Summary:

- Galaxy Digital, 2021 year-end earning look good. Disappointment on US Listing date.

- Consumers already tighten their belts – MarketWatch.

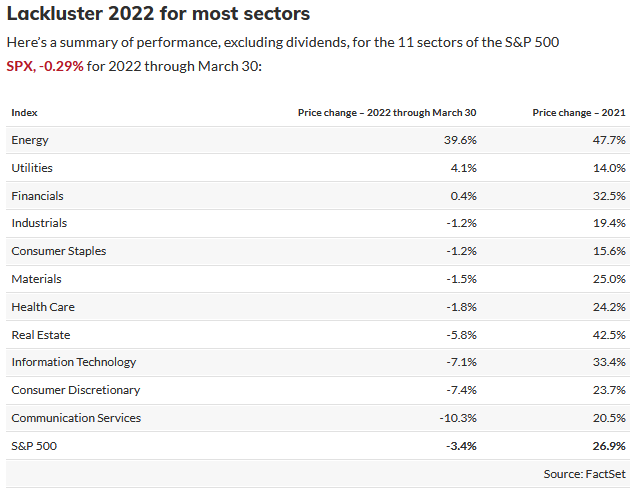

- Lackluster Q1 2022 for everyone but the Energy sector.

- Vermilion (VET) finding Price Resistance but still strong Fundamentally.

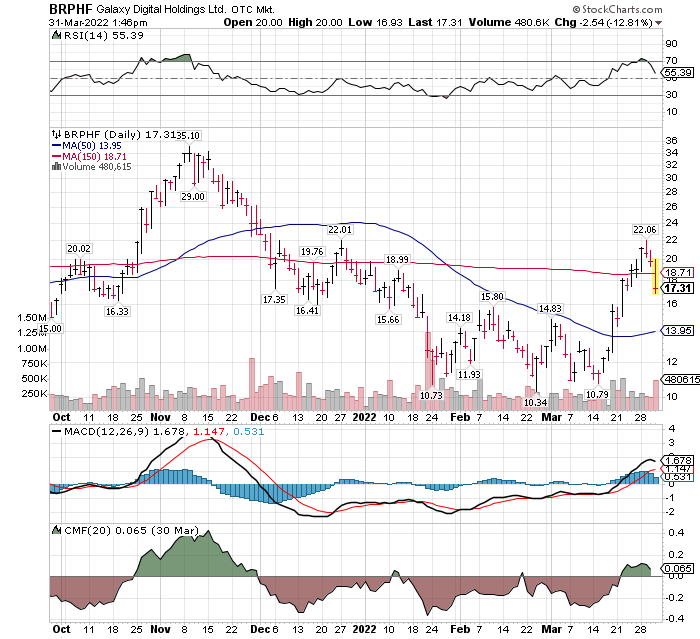

Galaxy Digital (BRPHF) $17.31

The disappointing news for me (I suspect for everyone) on Galaxy, is that the public listing in the USA is pushed out with no clear time period for the event. The new timeline is vague. Stated as, between sometime in Q2 to Q4 Year-end. It is in the hands of the SEC, not Galaxy. BitGo closing would happen after the USA listing of Galaxy happens. The year-end 2021 announced today, was very impressive when comped to 2020 year-end. Linked here.

2021 Year-end highlights for Galaxy:

- Net comprehensive income increased 345% to $1.7 billion versus prior year

- Partners’ Capital increased 226% to $2.6 billion versus prior year

- Assets Under Management (“AUM”) increased 256% since Q4 2020

- Galaxy remains committed to listing in the U.S. and closing the BitGo acquisition

The Chart:

The chart above is fine, but for short-term traders it’s a setback. Resistance in the $20 to $22 dollar area. Support is in the $15.50 to $16.50 area. The 50-day moving average at $13.95 is secondary support area. The 150-day now above the price, could be resistance, but the stock had no trouble slicing above the 150-day earlier this month. As mentioned above, the key catalyst at this time is the stock getting listed in the USA.

Lower-income consumers will start tightening their belts by trading down to private label goods in 2022, analysts say March 31, 2022, Tony Garcia MarketWatch

LOTM: I am already seeing this in the grocery store. Private label items are “sold out” while branded items are still on the shelves.

If you didn’t own energy, the first quarter 2022 was a tough quarter. Sourced from a MarketWatch article.

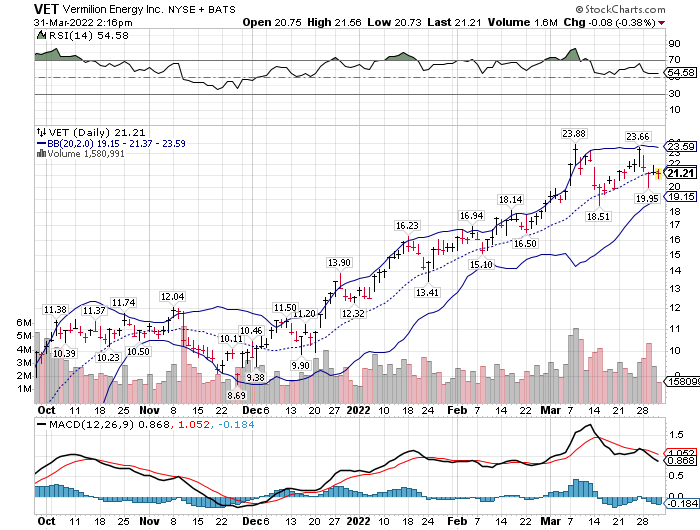

A Look at one of our Favorite Energy companies: Vermilion (VET)* $21.20

The chart below suggest the shares are losing momentum Vs the broader market. Note the RSI in the top of the page has fallen out of the “above 70%” area. This action is considered negative for short term traders. The price also tried and failed to get above its previous high water mark of $23.88 in early March. A potential double top.

Fundamentals for Vermilion are super strong so longer-term owners are still ok, but we’d have to rate VET a Hold at this time. We expect dividend hikes and share buy backs along with debt reductions. The trailing P/E is very low at 3.86. The fundamental picture is excellent as to the health of the company.

The bigger picture is that we do expect lower oil prices. It does look like the conflict in Russia / Ukraine is subsiding.

Longer-term fundamentals were boosted by VET’s second acquisition announced this week. On March 28, VET announced a Strategic Acquisition of Multi-Decade Free Cash Flow Generating Montney Assets.

As an investment in fossil fuels, VET is doing everything right and is still cheap on a valuation basis. We would add to shares on price weakness should the share price dip below the $18.00 level and the macro view for energy remains stable. We consider stable as a low price range of $65 to $70 a barrel of oil. VET is expected to be very profitable with oil in that area and above. We could easily raise our buy price target, but for now we are saying below $18 looks good.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()