This week saw correction in a number of our holdings. Energy took a drop in the second half of the week on the new administrations dropping the Keystone pipeline project. This reminded everyone that we are back to the Obama Administration’s, War of Fossil Fuels.

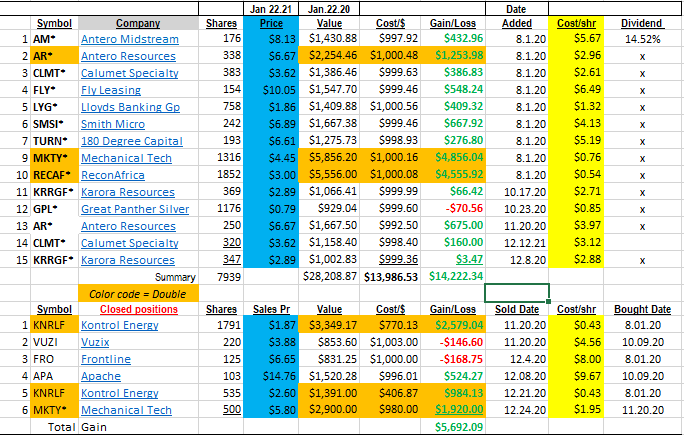

Energy: In our holdings in the Ten Under $10, that meant Antero Resources (AR) $6.67 came off its highs around $7.80 and Antero midstream (AM) $8.13 came off its high around $8.80. AM is the distribution sister company for AR the E&P, sister company. We find them both attractive to buy at this time AM for the 15% dividend and AR for its appreciation potential. Recon Africa (RECAF) $3.00 also came off its high price. The shares had continued to rally early in the week on news of progress reports in Africa, spiking to all-time highs around $4.00. We like ReconAfrica for continued accumulation especially under $3.00.

CLMT $3.62: Related to Biden and the closing of the Keystone Project’s pipeline, he actually did one of our holdings a favor. Calumet has its Great Falls (GF), Montana refinery for sale. It is the newest and one of the most efficient refineries in America. Who knows when another refinery will be built on American soil with the incoming policies? The favor that Biden did was close Keystone pipeline project. With Keystone pipeline, Canadian oils had an option to by-pass Great Falls refinery and pipe oil to refineries and ports in the south of USA. With the pipeline closed, the Great Falls Refinery – just this side of the Canadian border, it becomes more valuable to a prospective buyer. Finished product can be moved by rail or semi-trailers from Great Falls. The finished product could be a number of fuels. GF Refinery is flexible to the market and can shift easily between production of gasoline, diesel, or jet fuel. They also make asphalt which could play into any infrastructure legislation passed by the new admin. Thank you, New Administration!

Proceeds of the sale, estimated prior to closing of Keystone at $350 to $400 million, will be used to pay down debt. Presently CLMT has about $1.4 billion in debt. They have been running about $200 million in annual free cash flow so have no issue with servicing their debt. Over the past four-years, CLMT has reduced its Debt from $2.3 billion to its current $1.4 billion lever. It is possible, CLMT reinstates a dividend follow the closing of this sale. Cash Flow is strong enough that we would expect a $1.00 in annual dividend. That would be nice on a $3.60 stock and even nicer on our cost. The Ten Under $10 portfolio added a second unit of CLMT on Dec 12, 2020 on the weak shareholders fearing the Biden Admin coming to Washington. On the closing of Keystone project, the shares jumped 20% this week. Our expectations are a target of $5 to $7 on closing sale of the GF refinery. $8 to $10 if they reinstate the dividend.

Speaking of GF refinery sale, management says there is strong interest from both domestic and foreign potential buyers. The Virus has slowed the process, limiting inspection by foreign buyers. We expect a sale in 2021 but an effective vaccine would help speed the process.

One of our favorite holdings and one we consider an aggressive buy at current prices, is Karora (KRRGF) $2.88. There was great news this past week:

Karora Announces 21% Increase in Production Guidance for 2021 Following Record Annual Production of 99,249 ounces.

Prior to this announcement, Karora had announced a 334% Increase in Proven and Probable Mineral Reserves to 1.33 Million Ounces and 167% Increase in Measured and Indicated Mineral Resources to 2.52 Million Ounces. There will be a mid-February, year-end earnings announcement where Karora management will discuss 2021 plans. Do not wait, buy the shares now while you can get these prices. The shares are trading about 9 times trailing twelve-month earnings and is generating cash from gold, like they own the printing press. Really!

Mechanical Technology (MKTY) $4.45, is consolidating its great run from $0.75 in August to a high in December near $6.50. We are still bullish on MKTY with little fear of the company. The stock price will do whatever it does but knowing there is news coming between now and early Q2, we are looking for positive reactions in the share price. MKTY is doing Crypto mining through its new subsidiary EcoChain. That is what got the share price fired up. The story is bigger and one we really like. Yes, MKTY is doing crypto mining but its true goal is to be the low-cost alternative energy data center for all things related to Blockchain and Crypto Mining. This would include services and support for tenants of its data center.

This week MKTY announced they had purchased land in SE USA to build an alt-energy data center. The data center is anticipated to be complete by December 2021. Potential news items in late Q1 or early Q2, are a fund raise, to finance the company expansion and a move to a higher visibility stock exchange. Likely it is the National Nasdaq, but as of yet not specified.

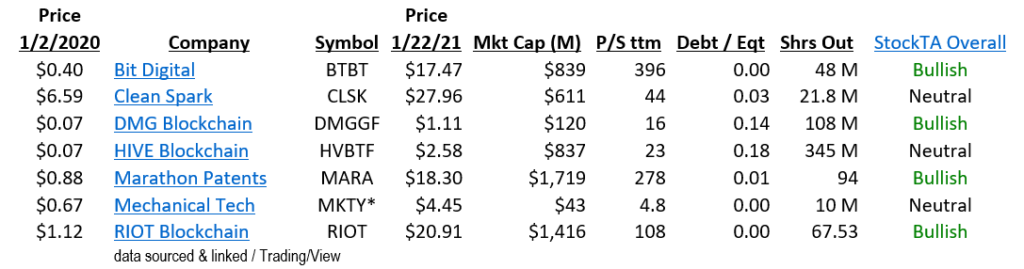

We are looking at Market cap when making our share price projections. MKTY is about $44 million market cap while its peer group is much higher. We feel news of a financing raise and a higher trading platform will allow MKTY to go to a higher level of market capitalization. Presently we do not know the dilution impact, so we will suggest 5 million shares at $4.00. Our Market Cap target is $100,000 million. Still far below its peer group, $100 million market cap on 15 million shares outstanding would give us a target price o $7.50. We hope we are conservative with our target, considering the explosive nature of this market for micro caps, but conservative we will stay.

MKTY’s Peer Group:

Be Happy – Be Smart – Be a Critical Thinker in everything you read! Agendas are everywhere.

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()