30% correction in Crypto Related Stocks

Six that are Ready to Rally

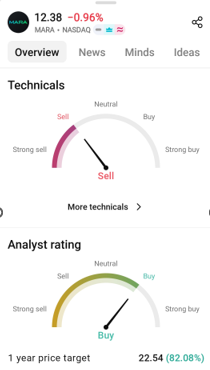

MARA Holdings (MARA*)

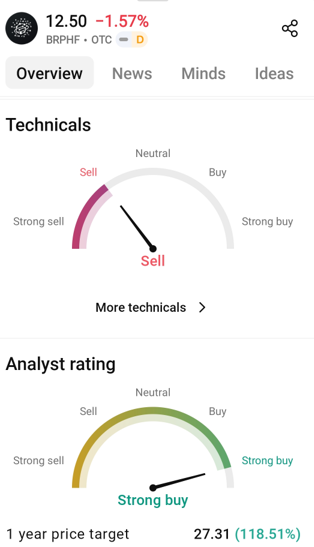

Galaxy Digital (BRPHF*)

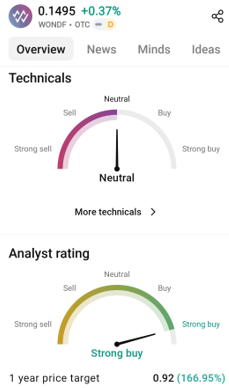

WonderFi (WONDF)

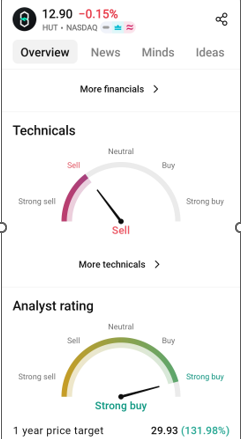

Hut 8 (HUT)

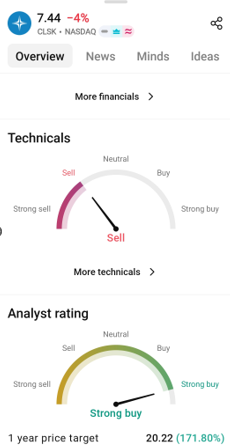

CleanSpark (CLSK)

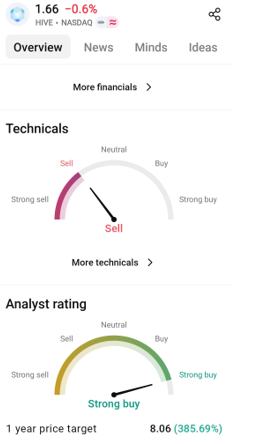

Hive (HIVE)

LOTM believes that since 2022 year-end we have had two waves higher in the Crypto/Blockchain stocks. This “correction” sets us up for the third wave higher before a longer-term correction.

The Crypto/ Blockchain industry has a decade or more of a rising tide looking forward. As we have just experienced, however, corrections happen along the way. The names above have yet to rally off their over-sold condition.

Three names we really like, have already made big moves Neptune Digital (NPPTF*) – up 25.6% last five days, DeFi Tech (DEFTF*) up 64% last five days and Exodus Movement (EXOD) – up 76%n last five days. In related accounts we have purchased and sold shares of EDOX for a nice part of the 75.6% rally EXOD made. The long-term probability (six months or more) is that the six names listed above will trade higher than they are today.

If you understand the company and are comfortable with the company valuation, it allows the freedom to act impulsively when volatility occurs that causes emotional panic or programed stop-losses to happen. With robotic trading, knowing your company opens up trading opportunities for taking advantage of the auto or fearful selling. One does not have to think – just do, if you know your company and also understand the reason for the selloff. As a broker in a past life, I had a number of clients that did not need me to trade but they understood I “knew from the know your company adage” certain companies or industries. checked with me prior to placing trades. They traded those companies or industries to increase their probability of successful trades. They were a fun group because they knew what they wanted to do but wanted my perspective on the trade from a company perspective. Funny thing was while being very loyal to me as their “customer man”, they rarely made a trade if I called them with an idea. We each understood our roles and trusted each other in the relationship. Thanks for listening to this editorial part. I’m trying to contribute towards making better traders of us all, my self-included.

We sourced charts and indicators from two places below – TradingView.com and StockCharts.com

Understand, the Williams %R in the charts below is a very short-term Over-Bought / Over-Sold indicator. Wm%R is helpful for entry and exit points but nearly worthless (from my perspective) for Trend Analysis.

The large surge in volume in CleanSpark, Friday, is interesting.

Also, lots of recent Volume for HIVE.

Above: Galaxy Digital (BRPHF*) Above: MARA Holdings (MARA*) Above: WonderFi (WONDF)

Below: CleanSpark (CLSK) Below: HUT 8 (HUT) Below: Hive Digital Tech (HIVE)

LOTM COMMENT: Technical signals and Fundamental (Analyst Ratings above) signals. I try to buy early and hate playing catch-up to price moves. When the long-term technical trend is up but the stocks are correcting within that positiv e long-term technical uptrend I like buying the negative technical (but over-sold) signal. If the company fundamentals or industry fundamentals are breaking down then – NO avoid both company and industry.

IMHO, Crypto and Blockchain ares still in a major uptrend.

Three Timely Videos on what is happening in Crypto and Blockchain.

In LOTM speak: The US Dollar is for purchase and sales transactions. Gold and Bitcoin are stores of Value. Stable Coins are the transaction vehicle between store of Value (Gold and Bitcoin) and purchase & sales transactions (US Dollar-cash).

We are moving towards this model at breakneck speed. From LOTM’s pewrspective we want exposure to the digital world of Crypto, Blockchain Commpanies with applications to this new monetary model and Fintech companies.

- Trump administration wants to buy as much Bitcoin as possible, Crypto Council’s Bo Hines reveals

March 18 article in Crypto Briefing

- Bitcoin Is Taking Over Wall Street RIGHT NOW – Anthony Pompliano with Jan Van Eck, the CEO at VanEck March 19, 2025

- “Crypto is my TOP Priority… Bitcoin Will Boom!” Trump BREAKING NEWS + What Comes Next!?

Altcoin Daily March 18, 2025

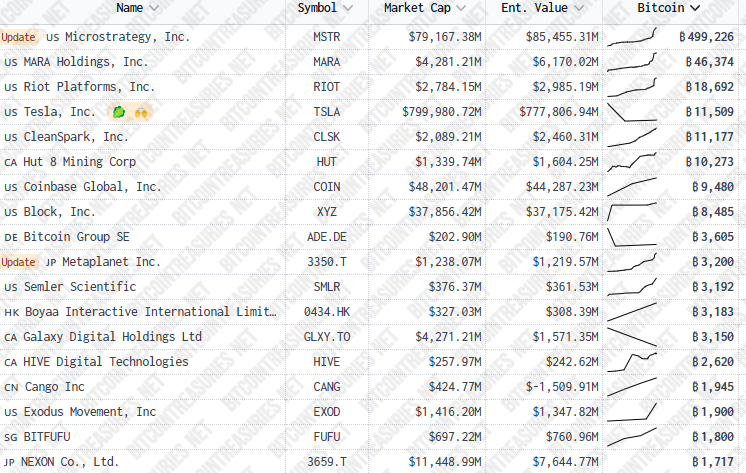

Largest corporate holders of Bitcoin dated March 22, 2025 – sourced from BitcoinTreasuries.net

![]()