Soluna Holdings (SLNH)* $3.48

Today an account related to LOTM bought shares of Soluna common shares and Soluna Preferred with a 23% yield.

- 72 divided by any number gives you the time to double. 72/23% is 3.14 years.

Naturally, I am assuming they will continuing to pay the dividend but cannot assure that.

- Today management gave their update on July activity. Linked here. If your are concerned about SLNH financially you must watch. Knowledge is Strength. Knowledge plus knowing what your looking for is Power.

It seems unexpected delays In May and June and surcharges on electricity for July and August are financial problems. So big a problem, the auditor qualified Soluna’s Q2 report as a going concern. Management believes and anticipate the energy sur-charges will revert back to normal in September. Neither they nor I can give assurance that they can solve their problems.

In my opinion – only my opinion, the financial challenges are a survival problem for the company. More negative could always develop but as it stands it appears to me that the company can overcome these challenges. Let’s go day-to-day in our monitoring SLNH. They are in discussions with a number of parties through Truist, their banker, concerning financing options for working capital and future projects.

Letters of Intent (LOI) are at about 2 Gigawatts. Current production is at about 53 Megawatts. Soluna needs operating money as well as financing or JV money, but also have a lot of pipeline growth to offer in either raising money or finding JV partners. So, the current financial crunch appears solvable.

One of the chat-line comments mentioned that management suggested in a public meeting, to not be surprised, if we see some Insider buying of shares in the coming days. I could not confirm that. Like to see it happen.

Shares bought today in Soluna can and will be sold at any time. They were bought as a short term trade not as a long-term position.

Dr. Copper.

Copper is called Dr. Copper because copper prices often move first when coming out of a recession. It is assured that the next two quarters at least will provide very negative Headline Economic News, Very negative. Yet copper stocks are beginning to rally. All I can say is perhaps the market is sniffing out a top in the Fed’s interest rate hike cycle. Markets move in anticipation of the future. Six months early plus or minus. Sounds about right if we have two quarters of really bad news as a Wall of Worry for the Market to Climb.

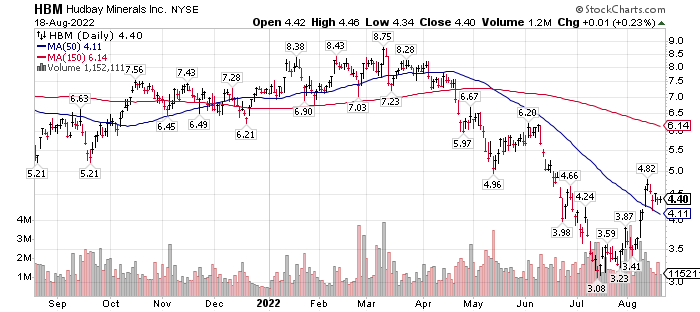

Here is a chart of one Copper miner.

- Hudbay Minerals (HBM) $4.40

Hudbay is a name we have mentioned in the past. Hudbay mines more than copper. Do your due diligence. Here is a partial check list.

- Is the asset class receiving in-flows? Commodities are receiving in-flows, yes.

- Does the industry have favorable visibility and not over extended. Yes, demand and visibility for copper as a battery metal outlook is good.

- Are the company fundamentals Ok. Stats at Finviz: Forward P/E for Hudbay is 5. Other stats are in the link. Valuation looks appealing.

- Technically is the stock above its intermediate-term moving average the 50-day MA – Yes, that is positive.

I have no idea what your personal financial situation is or what your risk management plan is. Have one – this is a very fluid market. One must be prepared for anything. Typical risk management plans might be dollar cost averaging if investing or the use of stop losses if trading. There are many other options and variations of the two mentioned.

The chart pattern is a classic Cup and handle pattern.

Are you trading or investing? Anything past four months is investing. Four months or less holding period is trading. There is a middle path and that is being a momentum investor. Ride the uptrend as long as possible then exiting when momentum breaks downward. Each style has its guidelines and rules. Know yourself and what you want to do.

Listed below are symbols of “some” Copper miners I have in a watch list.

These are some of the better known copper miners.

GLNCY – Glencore – $11.85

IVPAF – Ivanhoe – $7.05

RIO – Rio Tinto – $60.49 high dividend but variable

TECK – Tech Resources – $34.61

VALE – Vale – 13.10 – high dividend but variable

CPPMF – Copper Mountain – $1.26

LUNMF – Lundin Mining – $5.48

BHP – BHP Billiton – $57.13

FCX – Freeport- McMoran – $31.23

- We will have more on this assuming the trend continues to unfold. No, we are not selling Gold or Silver miners to buy Copper miners.

Personally, I believe money will flow into Commodities from the S&P 500 for the rest of this decade. I reserve the right to change my mind, but trends are in motion that are decades long in the unfolding.

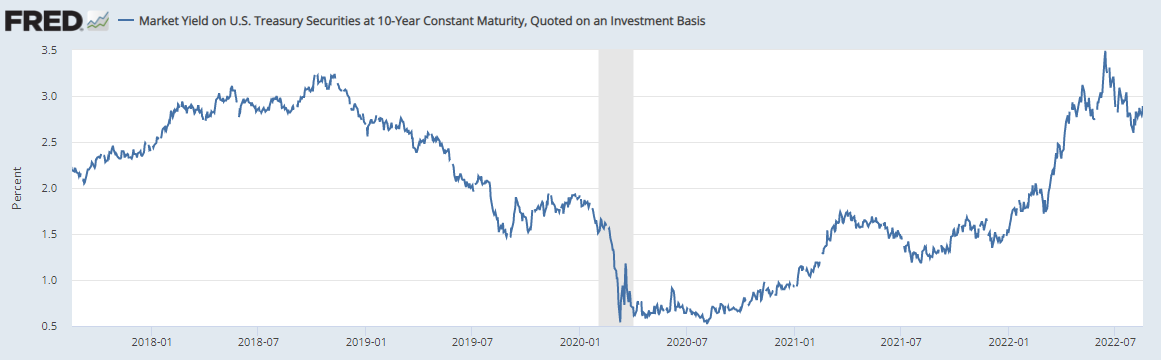

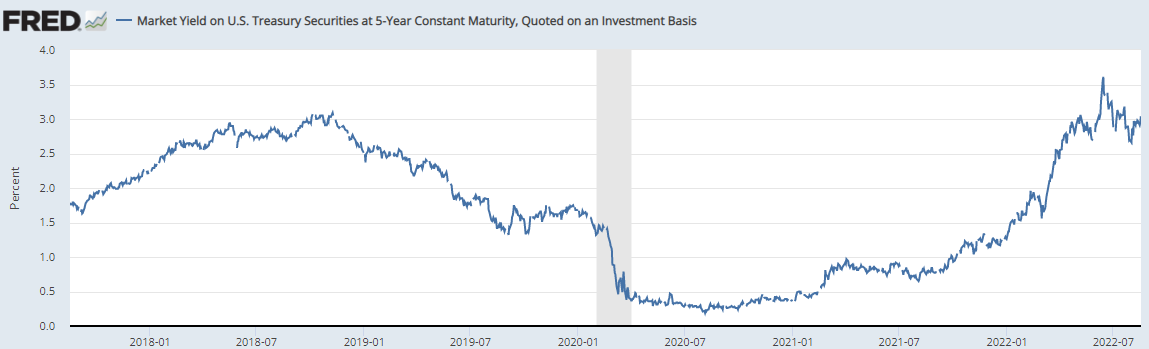

OK – So you’re tired of it all and just want a safe place to park your money.

The economic news is going to get really bad over the next six to eight months. The market know this. That is why the market sold off from November 2021 to now. Will it get worse for the stock market? I don’t know.

Since the economy is going in the toilet, and the headlines will be reminding you of that, the safest palace is in three to five year treasuries. You know you will get you money back. You get a break on state taxes as Interest on treasuries are tax free at the state level. You get some interest. What you will lose out on is purchasing power due to inflation. Loss of purchasing power might be a lower risk than the market. Combine Treasuries with peace of mind and it is a winning formula for some.

Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis (DGS10) | FRED | St. Louis Fed (stlouisfed.org)

Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis (DGS10) | FRED | St. Louis Fed (stlouisfed.org) Market Yield on U.S. Treasury Securities at 5-Year Constant Maturity, Quoted on an Investment Basis (DGS5) | FRED | St. Louis Fed (stlouisfed.org)

Market Yield on U.S. Treasury Securities at 5-Year Constant Maturity, Quoted on an Investment Basis (DGS5) | FRED | St. Louis Fed (stlouisfed.org)

Written Aug 18, 2022, by Tom Linzmeier, editor, www.Livingoffthemarket.com

Know Yourself and what you Want

Have a Strategy to get What you Want

Build Your Team

Make the Plan

Have a Risk Management Plan as Plan B

Execute with Discipline

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()