Junior Miners Catching a Bid

West Red Lake Gold (WRLGF*)

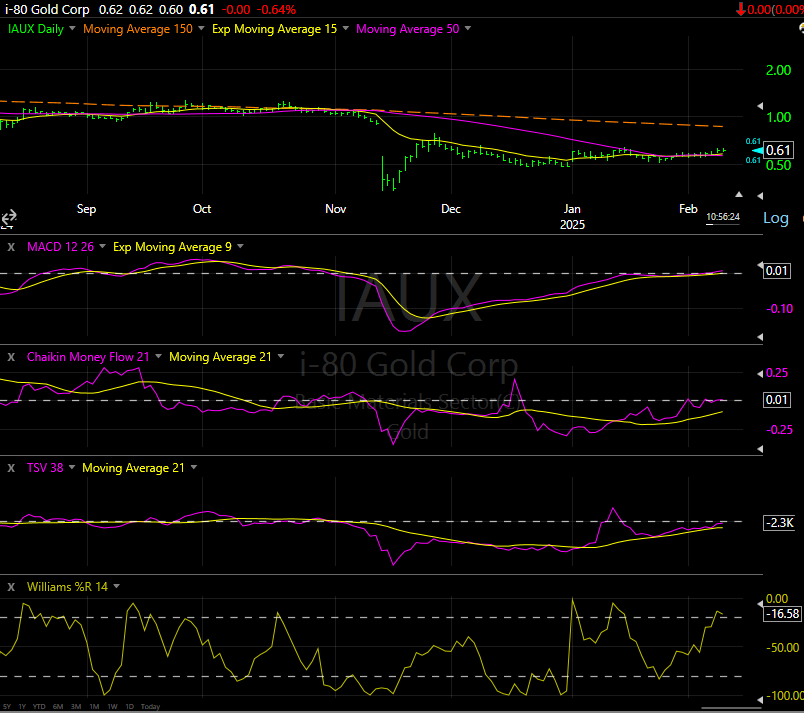

I-80 Gold (IAUX*)

Avino Silver & Gold (ASM*)

Aya Gold & Silver (AYASF*)

FLASH NEWS: Hot Chili (HHLKF*) – Major Cu-Au Porphyry Discovery. Expand potential.

We are sharing a few charts illustrating that Junior Miners are catching a bid. If you want levels of safety (as in cash flow) the we have two ideas that are beginning new cash flows in 2025. Some of the higher risk but high potential movers would be exploration stage miners who are a few years away from production.

We are showing multiple technical indicators that help illustrate accumulation that is building in the shares of these companies. NOTE: These are small illiquid companies that traditional trading (stop loss) tactics don’t work. Consider that you are buying companies, and you like the prospect of the company longer term and hope you get a big run short term. If you want in & out trading look to the bigger producing names in the mining sector.

West Red Lake (WRLGF*) projects that they will start production in late Q2 or Q3 of this year.

Annual profit is projected to be in the $75 million area for 2026. This is a small mine that management wants to use to grow through expanded drilling on the current claim and bolt on acquisitions over time.

I-80 Gold (IAUX*) has plans to open multiple mines in the Northern Nevada area along I-80 by 2020. The first mine will go into production in the second half of 2025.

Avino Silver & Gold (ASM*) below, is a producing mine with a strong growing revenue stream over the next three years. This is one of the safest junior miners due to its existing production and strong growth profile.

New Mine, New Milestones for 2025 | Avino Silver & Gold Mines Ltd.

GoGold Resources (GLGDF*) see next page for chart

Bradley Langille of GoGold Resources Inc. presents at Metals Investor Forum | Jan. 17-18, 2025

GoGold is a producing miner, producing more silver than gold. They are opening their second mine in about 24 months.

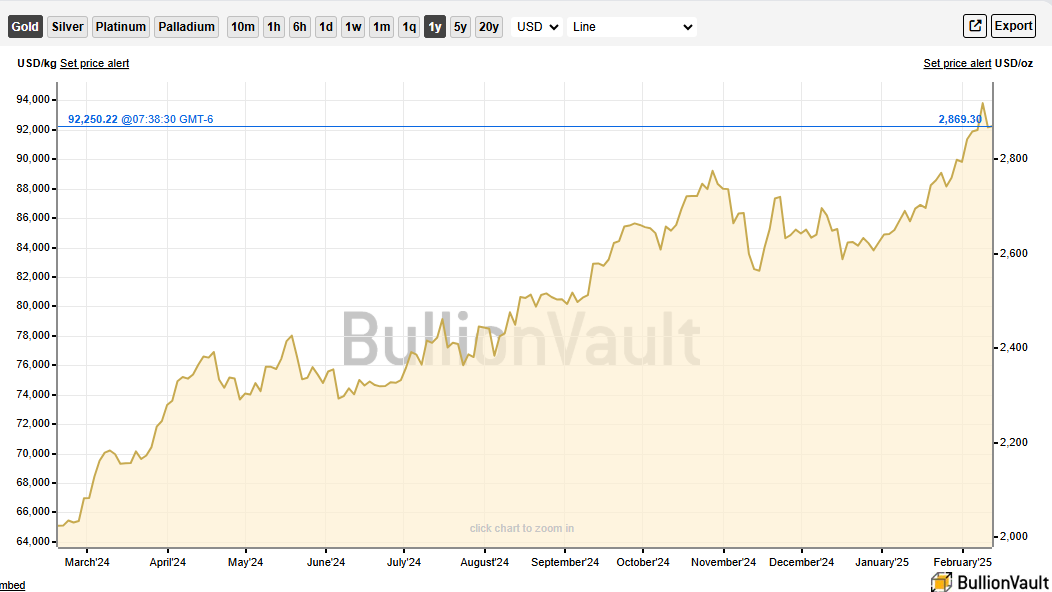

A Run for Physical Gold from the Vaults?

Chart source: https://www.bullionvault.com/gold-price-chart.do

Today’s note is actually a 20 plus minute video from Mark Moss.

The Hidden Crisis Behind Gold’s Surge | Paper Gold Collapse?

In the video Moss gives his understanding of what is causing the price of gold to sky-rocket. Moss talks about a long held belief that the paper gold is manipulated and over leveraged to the actual amount of gold held in the major bullion vaults. Because of recent actions by the US confiscating Russia assets, Central bankers around the world no longer trust the USA. They are pulling their gold back to their homelands and this is forcing a “Run on the Vault,” similar to a run on a bank. There has also been an arbitrage play of buying gold in the USA and London and reselling it on the Shanghai Gold Exchange where it trades at a higher price. The “Vaults” owe more gold than they actually hold. This has created a run on gold held in vaults. That is my rough version of what Mose is sharing.

While I have not checked his numbers Mose states the price of physical gold is up 46% in the last twelve months. This beats the performance of both the NASDAQ 100 (QQQ) and the S&P 500 (SPY). Ther SPY was up 20.78% over the past twelve months and the QQQ was up 20.91% . TradingView has physical gold up 41.53% in the same period. Bottom line, Trading View’s numbers or Mose’s number physical gold has outperformed by 2X these two major exchanges.

Gold Miners are historically cheap when comped to the price of the physical metal. LOTM owns the miners, so we are up but the share prices of miners are lagging physical gold, similar to the SPY and QQQ. It is a good probability that miners will play catch up to physical gold but we cannot guarantee this. Odds are in our favor. If buying miners based on this version of what is happening buy the big producing miners. Some of the best large producing miners are by symbol – PAAS, AEM KGC, & AGI. NEM and GOLD are the two largest gold miners but fist four listed are considered by many to be better run, more efficient large cap gold producers.

FLASH NEWS: Hot Chili (HHLKF*) $0.50 – Major Cu-Au Porphyry Discovery. Expand potential. Press release 2.11.25

Crux Investor Interview: Hot Chili (ASX:HCH) – 2Blbs of Copper is Achievable & Attractive

21 minutes – released 2.11.25

This news come on top of an two existing project. The first project to commercialize will be a water distillation plant that Hot Chili intends to sell. Anticipated proceeds will be used help fund the second project, which is an open pit copper mine. Anticipated value of the water distillation plant is in the wide range of $350 million to $400 million USD. In addition to the helping fund the copper project, Hot Chilli will retain water rights required to mine in this region of Chili.

The good news is the company is debt free with a market cap of $69 million and (my ballpark estimation) of $2 billion. Additional good news are the water rights. It takes about ten years to get water rights to mine in Northern Chili. Hot Chili not only has the water rights they own and are building the desalination plant as an asset.

The bad news production is likely four to five years forward.

Between now and then, I believe we have the potential to double to triple the share price, but much depends on the market’s desire to own a copper/gold, open pit mine. We have an asset worth far more than the Market Cap. Now it is up to the market to recognize the value! Timing is the uncertain part of the deal.

Hot Chili stock is thinly traded with a big spread between the bid and ask price. Use limit orders to buy or sell. We suggest accumulating shares slowly and on price weakness.

#hotchili #coppermining #gold #silver #stock

LOTM Notes updated Hot Chili, Feb 12, 2025 – originally sent to readers of LOTM on Feb 11, 2025

![]()