- Soluna’s News reminded me of two other companies that run short of cash

- Calumet Blows Expectations Away

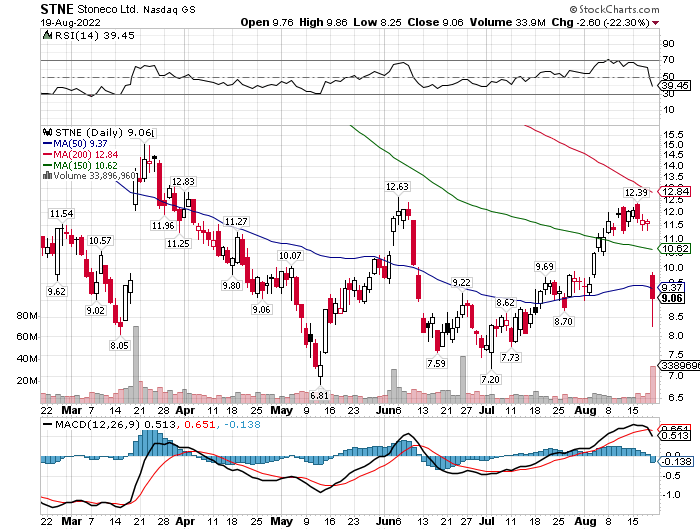

- StoneCo Down 21% on Meaningless Negative Headline News. Opportunity.

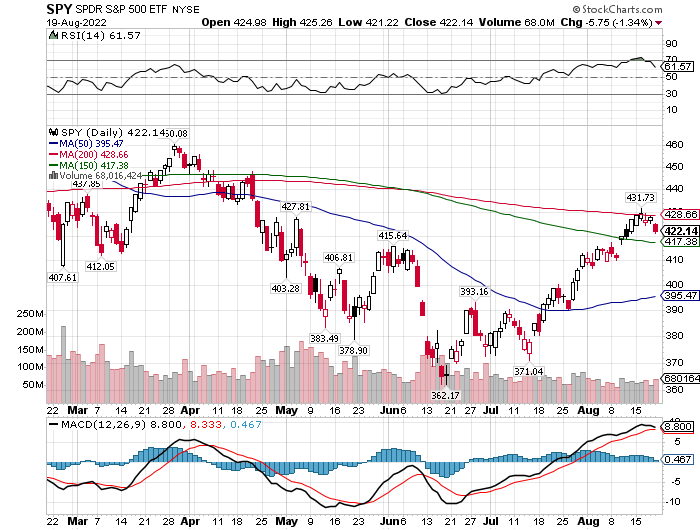

- S&P 500 failed at 200-day MA. End of the Bear Market Rally?

Soluna (SLNH)* $3.35

Soluna is my biggest position. The news about the 10-Q qualification as a going concern surprised and bothered me. For all the transparency of the monthly updates there was no disclosure about cash flow and finances. I believe Soluna can come through this mess, but it got me thinking about other companies that had near death experiences. Building a company is not easy and young companies are always on the edge of something could go wrong. Founders and management have to scramble to resolve the problem. Here are two companies that survived their near death experiences, Tesla twice, and Fed Express. You might not know or perhaps forgotten about these close calls and how they got resolved. While I believe Soluna can resolve their problem, no one can say for sure they will. In the scheme of things this isn’t a big problem, but it is a serious problem. Act accordingly for your own account and situation. Events like Soluna is experiencing are more common than you think.

Joe Michalowski, Content Strategist, MOSAIC, Published on March 9, 2021

- The Founder Of FedEx Saved The Company From Bankruptcy With His Blackjack Winnings Maggie Zhang, BusinessInsider, Jul 16, 2014, 8:57 AM

Calumet (CLMT)* $16.83

- Goldman Sachs In Barron’s recommends Calumet. Aug 18, 2022. Price target $23.00

Calumet Specialty Products (CLMT) Goldman Sachs upgraded shares to Buy from Neutral with a $23 price target, up from $14.

ZACKS: Nilanjan Choudhury – August 8, 2022·8 min read

Calumet Specialty Products Partners, L.P.: This downstream operator focuses on specialty products (oil, waxes, white oils etc.) and solutions, in addition to renewable diesel (or refining). CLMT targets high-performance markets for lubricants and engineered fuels, which provide ample growth opportunities for the partnership.

The 2022 Zacks Consensus Estimate for Indianapolis, IN-based Calumet indicates 76.2% year-over-year earnings per share growth. The firm beat the Zacks Consensus Estimate for earnings twice in the trailing four quarters, the average being 62%. Valued at around $1.2 billion, the Zacks Rank #2 (Buy) CLMT has surged 145.9% in a year.

Calumet Specialty Products Blasted Off, The Cash Flow Went Solar

Aug. 19, 2022, Seeking Alpha

Summary

- Calumet reported a through-the-roof record of $175 million in EBITDA far above the most bullish estimates.

- Significantly higher cash flow will likely continue.

- Between cash on hand and cash generated in the 2nd and 3rd quarters, the company will have enough cash to purchase the 2024 bond debt. (Full story in headline link)

StoneCo (STNE)* $9.06

LOTM: Q2 results (below) showed a surprise loss, and the stock is sold down hard.

In reading the news most of the loss was from a trading anomaly that is a “mark to market’ bookkeeping entry that was erased within days. We like STNE short-term and long-term. Obviously, StoneCo is a volatile stock. For trading or accumulation this can be an advantage. We think the drop sets the stage for a price recovery in within a week or two. An account related to LOTM purchased shares on Friday the 19 of Aug. We expect to trade some share and own some shares.

FROM eTrade news:

StoneCo Shares Fall on 2Q Loss 7:19 AM ET 8/19/22 | Dow Jones By Will Feuer

Shares of Brazilian financial-technology company StoneCo Ltd. fell in premarket trading after it reported it swung to a loss in the second quarter.

The company posted a loss of 489.3 million reais ($94.7 million), compared with a profit of BRL526.0 million a year earlier.

The company said the swing to a loss was mostly due to mark-to-market losses from its investment in Banco Inter SA, which hurt profit by BRL527.1 million in the recent quarter and boosted profit by BRL841.2 million a year earlier. Banco Inter’s publicly traded parent company, Inter & Co., was hit by a wave of apparently unusual trading activity around the end of the quarter, StoneCo said.

Inter stock fell 26.1% on June 30, and then increased by 31.9% on July 1. StoneCo said its mark to market is based on the value of the investment on June 30.

On a per-share basis, the loss was BRL1.56, compared with a profit of BRL1.72, it said.

Stripping out the effects from the investment in Banco Inter and other one-time items, adjusted earnings came to BRL0.25 a share. Analysts surveyed by FactSet had been looking for adjusted earnings of BRL0.24 a share.

Revenue surged to BRL2.3 billion from BRL613.4 million in the prior-year period, which included a BRL397.2 million negative adjustment in credit fair value. Analysts surveyed by FactSet had been looking for BRL2.2 billion.

The company said Chief Financial Officer Marcelo Baldin will depart the company, and Silvio Jose Morais will take over as interim finance chief. Mr. Morais will temporarily step down as a board member to assume his new duties, the company said. The company said Tatiana Malamud was appointed chief legal officer effective Aug. 1.

- Mark to Market accounting has no bearing on cash. Bookkeeping entry only.

SAME NEWS BUT, OH HOW DIFFERENT IT READS:

Yahoo NEWS:

The company beat all quarterly guidance lines; Adjusted net income of R$ 76 million was 48% higher vs. previous quarter on a comparable basis

SÃO PAULO, Aug. 18, 2022 /PRNewswire/ — Today, August 18, StoneCo Ltd. (Nasdaq: STNE) reported its financial results for the second quarter of 2022. The highlights are net revenues of R$ 2.3 billion, 5% above the guidance, and pre-tax earnings of R$ 107 million, 19% above the guidance. Revenue growth was driven by a 101.5% year on year rise in revenues from the Financial Services segment, which reached R$ 1.9 billion, combined with a 23% increase in revenues from the Software segment, which reached R$ 351 million. The company expects to continue consistently growing revenue and expanding margins throughout 2022.

Full story link

We believe this selloff is a knee jerk reaction to headline news that upon inspection is not material to our perspective or the company’s situation. Call it noise or call it Fake News, it is not material. We believe the story line for StoneCo and PagSeguro (PAGS)* as the leading fintech companies in Brazil.

The problem with Technical Analysis. A negative news headline that did not change anything in the fundament picture of the company, triggered multiple technical indicators to flash sell signals. Price broke below the 150-day MA and the 50-day MA. RSI fell below the 50% line. MACD flashed a sell signal as the fast (black) differential crossed below the slow (red) differential. And nothing changed at the company.

Our guess is that once humans get involved, the price will stabilize above $10.00 and closer to the 150-day moving average at $10.62. Consider buying the stock and selling the $10.00 call options. Best guess on downside price risk is $0.60 to $1.50. Seems to be a lot of price support in the $8.00 to $8.50 area.

S&P 500 (SPY) Bear Market Rally over or a Pause to Build momentum to cross above the 200-day moving average?

It’s really hard to make this call. We wrote recently that Copper stocks were beginning to rally. This is a lead indicator on what the market thinks. Bullish. SPY stopping at its 200-day mA is a bad omen and could be behind a lot of the quick to pull the sell trigger in other stocks.

We are pretty sure we have six to eight months of negative economic news in front of us. Since the first six months of 2022 were down big time, odds are high we will have a string tax loss selling season starting in about two weeks. Another reason for a quick sell trigger finger.

When we look (below chart) at the various indicators we use for our technical signals, we have to say respect this failure at the 200-day moving average. RSI is starting to fail. MACD is close to Failing. Filed at the first attempt to cross above the 150-day MA. Best guess is we fail to stay above the 150-day moving average, but we have a chance to hold at support at 410 area on the SPY. Secondary support is at 400.

I am going to assume we will fall to 410 on the S&P 500. It has been a great 60-day rally. Time for a break – possibly a resumption of the bear market. Be careful. Unknown at this time.

Written August 20, 2022, by Tom Linzmeier editor, www.LivingOffTheMarket.com

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()