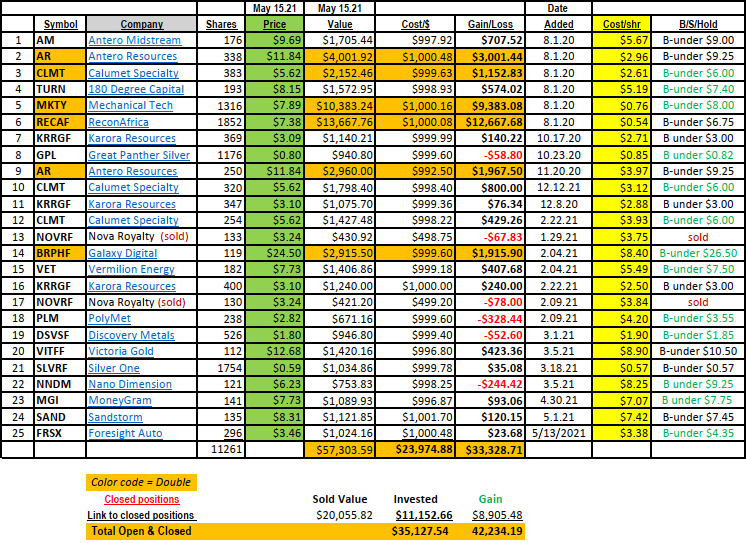

Lots of action this past two weeks. We have no new sells this week, but we did add Foresight Autonomous (FRSX)* $3.46 to our list of potential doubles. Our goal is a double in 12 months but lets be real. If we double in 24 months, we’d be happy. You can conclude from this comment that this is not a trading list but rather a deep value list or a momentum list. Those are the only paths to a double in 12 to 24 months that we are aware of.

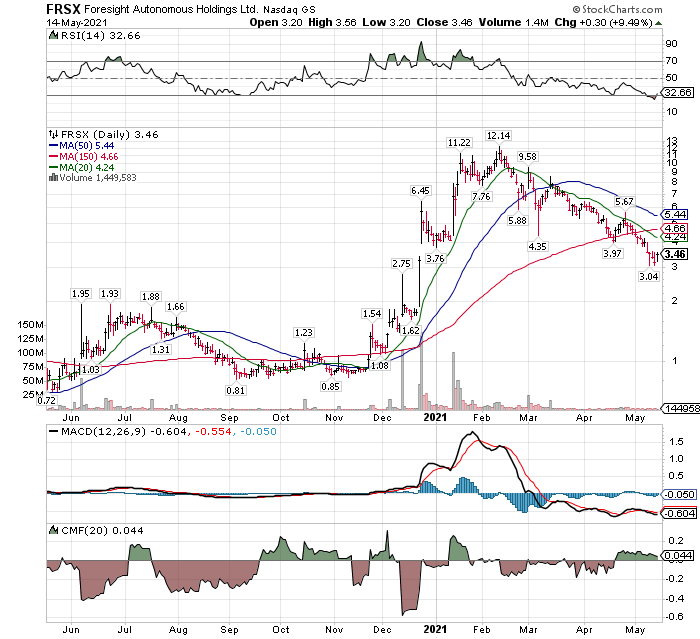

FRSX is a momentum stock that is oversold. Not exactly a deep value name, but close enough when we put it in the broken momentum list.

When CMF is viewed, we see someone is accumulation share of FRSX at these levels. MACD is over sold and ready to do a crossover buy signal and RSI is worse (oversold) that most of the market. The story has not changed one little bit. Simply an “in favor” to “out of favor” shift in sentiment. Perfect set-up for a double. Certainly, we could have more to work through to establish a bottom, but we like this a lot.

We highly recommend you view their web site to get a “visual” on what they can do. This technology is military proven in combat and is now civilian auto ready to application. Web site link.

In other names on the Ten Under $10 list, we love The Metal Miners. This too is an oversold sector but healthy sector.

If you get the LOTM Daily Notes you have the list of Gold and Silver Miners, we are tracking and like. From the Ten Under $10 list these include, KRRGF / GPL / PLM / VITFF & SILRF

Nat Gas & Oil stocks are doing fine. We have a number of positions that were bought when they were “Deep Value’ last October / November. That is working out great and though they are no longer Deep Value’ they are not over-priced either. From above these include AR / AM / RECAF & VET.

We will look for new ideas in the Defense industry. LOTM Macro Trend analysis suggest this will be an a “hot sector”. The US is back into the global conflict business so from an investment perspective it should be a good money maker. Here is our logic and vision:

The US federal reserve wants higher inflation to pay off our debt with cheaper US Dollars. Unquestionable as Both the federal Reserve and Treasury have said this. Maybe not so direct but they have said this.

How to do this differs. Whereas the Previous Administration chose 1) bring American business back to domestic production, 2) less regulation and less tax as a means to stimulate growth in the economy, the Current Administration is reversing this by increasing regulation and taxes and reverting back to the time worn strategy of going to war to stimulate growth and inflation. What is happening in Israel & Palestine could be the opening act in a return to Clinton / Obama style globalist strategy. We are not being political here – please. We are using pattern recognition and profiling to recognize reality and get positioned in the right investment sectors. This is simply the different ways a Globalist Policy differs from a Populist Policy. Your vote matters so know what you are voting for. We just read the tracks in the sand of what the trends are.

The probability is high, the US and China will be in a kinetic war within five years. We are already in a cyber war with China, Russia, and Iran. We believe this will escalate into increased kinetic conflicts. Tensions in the Middle East are on the rise again as the USA green lights that it is ok for Iran go after Israel. We expect Russia to become expansionary again as well. China is pushing forward in the South China seas and with Taiwan. Space will become a new battleground. You will see more ideas in the Defense / Cyber & Space sectors from LOTM.

In our holdings listed above NNDM (Linked chart) is down enough from our purchase price that something needs to be done. It is the same storyline – Momentum stock loses its MOJO and gets deeply oversold. We were early in adding NNDM to our list, but our perspective has not changed. We suggest buying an amount in Dollars that is equal to the original investment (in our case example $1000) at this time. It the future on a rally we will sell the highest cost basis holding first to free up cash for other ideas or downsize the position. Managing a position is hardly ever discussed in the stock market but we find it is the “known but unspoken” tactic of being successful in the market.

Have a good week. Tom

If you want more from LOTM, upgrade of our LOTM Daily Notes. Simply send an email to Money @ LivingoffThemarket.co (no spaces) and say Send me the Daily Notes. It is free.

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()