Our goal is to find stocks that double. We think that is rather easy. After all, the majority of stocks, as measured from their annual low price to their annual high price have a 100 percent range in their price pattern. Fitting it into eight months is highly desirable but not so easy to do. “Time” is always the hardest part of the Time & Space formula. We got lucky on the timing in that we bought deep value right before a rotation into commodities to include Nat Gas. There are still companies on this list trading at modest P/E ratios. I an tempted to call the group a hold at best but each quarter the earnings improve. The demand is expanding, and the prices are rising as well. Remember eleven months and two weeks ago oil traded at minus $35 a barrel. Today oil per barrel is in the mid $60’s. That is a swing of $95 a barrel.

There are still companies on this list trading at modest P/E ratios. I an tempted to call the group a hold at best but each quarter the earnings improve. The demand is expanding, and the prices are rising as well. Remember eleven months and two weeks ago oil traded at minus $35 a barrel. Today oil per barrel is in the mid $60’s. That is a swing of $95 a barrel.

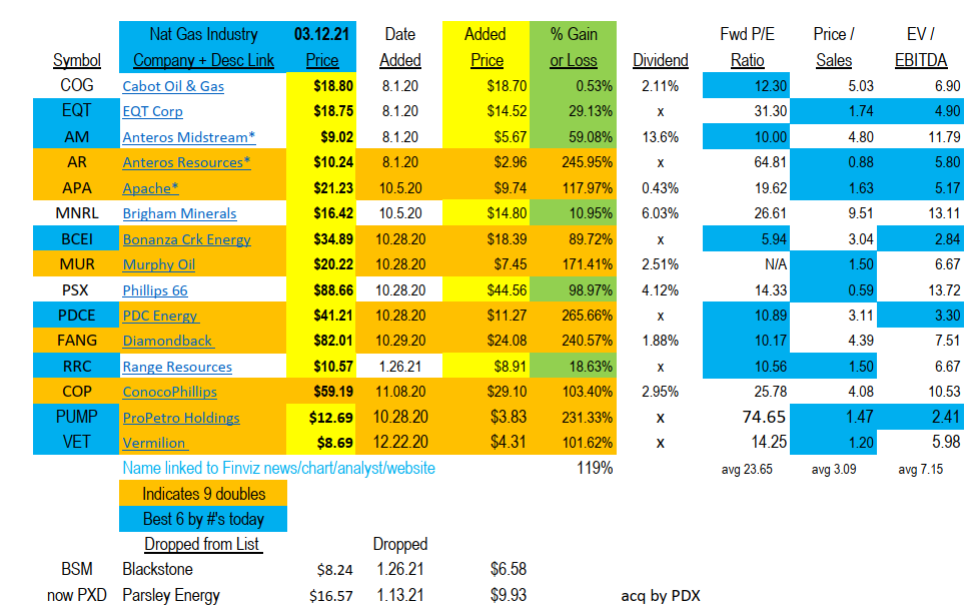

By the numbers above here is what we see:

- Anteros Midstream (AM): The dividend is solid and at 13%, what’s not to like? Right?

- EQT Corp (EQT): The largest company in the Nat Gas industry has hardly moved compared to its per group. The valuations for Price to Sales and its Enterprise Value (EV) to EBITDA is on the low side to this grow. EQT made two large acquisitions in late 2020 so it is still not at a high-performance level. However, they did what every industry leader should do. They bought their competition when the price was low, and the company/industry was struggling. Lots of room for catch up in this stock.

- Bonanza Creek Energy (BCEI): BCEI has lowest forward P/E in the group and valuations are reasonable. Still looks attractive.

- PDC Energy (PDCE), Diamondback (FANG) & Range Resources (RRC): All at 10 to 11 times forward earnings and reasonable valuations. Rising prices can heal a lot of problems.

- Vermillion (VET): Up almost a double we like VET even here. They used to pay a monthly dividend but stopped with the March 2020 crash. They are now focused on debt reduction but at the current prices have no debit problems. They did not have debt problem lower oil prices either but took a conservative path during covid uncertainty. They have stated that they intend to reinstate the dividend after debt is reduced however I do not know at what debt level, they will reinstate the dividend.

Oil especially carries the risk that Saudi Aribia and Russia can increase production at any time to flood the market if they wish to crush competition. Most oil producers know this and “should” be fiscally prepared. We like Nat Gas producers because Nat Gas tends to be used more locally than oil. It is also a needed energy source for the time being to supplement Wind and Solar. I have not seen numbers, but I suspect Nat Gas is cleaner &/or less energy consumption than hydrogen as well. Hydrogen needs electricity to be made then it is converted back to electricity through a fuel cell. Electricity to Hydrogen back to Electricity. Seems like an excessive use of energy to make energy.

Do your own reading on each company to see what is happening. Listen to the conference calls! Watch what is happening within the industry. This industry “should” be ok as demand to energy for transportation increases as people get out and about. Air travel is still 50% of pre-covid but expanding.

Our industry screening is to find deep value when it is cheap. We like the risk / reward at its lowest (risk) and greatest (reward). Once we have positioned the shares and prices move up as much as this group has, we are happy to ride the price momentum wave but equally as happy to rotate into the next best risk/reward industry we identify.

We have found the next best industry for our purposes. We will share some ideas in that industry shortly. The industry is the Gold Mining industry.

Good Luck – have fun – it is your life adventure!

Tom

Training, Coaching & Mentoring available

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()