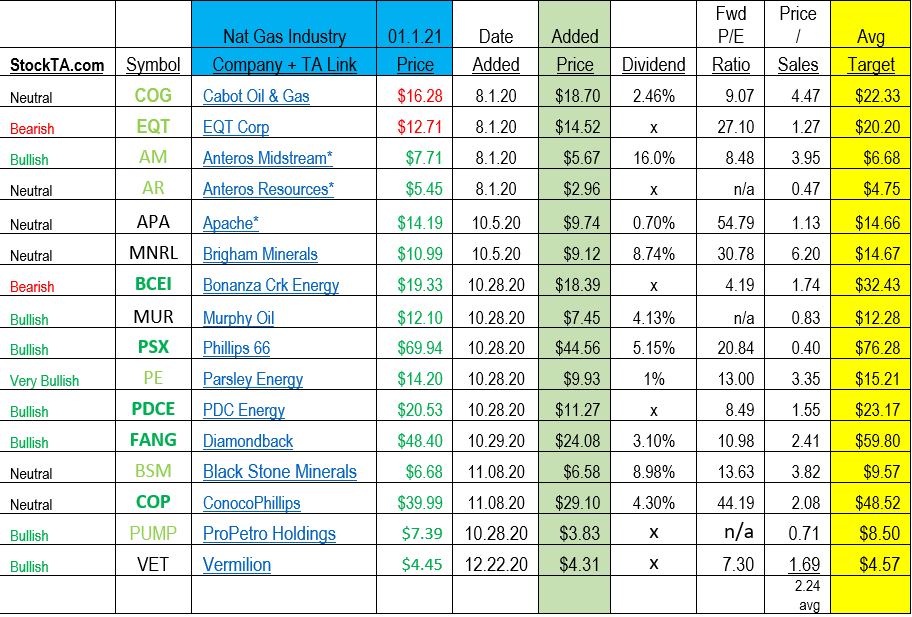

Six Level Coded Buy/Hold/Sell Ranking:

1) StockTA.com: Technical “Overall”

2) TA Opinion – Name linked to complete Technical Opinion

3) Analyst Strong Buy: Symbol bold and green

4) Analyst Buy: Symbol bold & pale green

5) Analyst Hold: Symbol black

6) Analysts Sell: Symbol red

Oil and Gas sector had a great month of November and early December. Many companies in this sector were up 35% to 100%. It was a rally from an extreme, oversold position. Since mid-December many have consolidated this initial move off the lows. We are of the opinion that a second wave upwards is in store for the oil and gas sector in early 2021. In related accounts we made the trade and are looking to re-enter the oil and gas sector on a stock-by-stock basis. Listed above, are some the favorites we have filtered from the industry. They include small and well as some large companies.

The two largest Natural Gas companies in the USA were the two worst performers, not even coming off their lows. The largest Nat Gas company in the USA is EQT and the second largest is Cabot Oil & Gas. These are good companies, and they will rally but are lagging the group at this time. You will not be able to keep these stocks suppressed as the industry rebounds.

The way we are using the chart above is a very simple screening process. We are looking for the best value by looking for a low forward price to earnings (P/E) ratio and a low price to sales (P/S) ratio. The low P/E give us value metric based on earnings and the P/S gives a value based on total sales.

- Bonanza Creek (BCEI) is our lowest forward P/E of under 5, with a modest price to sales ratio of 1.7. We really like this opportunity at this price.

- Anteros Midstream (AM) has a low forward P/E ratio and a big dividend of 16%. Hard to beat that combo. Management said free cash flow will be increasing in 2021 and they have no intention to reduce the dividend. We have a string buy and accumulate on weakness opinion about AM.

- We like the parent company of AM, Anteros Resources (AR), the Exploration and Production (E&P) part of the AM, which is pipeline distribution arm. AR is cheap on price to sales ratio of 0.4. Four to five years back AR was a $60 stock. Management is excellent. Battle tested over-time and on top of their game. AR would be our choice for biggest potential upside from this group of names.

- Apache (APA) is a company that originated in Minnesota. Early in my career, back in the 1970’s, I was in many office presentations from Ray Plank, the founder of APA. Current management has stated that their break-even cost on oil is about $30 per barrel. With prices between $30 and $50 they would focus on debt reduction and with oil above $50, they would begin an exploration process again. They have a strong inventory of prospective drill sites. APA would be our second best, appreciation prospect.

- Vermilion (VET) was just added to the list of companies of interest. It has a low forward P/E ratio of 7.3 and a below average P/S ratio of 1.69. Free cash flow is strong in the most recent Q1 at $81 million. The chart pattern is a perfect Cup and Handle pattern. My best guess is this stock is ready to move higher.

I love the “flat-line” pattern the stock is in. To me it means someone big has an open order to buy as much as they are given.

NOTES:

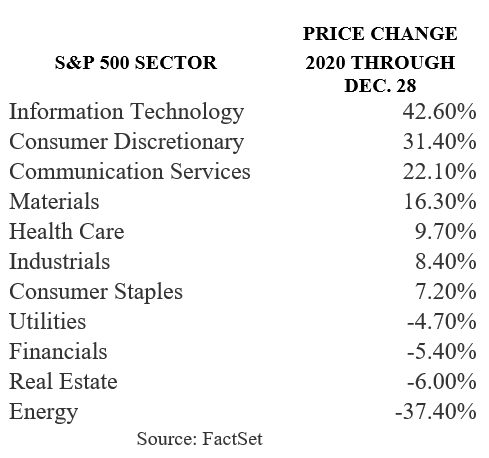

- Energy finished the year 2020 as the poorest performing sector in the S&P 500. Even after the great November rally. Energy is still CHEAP!

- Goldman Sachs has a $65 target price on Oil for 2021.

Structural underinvestment in oil and gas will put upward pressure on oil prices, Goldman Sachs’ commodities chief Jeffrey Currie told CNBC this week, commenting on commodity markets.

All markets except wheat, Currie noted, are in a deficit, and this is certainly bullish for prices. But what he calls structural underinvestment also has its part to play for the future of prices. This is particularly true for oil, where the underinvestment is not just motivated by the price rout but by the shift towards renewable energy investments. Follow link in headline for the rest of the article.

LOTM COMMENT: Goldman is looking for another 30% increase in oil prices in 2021. 30% increase in oil prices from the current price will create a multiplier effect on profit margin in oil and gas companies. LOTM opinion is that there is 50% to 100% appreciation potential in the energy stocks as a target range in 2021.

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()