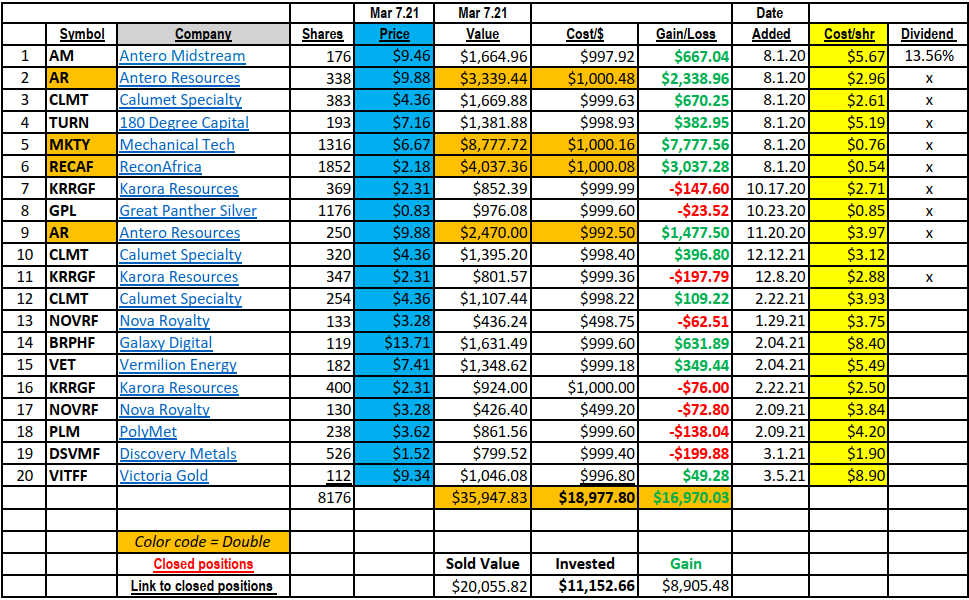

LOTM: Ten Under $10 tends to be industry targeted into the industries that we think hold the least risk and the greatest appreciation potential. Looking at the numbers above it is easy to see we are targeting the commodity asset class.

There are only four or five asset classes to invest in.

LOTM considers the asset classes as:

- CASH – to include Currencies

- Bonds/Interest Rates

- Equities

- Commodities to Include Real Estate

- Bitcoin

Cash: We consider US$ Cash (Fait Currency) as overvalued and declining in purchasing power. This is the stated desire of the US Federal Reserve and Treasury Department. There are other Fait Currencies one could shift into, so we are not limited to one currency.

BONDS: Rising interest rates cause bond prices to fall. Not a safe haven long-term but potentially a trade as The Federal Reserve implements Yield Control on interest rates. Ultimately interest rates have to rise.

EQUITIES: Equities offer more selection options that cash of bonds. Interest rates impact equities, but the there are ways to benefit whichever direction interest rates trend.

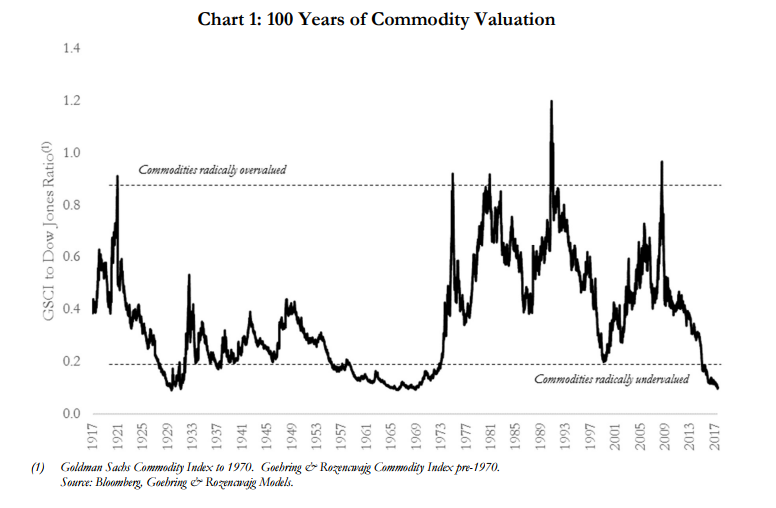

COMMODITIES: Typically, commodities react to inflation trends.

BITCOIN: LOTM recognizes that traditional financial institutions, public companies, the SEC, insurance companies, asset managers entered the crypto currency world in 2020.

Intermarket relationships analyze markets and the actions of different asset classes and how they react to each other.

Since Interest rates directly impact bond values, it is easy to show that interest rates peaked in 1982 in the high teens for ling tern treasuries. Over this 38-year period bond prices have been in massive bull market. Rising interest rates from current level would cause a massive bear market in bonds. Key questions are when, how long and how high.

Because interest rates are an expense for equities that borrow, and future earnings are calculated within a discounted cash flow model, the lower interest rates fall, the higher valuation awarded stocks. Therefore, the highest risk in the market are future growth stocks and companies who borrow heavily.

Cash – bonds and growth equities are considered in bubbles due to low interest rates.

Low interest rates and easy money from the Federal Reserve and Treasury Department, along with both agencies having a desire for rising inflation direct us to be heavily over-weight in commodities.

3 Charts Illustrate Commodities Now A Better Bet Than Equities – December 2020

- US Growth Price/Sales Ratio

- US Money Supply

- Commodities to Equities Ratio

LOTM Conclusion: Commodities are the safest place to be invested and the Asset Class with the greatest Upside potential is Commodities.

Karora Resources (KRRGF) $2.31

- LOTM Ten Under $10 is over-weight in Karora, with three units in the list above. The company mines primarily Gold and Nickel. Trailing twelve-month (ttm) earnings ratio is about 8. Our LOTM forward estimated P/E ratio is 5.5.

- Reserves estimates were revise dramatically upward in December 2020. Of the five mining locations, Karora mines in Western Australia, two or the five were not included in the asset revisions. They are expected to be added in 2021. Therefore, Reserve Assets are still undervalued.

- Karora digested three acquisitions in 2020 and is now entering a growth phase.

- A February 10, 2021 Interview linked here, discusses the current state of affairs at Karora. We encourage you to watch and listen at least twice to the video. The first time to get the overview. The second time to really listen to what management is really saying. 2021 is going to be an exciting year for Karora.

- Six Analysts have twelve-month targets ranging from C$5.50 to C$8.50. In Canadian dollars KRRGF is currently priced at C$2.92. In US dollars the current price is US$2.31.

The situation at Karora Resources is outstanding. The mining industry, and gold miners specifically, is one of, if not the lowest valued industry groups of any industry group. The Industry has strong cash flows, clean balance sheets and excellent prospects for higher gold prices ahead. Short-term volatility exempted; this asset group is a safe haven with dynamic price appreciation potential. Gold miners fit perfectly into our model of looking for value and doubles or better. We really like Silver, Copper, Nickel and Uranium miners as well, but they are not as low a valuation as Gold Miners.

Training, Coaching & Mentoring available

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()