Good Morning everyone:

I’ve been a bit quite. I had a respiratory infection for about three weeks that either stopped me cold or were variable periods of activity and fatigue. Mostly fatigue. I am much better now and getting back to “normal.”

The Market: Summer doldrums but we have gold, silver and mining stocks perking up and Crypto/Blockchain related stocks hanging in there while crypto itself is in a correction mode. That is very healthy. Basically, the accounts are doing very well so what’s to say – enjoy. If one is in mining companies and blockchain companies, LOTM focus at this time, you should be at least neutral and likely in a bullish mode.

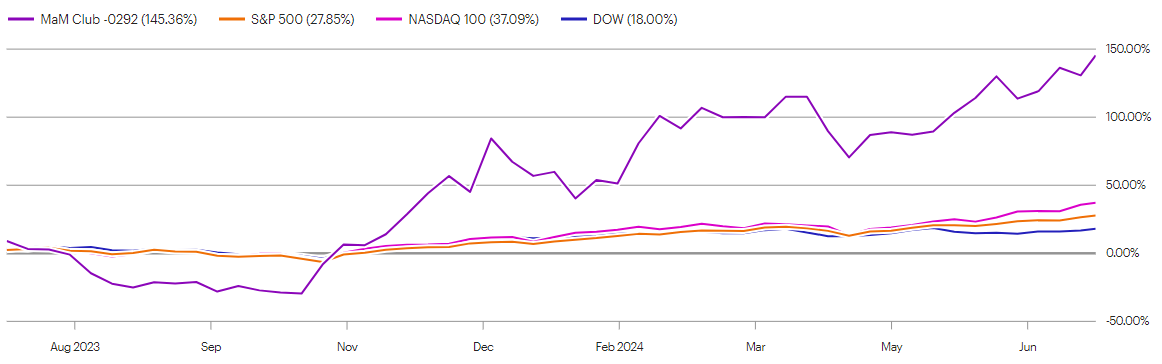

One-year performance of the Making a Million$ (M&M Club) ”focused account” performance:

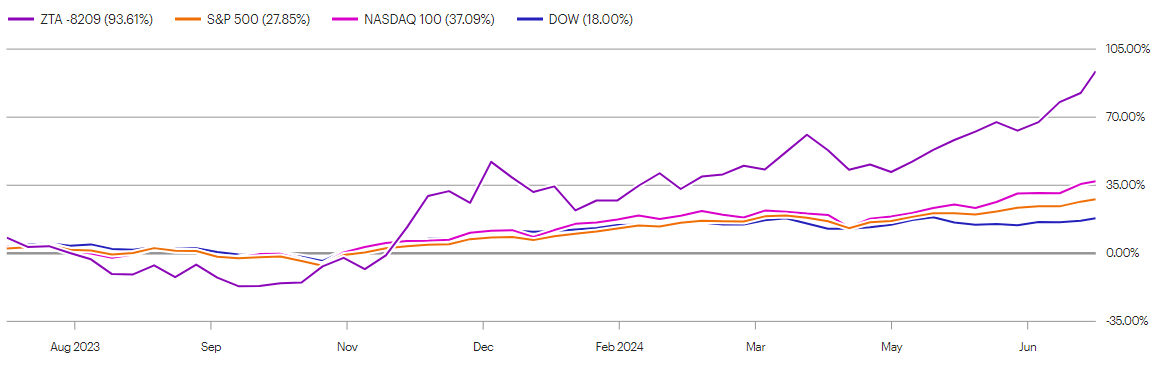

ZTA Partnership, our multi company, yet concentrated by industry, account one-year performance:

Looking forward:

The economy is weaking very fast. The Fed has said as much but wants to wait until the actual data points appear in the dot-plot report. A lagging indicator at best. So, it is highly probable the Fed is late in cutting interest rates and times forward for the economy could be weaker than expected. This means the fed will drop interest rates multiple times or a couple of big cut possibly starting in September or perhaps wait November after elections. This is very good set up for commodities, crypto and tech stocks. BioTech is one area that is over-sold and could rally back strong with expected falling rates. We see no reason to adjust very much as we believe gold, silver and copper in early in a multi-year bull move. Crypto, as judged by its four year cycle, has another year to run. So steady as she goes.

Enjoy – Tom

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()