LOTM Sharing Ideas and Positions:

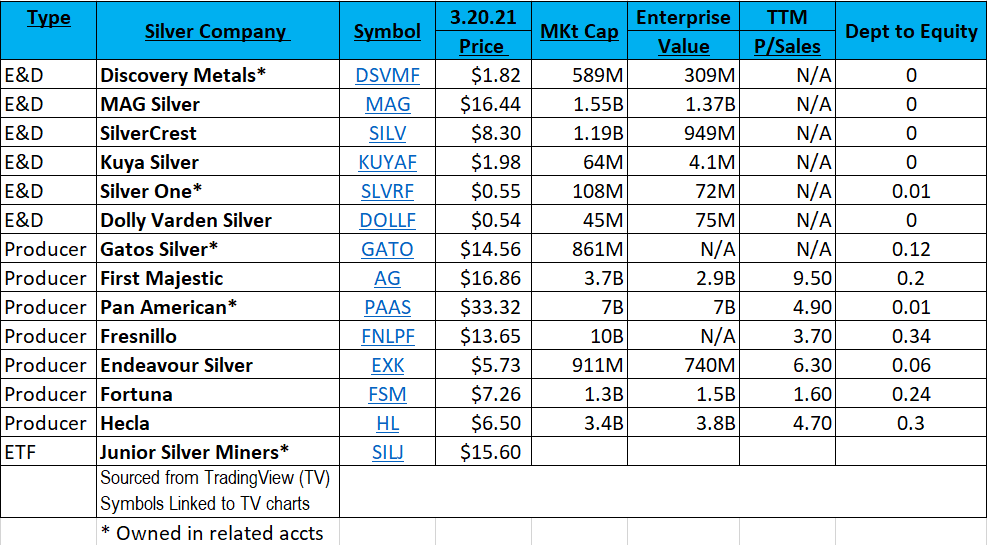

SILVER:

Silver has had declining production for about six years with the last four years where demand has exceeded new supply. Demand from Electric Vehicles, Electronic devices and solar – each solar panel has a thin coat of silver will increase demand for silver. Silver is the best conductor of electricity on earth. In addition, investor demand related to the rapid printing of fiat currency, is expected to create rising demand for physical silver.

Here are ideas LOTM finds attractive in Producing Silver companies and highly regarded Exploration & Development companies

NOTE: The low Debt to Equity ratio in the grid above. These are healthy companies. The E&D companies would benefit from rising reserve values and potential acquisition target as/if silver prices rise. For producing companies, the company benefit is rising cash flows. We expect a consolidation within the mining industries.

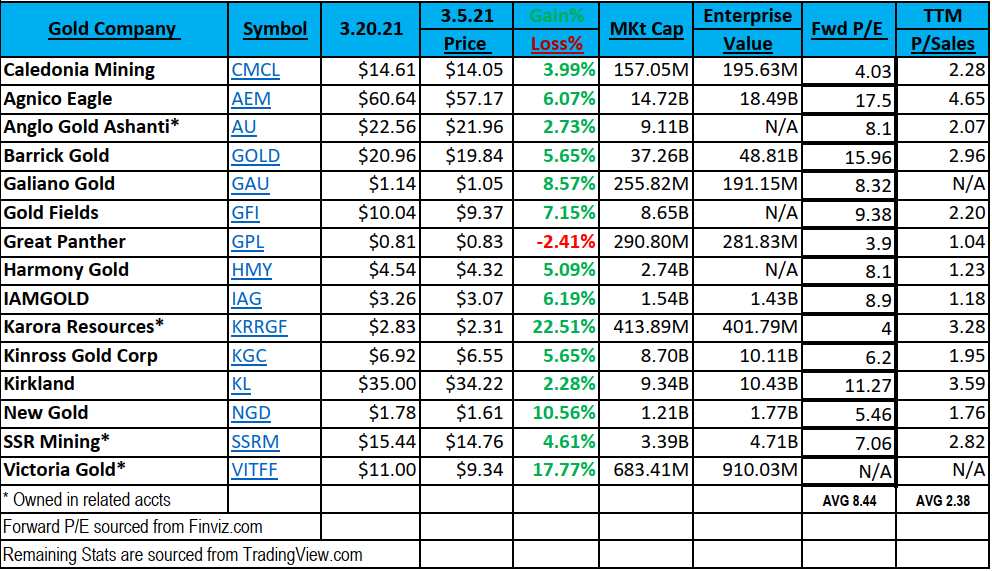

GOLD: As far as LOTM is concerned, Gold Miners are the most attractive industry for both value and appreciation potential

E&D to Mid-Tier in Two Years!

Two companies we are really excited about in the Gold Mining sector are Karora Resources and Vitoria Gold.

These two companies, two years ago, had very little if any revenue. 2021 will show out sized leaps in revenue and earnings. These are not well-known names outside the mining industry so lots of room for investor discovery. I have not found a forward PE ratio for Victoria Gold, but revenues will approach 200,000 ounces in 2021. Zero to 200,000 ounces in eighteen months is an amazing transition.

Karora was very profitable in 2020 with a ttm P/E ratio of 5. Karora is projecting 15% growth of gold and nickel production in 2021. We believe these are conservative numbers. Above 100,000 ounces is considered Mid-Tier sized producer – Karora is no longer a E&D or Junior producer.

TABLE NOTE: KRRGF and VITFF share prices are up the largest % increase in the last two weeks of our posted companies. Close followers in the mining industry are recognizing the growth coming in 2021. They are still cheap vs what we think their prices can be in one-year. We are looking for 2X or better as price goals.

Established Gold Producers:

The large companies like GOLD, NEM (not listed), & AEM will provide more stability but less upside than say, companies under $10 billion market cap.

Companies like KL, KGC, NGD & IAG are excellent companies, and we endorse accumulation of these Miners.

Companies, SSRM and AU are very volatile and great trading stocks in the mining industry.

Similar to silver companies, there will be a high level of consolidation in gold miners.

Low P/E Ratios still matter – An Under 10 P/E ratio is very cheap in a stock market Priced to Infinity and Beyond.

Tide is turning: “You have to be in Gold, Silver, Platinum and Palladium” – KITCO

A lot has happened in the gold space this week. And the tides may finally be turning for the precious metals. Here’s a breakdown of the top three stories.

- The Federal Reserve kept its monetary policy unchanged but revised up its economic and inflation expectations. The Fed now sees U.S. GDP at 6.5% and inflation at 2.4% in 2021. In response, gold finally rose as the Fed signaled that it plans to keep rates near zero through 2023. Fed Chair continued to refer to any price spikes as transitory while ignoring rising yields. As all of this was being digested, gold breached above $1,750 an ounce — almost a 3-week high.

- Mark Mobius, founder of Mobius Capital Partners, said that investors have to be in precious metals, citing everything from gold to silver, platinum, and palladium. He described the precious metals as the best “long, long term investment simply because they represent a form of currency.”

- Ray Dalio, founder of Bridgewater Associates, warned investors that high levels of debt in the U.S. could trigger “shocking” tax changes that might involve prohibitions against assets like gold and bitcoin. Dalio gave examples from the 1930s and 40s when the Fed was able to control yields because gold was banned in the U.S. Dalio once again said that cash is “trash” and told investors to buy “any stuff that will equal inflation or better.”

By Anna Golubova For Kitco News – REPRINT FROM KITCO NEWS March 20, 2021

Know What you own & Why you own it.

Know When and How you will sell (Execute your Risk Management Strategy).

Can you ride through a three-year market decline?

If you do not have the answers to the comments above, consider a conversation with Tom. Tom’s available on a one-time consulting basis or a monthly retainer for keeping your strategy in focus and on track.

Rates: $150 an hour for one time consult & $100 per hour for a recurring monthly strategy & trend tune up.

Tom started in the brokerage industry in 1976 – 44 years’ experience in every market condition you can imagine.

Training, Coaching & Mentoring available

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()