Featured Companies:

- Gatos Silver (GATO) $4.72

- Frontline (FRO)* $9.76

- Karora Resources (KRRGF)*

- Gatos Silver (GATO) $4.72

Gatos Silver Reports Record Quarterly Production; Announces CEO Succession and Additional Management Changes

Press Release: April 07, 2022, Dale Andres, President, Appointed CEO Following Stephen Orr’s Retirement

DENVER–(BUSINESS WIRE)– Gatos Silver, Inc. (NYSE/TSX: GATO) (“Gatos Silver” or the “Company”) today announced record silver production from the 70%-owned Cerro Los Gatos (“CLG”) mine during the first quarter of 2022 (”Q1 2022”). The Company also announced the appointment of Dale Andres, current President, as Chief Executive Officer and member of the Board of Directors (“Board”) as part of the Board’s CEO succession plan, as well as two additional executive management changes.

Q1 2022 Production

CLG achieved record silver production in Q1 2022 at 2.39 million ounces, a 58% increase compared to the first quarter 2021 (“Q1 2021”) which was impacted by a temporary shutdown for two weeks due to a power outage. The increased production in the quarter was primarily due to significantly higher silver grades, in addition to higher plant throughput and improved recoveries. Lead and zinc production was 10.3 and 13.8 million pounds, representing an increase of 36% and 58%, respectively, compared to Q1 2021, primarily due to higher mined ore grades.

CLG achieved throughput of 234,985 tonnes and continued to achieve excellent recoveries for silver, lead, zinc and gold. CLG remains on target to achieve its annual guidance for 2022, including the plans to increase plant throughput levels to 2,700 tpd in the second half of 2022.

As of March 31, 2022, the Los Gatos Joint Venture (“LGJV”) had over $40 million in cash. Given the continued strong operating performance of CLG, the Company expects the first dividend from the LGJV to occur during Q2 2022. Full press release linked here

LOTM: As you can see, operations are solid at Gatos. LOTM has taken the view, that the drop in price in Jan ’22 was an overreaction. So far that assumption is ok. My additional assumption is that the new reserve adjustment, expected prior to year-end ’22, will allow the share to rise to the $6.00 to $7.50 area. Positive news from new drill results, should it happen, will bring the shares back to the $10 plus or minus area. Gatos has a large area in a mineral rich area of Mexico.

The dividend mentioned in the above Pr, is between Gatos and its partner, Dowa Metals & Mining Co., Ltd. (“Dowa”). This is not a shareholder dividend.

GATO lost 70% of its value in January ’22. Accounts related to LOTM did not sell, but rather bought an additional, equal dollar amount and eventually more, than we had invested in Gatos at the $9.00 to $10 area. Operations, as you can see above, have not been impacted by the news that there was a miscalculation in estimating the reserves of Gatos. The potential reduction in reserves would impact mine life. The reduction in reserves has not impacted operations. At the time of the announcement, we felt we could buy the price drop, wait and see what happened to the position. Since Gatos has only explored 20% of its total claim area, we also felt that being in a mineral rich zone, there was the potential for Gatos to add back reserves in the future. The 70% drop was a knee jerk reaction to a less than 70% reduction in reserves. How much and what reserves will be reduced is still unknown but estimates in the PR announcement were 50% or less. Management is smart – I assume they over-stated the reserve reduction so they would have a future positive update.

An additional positive is the potential even probability, that the price of silver could increase in the coming months and years. Electrification of the world demands more silver than there is supply of silver. Our average cost in related accounts is now about $5.05 per share. We are very comfortable with Gatos’ financially, its management and in their ability to find additional reserves. As such we consider Gatos Silver a buy and especially buy on weakness. Our time-line is three to five years. We will trade the shares in this period as well strengthen (lower price & expand ownership) our cost basis through share position and tax management.

Gatos Silver came public in December 2020 at $8.00 per share. We assumed the drop to below $3.00 was margin call liquidation and a fear reaction. While anything is possible the probability is only the strong holders remain in the shares of Gatos. Therefore, we conclude sharp sell-off will be met by willing buyers.

LOTM Considers Gatos Silver a buy under $5.00.

- Frontline (FRO) $9.76 to Merge with Euronav NV

In a merger of equals, Frontline will merge with Euronav NV

The results of the merger will be reduced overhead and similar combined revenue. A positive for both companies. The new company will retain the Frontline name and stock symbol.

LOTM cost in the Ten Under $10 is $7.49 – we will hold the position. Buy Under $8.50

See: Motley Fool article on merger April 8, 2022.

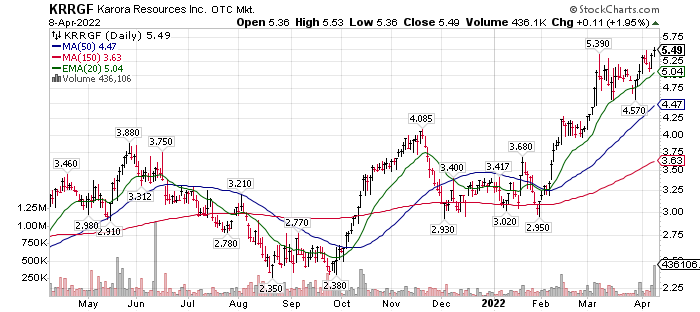

- Karora Resources (KRRGF)* $5.49

LOTM has said multiple times over the past two years that Karora is our top choice in the Gold mining industry. We are over-weight in the Ten Under $10 portfolio. Karora has added a significant amount of Nickel to its production that increases its margins. Processing material for nickel along with its gold does not increase the cost of milling very much. This limited increase of processing while adding a by-product and seeing the price of both gold and nickel increase. Karora is doing very well.

- First quarter 2022 results Karora Delivers Record Revenue of $264 Million and Cash Flow linked here.

Karora has the potential to double Revenue again in the next three years if the price of Gold and Nickel stays the same as today. LOTM believes gold and Nickel will be higher in three years than it is today.

Look at the price of Karora over the past year.

In six months, the share price has risen from $2.38 to $5.48 today. More than a double. The “company” is not over values at the current price but certainly not the deal it was in 2020 when we started recommending the shares. If you own Karora – Congratulations. Certainly, the stock price can retreat from where it is now, but our opinion is to hold the stock – Let your winners Win. The Bull Market is not over in commodities. In fact, we think it is still early days in the commodity bull cycle.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()