Ten under $10 for the Double:

Reminder that this is a dynamic list so we will hold positions greater or less than ten in the portfolio.

NEW NAME: Karora Resources (KRRGF)* $2.71

Today we are adding a less than known name but one we have owned off and on for about a year. Karora Resources is a Canadian based gold and nickel miner. This company is generating about $5 million a month in free cash flow. We KRRGF like longer-term as our belief is that we are shifting to a commodity based, investment theme globally. This trend could run from five to ten years. Therefore, we believe we have years of life in the miners with a price climax far into the future.

Antero Resources (AR) and Antero Midstream (AM) are both related to Natural Gas. AR as explorer and development and AM as the transport company basically for AR. Both are expecting increased cash flow in the next twelve months. Below is a chart of Nat Gas prices to support the trend. We have Apache (APA) also on this list and though not specifically a gas company, it helps.

Future name we expect to add for a double is Great Panther Silver (GPL)* $0.84.

We would like to see how the stocks we have on this list perform. We also only want to add one name a week at a maximum. Like a stable of racehorses, we have stable horses. We are monitoring and watching for a set up and will substitute from the stable into the race and back again. Our goal for GPL over twelve is above $2.00. Earnings to the PM group as a whole, will be very strong.

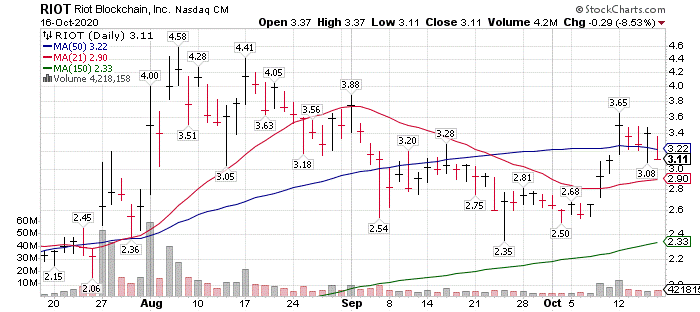

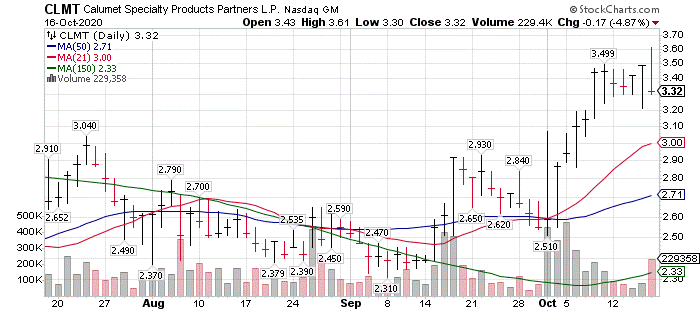

Not on the list is RIOT Blockchain (RIOT) $3.11. We will attempt to buy under $3.00 and expect to add to the list if we can. 2021 is expected to be a revenue expansive year for RIOT. Calumet (CLMT) sold off hard in the last half hour of Fridays trading. We believe games are being played to accumulate shares. Earlier on Friday CLMT was at $3.60. If you can buy or add to the shares on Monday, we see it as an opportunity. We have no stop loss and love prices below $3.40.

Calumet (CLMT) sold off hard in the last half hour of Fridays trading. We believe games are being played to accumulate shares. Earlier on Friday CLMT was at $3.60. If you can buy or add to the shares on Monday, we see it as an opportunity. We have no stop loss and love prices below $3.40.

Calumet has two divisions; buyers have expressed interest in buying. One is valued between $300 and $400 million and the second is valued at around $500 million. We believe that this is not fully priced in the shares. We expect these to be sold in the next six months. Our goal for the stock is $7 to $9 per share. These sales will change the debt structure of the company in a big way.

Favored Sectors are:

- Precious Metals: KRRGF

- Blockchain / Crypto: MKTY, KNRLF

- Nat Gas / Energy: APA, AM, AR, RECAF, FRO

- Natural Resources

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()