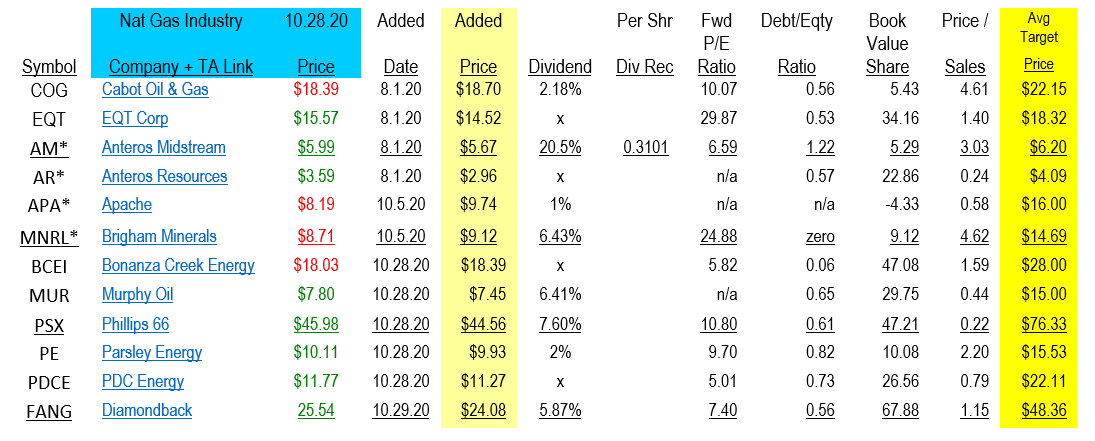

LOTM’s Top Picks in Natural Gas Industry

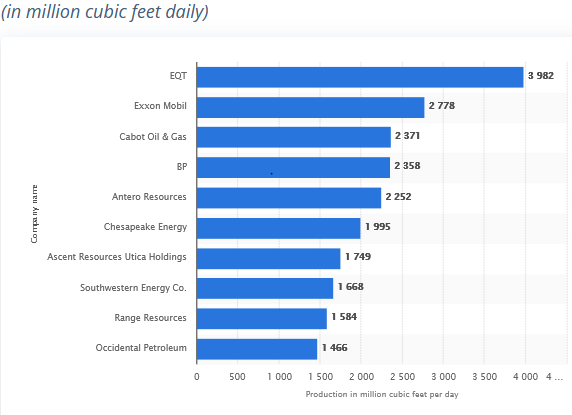

LOTM: we started following Leaders in the Nat Gas industry in July and August of this year. EQT is the largest Nat Gas producer is the USA. COG and AR are in the two to five positions depending on the revenue flows. Multiple analysts are predicting rising energy prices in 2021 and 2022 due to shut-ins, bankruptcies, and cutbacks in Cap-X spending. What we have heard from a number of E&P companies, is when oil moves above $50, they expect to expand their drilling activity. That mean supply is limited for the time being. In the meantime, they will reduce debt.

With a favorable industry for higher prices, we expanded the list of Nat Gas E&P companies. Apache (APA) was the first. Wednesday the 28th, we expanded the list to include low debt companies with attractive valuation metrics, combined with a 50% or higher distance between current price and analysts target prices.

The following companies appear to be lower risk profile and higher twelve-month target prices than the earlier dated suggestions – even though the first ones are the industry leaders. The companies below Brigham Minerals and including Brigham Minerals, fit the lower risk higher/ higher potential profile.

- As usual we suggest a package of companies rather than just buying one company’s stock.

- Warren Buffet invested close to $10 billion into this industry – announced July 2020:

Warren Buffett bets $9.7 billion on a long future for natural gas

www.worldoil.com › news › warren-buffett-bets-97-bill…

- EQT is on an acquisition spurt:

*EQT in $735M deal for Chevron’s Appalachia assets.

Oct. 27, 2020 4:22 PM EQT Corporation (EQT)By: Stephen Alpher, Seeking Alpha News Editor

*Natural Gas Giant EQT to Pursue Takeover of CNX Resources.

October 22, 2020 – Bloomberg: By Ed Hammond, Kiel Porter, and Gerson Freitas Jr. EQT Corp., the biggest producer of U.S. natural gas, is seeking to acquire rival CNX Resources Corp., according to people familiar with the matter, as M&A accelerates in the distressed shale patch.

LOTM: Industry Leaders Look to get Big when Times Get Tough

Nat Gas Leaders:

-

Where Value meets Buy Signals!

Feel free to forward or recommend to others.* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()