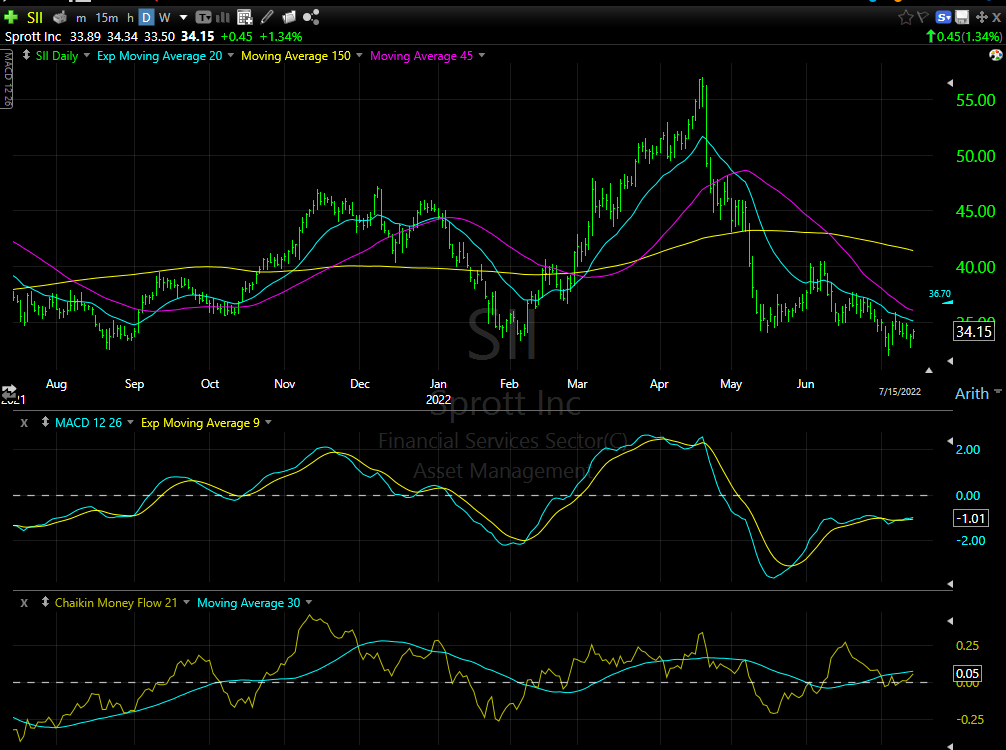

Sprott is a natural resource mining investment banker / asset management / broker. By the nature, investment bankers & brokers, are very volatile stocks. If you have read me for any length of time you know I have a love hate relationship with volatility. Normally I love volatility. That is when I am looking for a company or industry to buy and it explodes upwards. I hate volatility when owning a position and the volatility catches me and sucks my position down. My strategy at that time is to dollar-cost-average my way through the event, but it requires time. Sprott shares are very volatile. Be careful not to over-trade the position size. It is in the playground that I believe will be a hot arena for the next five to eight years – Metal mining and Natural resources. The current price drop brings the share price to a support level that has held since coming public on the NYSE. The $34 area plus or minus a small amount. I like Sprott Inc. and believe it is a well-run company. It founders Eric Sprott and Rick Rule have left the company but the culture they built remains.

I am going to leave it up to you how you play the trading game with the Sprott share price. I believe it to be a very good trade set-up for a potential 20% to 35% trade from the current price. Should the Fed pivot and decide the credit system is freezing up, we could see a quick trip back to $55 and higher. In a precious metal bull run – which I feel is coming – Sprott could easily 2X to 3X IMO.

For bigger players, the liquidity is adequate but not great. It is currently running about 140,000 shares a day. The shares out are 25 million with 21 million floating. Long-term debt to equity ratio is quite low at about 0.13. The trailing dividend is 3.7%.

The shares have just made a round trip in six months from $34 to $55 back to $34. A trip like that in a 12 month period would be great but in six months, mouth-watering!

There are options available.

- I prefer buying stock and legging into a call selling opportunity.

- Perhaps a put sale but this is harder to stop-loss out of it the trade goes against you.

- Buy an in-the-money call and sell-an-out of the money call. Makes a good trade but my greed level is a bit higher so prefer buying the stock and selling a lagging call against the shares or just trading the shares.

Thesis:

The world is rapidly moving to a bifurcated payment system where the US dollar is no longer the only global payment system for commerce. Saudi Aribia, Russia, China, India, Pakistan and Iran have begun transactions in oil away from the established US Dollar/SWIFT system. Certainly, the US Dollar will continue to exist but with a new bifurcated system, gold and copper will be included. This is true politically as well as practical purposes. China needs copper and minerals to continue growth. By including copper in a basket of currency and hard assets, China and Russia can draw Brazil, Peru and Chile into its “new” payment system as they are large producers of copper.

All of this points towards commodities being a major play for a five or ten year run.

Oil: The USA has foolishly committed half of “Our” strategic reserve of oil to bringing down the price of Global Oil. This is a foolish move as Saudi Aribia, Russia and China are not our friends. Russia and the Saudi’s collaborated before in March of 2020 to flood the world with an excess supply of oil. The goal was to break the back of the USA fracking industry. It so happened that Covid unexpectedly happened at the same time. The combination collapsed oil’s price to an unheard of, minus $30 a barrel price. We are now vulnerable to the opposite. By October, our strategic reserve will be drawn down to half-full. “We” are foolish asking other countries to increase their production while curtailing our own production. Again, a sign of both weakness and foolish planning on our part, To put it mildly other government officials are just smarter than our government officials.

Where am I going with this?

If Russia and the Saudis intentionally or “accidentally” restrict production of or cut the EU off from a supply of oil or natural gas “after” we have drawn down our strategic reserve by October, we could see the price of oil above $300 a barrel. This could easily happen before the end of 2022. This action would cripple the EU and cause immense food and economic damage to the USA and countries in our alliance. Countries like Japan and South Korea who are geographically close to Taiwan, would be hurt as they are importers of Oil and Gas. It opens a path for China to invade Taiwan.

Investment exposure to oil, gas, gold, silver, copper and nickel becomes important as an insurance policy against stupidity of government officials. Oil is literally the life blood of the globe. Gold is the only store of value without counter party risk if held physically. Central banks outside the sphere of USA alliances have been consistent accumulators of gold for a decade. What is unfolding at this time is not an emotional or spontaneous action. Russia and China have been preparing for this for a long time. Other governments who have seen this building have been preparing as well.

Sprott Inc will do very well in this environment as they provide wealth management for the physical safe keeping of multiple precious metals as well as uranium. They are also investment bankers for raising money to expand the Fossil fuel industry which our government at some point will encourage.

That is my commodity theme for the next five to ten years and I staying with it until it doesn’t work or make sense.

Written September 18, 2022, by Tom Linzmeier, editor, at LivingoffTheMarket.com

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()