Global silver demand to hit record in 2022 on strong industrial and investment demand – report

Vladimir Basov Wednesday February 09, 2022

(Kitco News) – Global silver demand is forecast to achieve a record high in 2022, rising 8 percent to 1.112 billion ounces, driven by projected record silver industrial demand as well as physical silver investment demand, which should enjoy double-digit gains, reaching a seven-year high this year.

This was reported by the Silver Institute, which said that in 2022, the silver market will build on the strong foundation set last year and that the increase in silver demand will be driven by record silver industrial fabrication, which is forecast to improve by 5 percent, as silver’s use expands in both traditional and critical green technologies. (full story linked in headline)

LOTM: Silver and Gold are breaking out however we still have to be smart about working in this sector. Yesterday was a bit of a high water mark with prices coming off their highs by mid-day. If you have been working in the precious metals area you likely have your own routine going. If not here are some comments to consider in working the Metals.

I: Metals have long periods of stock price inactivity then explode upwards in large percentage price moves but relatively short periods of time. Time being two months to Nine months. It is important top have an exit strategy in these periods of explosive price movement. One plan is sell half your position when the price doubles to get your money out. Simple like using a sludge-hammer to pound a nil but better than no plan. A different plan is to sell 1/3 of your owned position for every 50% the price rises. In selling 1/3 of your remaining position with every 50% move higher, you never completely exit the position but harvest profits along the way. Re-purchase shares based on a combination of lower prices, technical studies and fundamental development at company and Macro levels.

II: This is not an industry to buy and hold. Most professional take two paths. The first is strictly technical and momentum based. The second is as a speculator with the goal being a) profile your target as to its future potential, b) use price weakness to accumulate a out-sized position c) recapture your original investment as quickly as you can once the price moves d) fight to ride the upward momentum as long as you can like a surfer and e) know what will cause you to exit the trade in its entirety. This is a cyclical industry with many BOOM and BUST periods.

Below are silver exploration companies LOTM finds of interest. They are thinly traded, difficult to sell if physical silver falls in prices. It is best if smaller positions are taken in a number of silver exploration companies. These companies have a variety of different core samples. I will say that we have targeted either exploration companies with high grade core samples or companies in high grade silver districts. They are years away from actually producing revenue. By that definition they have to be considered speculative. At the same time, we can say that these companies once bought in LOTM related accounts are considered long term holding based on a shortage of silver required for the planet to “go green.”

Reference Notes:

- Enterprise Value (EV) is market cap + debt minus cash:

- Share count, Mkt Cap & EV are sourced from TradingView.com

Silver Exploration Companies:

GRSLF: Tiny company – easy to get stuck in the stock but also in a high density silver rich district in Mexico.

Shares outstanding: 167 million Market Cap: $44 million EV:$28 million

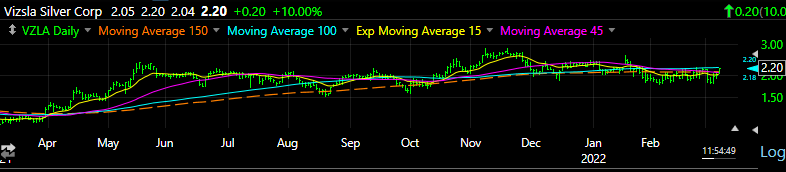

VZLA: Shares outstanding: 127 million Market Cap: $310 million EV: $252 million

DSVSF: Shares outstanding: 330 million Market Cap: $538 million EV: $257 million

SILV: In the moment of transitioning from Exploration to Producing company

Shares outstanding: 145 million Market Cap: $1.4 billion EV: $1.32 billion

SLVRF: Some production from Heap Leaching Pads but potential is in exploration prospects.

Shares outstanding: 202 million Market Cap: $71 million EV: $52 million

Producing Silver Miners:

EXK: I would trade EXK as a buy the dips sell the rallies. Operations are good but not strong enough in the near term drive the price.

Shares outstanding: 170 million Market Cap: 4888.5 million EV: $597.2 million

FNLPF: One of the largest silver mines in the world. Under appreciated, perhaps because it is a British company operating in Mexico it does not get much press in USA.

Shares outstanding: 736.8 million Market Cap: $7.8 billion EV: n/a

AG: The leading pure play in silver miners. Excellent leadership in founder-president, Keith Neumeyer.

Shares outstanding: 260 million Market Cap: 43.4 billion EV: $2.8 billion

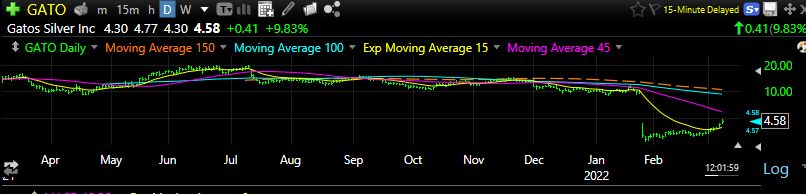

GATO: I am fully on-board with Gatos. The revision downwards in reserves is human error (independent party). Gatos has only tapped 205 of the leased property they have. Lots of time to expand reserves.

Shares outstanding: 69 million Market Cap: $310 million EV: $296 million

PAAS: Industry leader in the western hemisphere.

Shares outstanding: 210 million Market Cap: $5.73 billion EV: $4.97 billion

What to do now?

I am still accumulating shares in gold and silver miners for a two to four-year outlook. I believe the shortage of minerals for safe haven reasons, lack of supply for the build out of the Electric Vehicle market and for a sound money vs fait currency reasons have years of time to play out. Typically, commodity cycles and deflationary cycles run for decades. The deflationary cycle (interest rate decline) rand from 1982 until March 2020. Keep that in mind for a time perspective. We have only begun the rise in commodities. I did sell some of the price moves yesterday March 8th in miners that were extended but added to miners I though were still a good deal from a fundamental perspective.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()