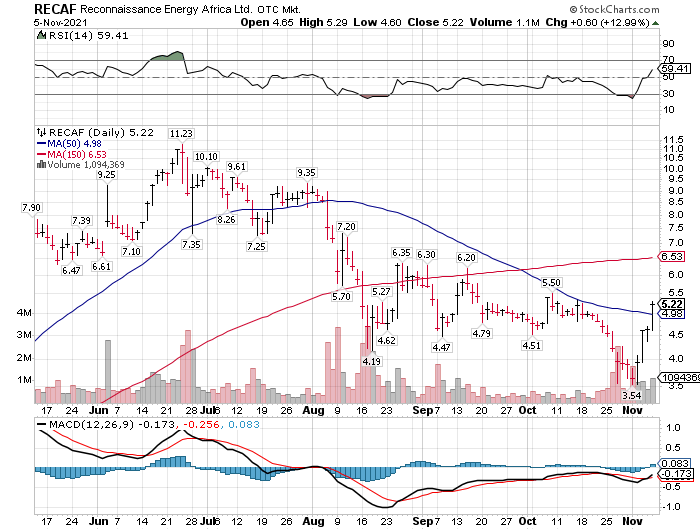

What a difference a few days make. Monday this week, Recon traded as low as $3.54. Friday’s close was $5.26. Up from the low on Monday by

There is a lot of negative news out on Recon Africa. Much of it is propaganda to either stop the development of oil in Namibia and Botswana by activist environmental groups or to aid the drop in stock, sold short by a group out of Germany.

The company has rebutted the negative comments with facts backed up by the governments of the property in question. We are of the opinion that Oil & Gas is a necessary component to the global energy supply chain during the transition to a carbon free supply of energy. This is a multi-decade process and not a five to 12 year process. Therefore, we have no issue with investing in assets that are part of the transition process. To do less would cripple the world and drive energy costs higher. Let’s be real. The science does not say the world as we know it will end in 12 years. If you believe this, then lead by example and give up heat this winter. If you talk the talk, please walk the walk. There is so much nonsense in America these days, my skin is getting thin. My apologies for saying what I think. I know it’s not appropriate these days.

Below is a positive article concerning Recon. It is likely a promotional article sponsored by Recon – no different from the anti-Recon articles promoted by others just someone’s perspective. I have followed Recon since a month after they came public through a reverse merger. I have tried to seek the truth to find the investment opportunity by cutting through BS, whether from the company or by people seeking to put the company out of business. My goal is neither to promote fossil fuels or to put them out of business. I am a purist in seeking the best investment opportunities available that use industry best practices. I am comfortable with Recon doing this. As for the investment opportunity I will let you read the most recent article below to determine the potential. Consider it for what it is – a promotional article. That does not mean it is fake news.

LOTM has no upside target on the shares other than a price above the top of the June highs. We consider this an asset play whose ultimate benefit is too large to guess and unknowable at this time. As such we will be opportunistic in buying and selling but keep a core position long term. It is my opinion that the price is well below the value of the asset it controls. With that perspective, we are deep value buyers.

Could This Be The Biggest Winner Of The Oil Price Boom?

By Tom Kool – OilPrice.com – Nov 04, 2021, 6:00 PM CDT

Join Our Community

Onshore oil discoveries are pretty much a thing of the past. The last time anyone got remotely excited about one was in 2017, when giant Repsol discovered 1.2 billion barrels in Alaska’s North Slope.

But a giant E&P company making a discovery doesn’t really move the needle for investors…

But the potential multi-billion-boe potential in Namibia’s Kavango Basin could be a whole different story.

It could be the last major onshore discovery the world ever sees – and a multi-billion boe potential is worth repeating.

And for us the most exciting part? The entire Kavango Basin is licensed to a small-cap explorer called Reconnaissance Energy Africa (RECAF) with an experienced team of geologists working with some of the industry’s premier service companies, Schlumberger and Halliburton.

And they just finished an extensive 450-square-kilometer seismic acquisition aimed to determine the details of a much-anticipated multi-well drilling program starting in Q1 of next year.

The full story is linked here.

This game has levels of understanding that could take a lifetime of Trial and Error to learn.

Available for Coaching, Training or Mentorships

Contact LOTM For One-on-One consultations.

Rate: $150 per hour / Monthly Retainer, Lowers Rate

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()