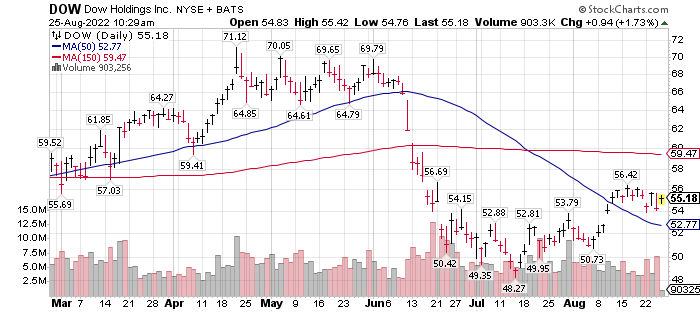

- Dow Holdings – a very favorable chart pattern, a 6 P/E and 5% dividend.

- Soluna – Buy Under $2.75, No news for a while and potential for Tax loss selling

- Frontline – A Ten under $10 holding, is being sold.

Dow Holdings is forming a Cup & Handle Chart Pattern. This is typically a bullish pattern.

Not shown is the relative strength (RSI), MACD and Accumulation and Distribution studies we also look at. The indicators are positive but in a neutral patter reflecting the pattern of the stock price.

Listed by Finviz is a trailing P/E of 6.08 with a forward projected P/E of 8.1

Dividend of about 5%.

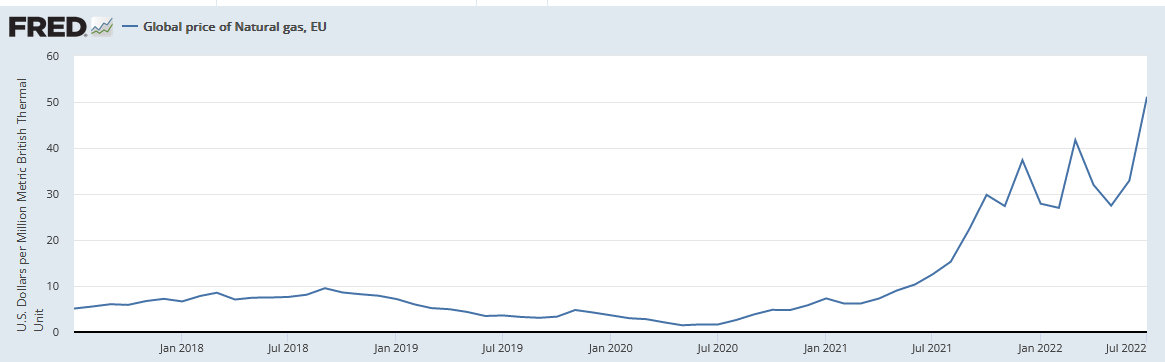

Natural gas is a leading material for producing a high percentage of products in the petrochemical industry. While Nat Gas cost for Dow have increased and expected to stay strong through the winter, Cost for Dow’s European competitors will be quite a bit higher. We think sourcing Nat Gas from the USA will be a competitive advantage for Dow vs non-USA competitors.

Nat Gas in the USA is up from $2.10 in winter Jan 2020 to today’s $9.35 – Simple math tells us that is a 4.45 fold increase in less two years. Hard to imagine what USA heating bills will be this winter.

Wait a minute. Be happy you do not live in the EU. In winter Jan of 2020, Nat Gas was priced at $3.62 and today, summer of 2022 it is priced at $51.15. The math is a 14 fold increase.

Inventories are being bought now for this coming winter. That means even if Nat Gas prices are lower in Jan you are likely being charged for Nag Gas being purchased now. In the case of the EU, if they can get it.

That is personal to you and me, but it is also what will hit industry’s raw material costs. This is an advantage Dow will have over someone like BASF in Germany. If you look at the glass half full you want to own Dow. You may choose not to own either but remember the market looks forward six-months, so some of this might be priced into today’s stock price at 6 times trailing earnings.

EU Nat Gas pricing from the US Federal Reserve Data base

USA Nat Gas Prices from TradingEconomics

Soluna Holdings (SLNH)* $3.34 – Buy at $2.75 and Lower.

You might have noticed I drastically dropped the buy under price on Soluna in the recent $10 Under $10 I sent out. The price is $2.75.

Soluna, IMO, is fine financially and will be fine financially. Most of the management team bought shares in the open market last week and early this week. Here is a link to the buying. Scroll to the bottom of the page. The prices don’t match the trading price of the common shares. I believe it is because some bought both common sharers and Soluna Preferred shares. Rather than separate the two classes, the data service simply added all prices and divided by total shares of both classes.

Before the shares rally, I am projecting that we will need good news from the Texas Grid System, ERCOT, allowing Soluna to activate their data centers. This should be pretty automatic, but we don’t know when. We also will need see the news of financing for Soluna to grow into its large backlog of business. It was said by management, it would be closer to the year-end than today. In between now and the press releases, we will have tax loss selling. Therefore, I am not so negative on Soluna. In fact, I think they will be just fine. I am negative for the price between now and when we get the news releases mentioned above. I have to say, that while I am confident, they will hit both goals, nothing is certain in life and there is not guarantee of the assumptions made here. Highly probable is the best anyone can say.

Is there opportunity in this glass half full half empty outlook. Up to you to choose.

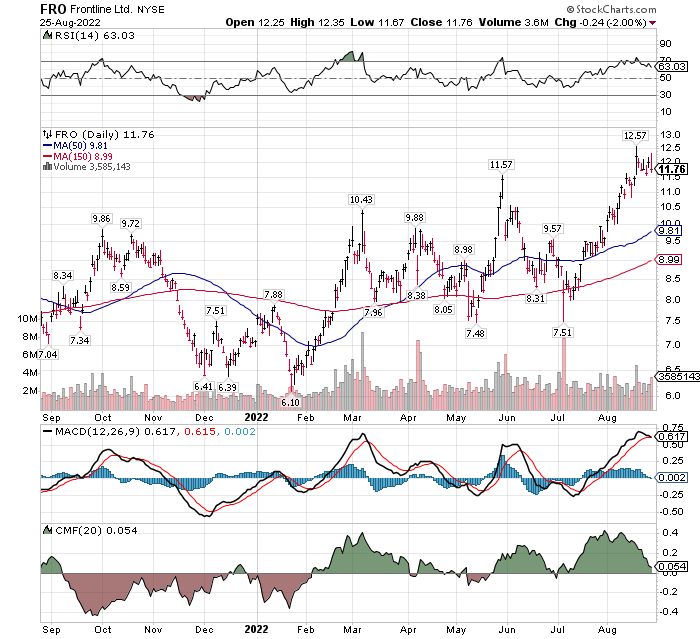

Frontline (FRO)* $11.76 and the shipping industry.

FRO is in the Ten under $10 for the double.

The video linked below, discusses the Dry bulk, Container and Tanker shipping business.

- The Global Shipping Crisis Is Not Over | Sal Mercogliano” on YouTube – One hour, twenty-two minutes.

If you want to understand the shipping business, this is a excellent interview. Mercogliano is very positive on the shipping business at the time being. He states that price corrections will rebound, Cash Flows are very high and shipping backlog problems have not been resolved. It is a good business to be in BUT you better understand the business. It is not like other normal businesses. In the interview, he shares worth while information, worthy of retaining. When shippers are in favor, they make money like they own the printing presses.

In the Ten Under $10 for the double we will sell the position just to be cautious. The market is bumping into resistance at its 200-day moving average. We have Tax loss selling season upon us. Most of the Christmas product that will get here has been shipped. Cost was $7.49. If a correction happens, we might be able to buy back in. If the market or FRO does not correct, then there will be plenty of other opportunities available.

All of our key technical indicators are still on buy signals, but you can see they are all struggling to hold upward momentum. As uncertain as the times are, we’d sell. A normal correction would be back to the 50-day moving average around $9.00 to $9.50.

Written Aug 25, 2022, by Tom Linzmeier, editor, www.Livingoffthemarket.com

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()