation + recession, yes, we believe DOW is an attractive purchase. It would help a lot if we gathered some momentum in the share price but that removes some of the attractiveness from Valuation and the Dividend. Higher base material costs (Nat Gas) even in the US, will cut into margins as well.

Conclusion: We like the story and valuation. We would place DOW into an accumulate slowly box. Add on weakness for a post-recession recovery. Anything gained from issues with BASF in Germany is a plus.

“If or When” the stock rallies 20% to 30% above average cost, we’d sell call options sixty days forward and slightly out of the money on 60% of the position. Repeat as long as you can or until your have a reason not to sell call options. A working man’s plan, but DOW is a working person’s stock.

As an add-on comment, my opinion on Hydrogen emerging as a base-load energy source grew substantially with research over the past few days. Dow Chemical is involved in the production, internal use and containerizing of Hydrogen for transport. This could be a added growth market for Dow Chemical, a division of Dow Holdings.

Good luck. I like the odds of this one but probably as a longer-term core holding.

Written July 26, 2022, by Tom Linzmeier, editor LivingOffTheMarket.com

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()