The Chinese started World War 3 (Three) as far back as Richard Nixon’s USA opening up to China (1972). While the USA looked at this as an opportunity to draw China into the USA way of thinking, for China it was the beginning of a 100 year plan, to control the USA and the world. Fifty years later, the USA is “starting” to waken to the fact that China has been at war with the USA for 50 years.

You can plan on China invading Taiwan prior to the 2024 elections. If it does not happen, consider it a gift but, not the end of our war with China. Russia combined with China is a geo-political nightmare of gigantic proportions for the USA. Russia has the natural resources China does not have. China has the manufacturing; the skill sets, and work ethic, Russia does not have. Add in the fact that Russia threatened the EU and America with limited nuclear attack and both the EU and America backed down. This gives Russia and China permission to bully us around. Need I mention the manner in which America withdrew from Afghanistan? A dog with its tail between it legs as far as other world leaders saw it.

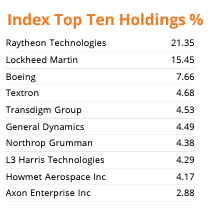

Exposure to the Defense Industry, Aerospace and Cyber Security is of growing importance.

Direxion daily Aerospace & Defense 3X Bullish (DFEN) $13.97

- Year to date performance – up 20.7%

DFEN is levered 3X so this is suggested as an idea generator list of individual stocks to consider

In the defense sector.

Safest way to transition the recession:

- Short-term treasuries: three month to two year treasuries – risk is loss of purchasing power from inflation. Positive, retain face value of principal.

- Physical gold. Risk is short-term price volatility due to a liquidity crunch. Positive, Gold historically, has kept pace with purchasing power / Inflation. Gold is typically the first asset class to rally coming out of a recession.

- Cash. Similar to short-term treasuries but no interest rate or state tax advantage.

- Dollar-cost-average if you have the cash flow to do so, into the market areas of your interest. Not mentioned but of high potential, are Payment Industry, Genetics, Robotics & the Metaverse.

- Personally, I think the recession will be short in duration (less than one year) but could be vicious in its volatility with many bankruptcies. Make sure you are not one of them. No leverage. The market will exist on the other side of the recession and will be explosive to the upside.

War time and Inflation Investing:

Everything related to Commodities.

- Energy, Materials (metals) & Food

- Consider your income investing focused within the commodity area. MLP’s in energy transportation are high yield and in a more income secure area than BDC (Business Development Companies) at this time.

- LOTM is in love with Junior miners as a high volatility but five to ten bagger upside over the next three to five years.

Bitcoin & Crypto:

The vast majority of crypto coins will go out of existence in the next year. Of the 19,000 different coins it is realistic to expect 100 will survive. In ten years, this might reduce to fifteen or twenty coins. The survivors could create great wealth for their owners. We like the equity companies that utilize the coins (substitute the word software for coins) better than the coins themselves. Companies that use the “application” of Blockchain can plug and play different software (crypto coins) without going out of business.

Banks are rushing full speed in to blockchain / crypto. This means regulation is coming soon. This is a good thing but will crush the majority of coins. Say with the highest visibility and the strongest applications. Think software not currency!

Payment rails (banks & payment companies) accepting and exchanging fait currencies with crypto is happening rapidly and at breakneck speed. This is a strong statement / commitment to what institutions think of Blockchain and crypto. This is a 20 year integration process that is a type of “technology gold rush.” Do not miss this trend. Equities are the safest way to participate with this trend, in our opinion.

In summary:

Major LOTM investment themes remain the same.

- Commodity exposure – Nat Gas, Metal Miners and Food

- Value stocks but start nibbling at over-sold growth Ideas

- Income Ideas but with commodity exposure

- Defense, Aerospace & Cyber Security.

- For Safety: Cash Equivalents & Physical Gold

- Crypto is a risk investment but like gold will probably be a leading investment rising from the recession.

Written June 23, 2022, by Tom Linzmeier – LivingOffThemarket.com

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()