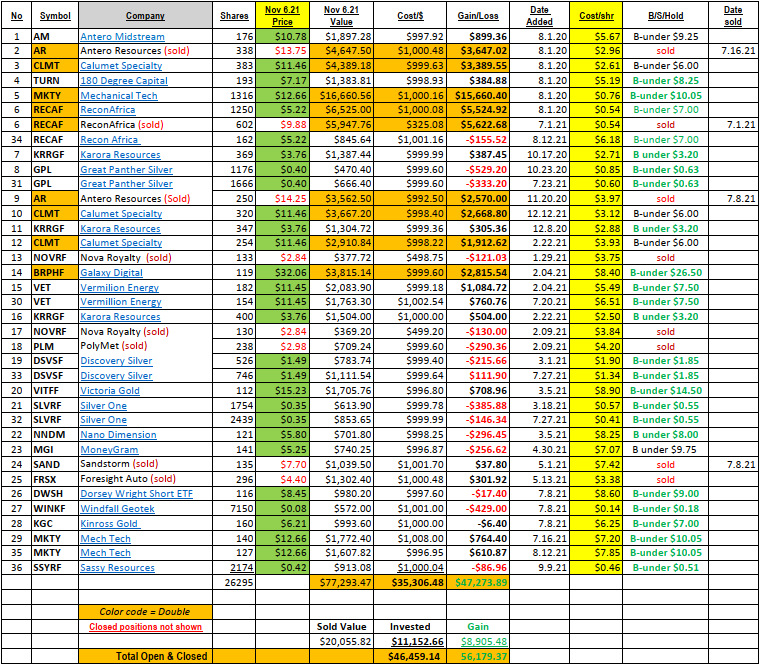

Comments on Select Positions within Ten Under $10 for the double.

Soluna Holdings (SLNH)* formerly Mechanical Technology (MKTY), is a core holding for LOTM. We continue to look for a double or even a triple for the share price in the next six to twelve months. You will see revenue explode higher in the next three quarters. Even into year-end 2022.

Great Panther (GPL) We will close out for the loss. Big year for profits over-all so we will sell the stock for the tax loss benefit. As for the company we really tried to give them the benefit of the doubt in turning the company around, but we don’t see that happening and no catalyst in sight either. We expect gold and silver to be BIG winners so will look elsewhere in the silver and gold space for companies with catalysts.

Karora Resources (KRRGF)* Excellent quarter, (conference call November 8) in this unknown company (outside industry circles) we think it is one of the best in the gold mining arena. Many inside the industry feel the same. Buy weakness if given the opportunity if given the chance. Finances, management, available resources for future growth and cash flows are all excellent. Out 2023/24 price target is $10 to $12 at a 10 P/E ratio. My napkin math. If anything, it is conservative. Core holding for LOTM.

Victoria Gold (VITFF*) Excellent company, potential buy-out candidate, Strong cash flow in only its second year of business. Still not on people outside the mining industry radar. Accumulate on weakness or continue to hold. Considered a core holding for LOTM. Conservative management, expect positive surprises from organic operations.

Discovery Silver (DSVSF)*

The stock suffered from what we can only figure out was end of the September quarter dumping by someone. LOTM mentioned a number of times in emails that we were buying during this period. It worked well as the share price has rallied more than 50% off their September lows. We were not too concerned about the stock as the company has a good balance sheet and enough silver resources in the ground to be projected as one of the five largest silver mines in the world when they begin mining. Unfortunately, that is not expected until 2026. In the meantime, exploratory drilling is successful in expanding the scale of the property with new high grade silver core samples. Hence the reason we are not negative on lower and lower price on the stock. Asset value is there. I expect the share price to chop between $1.30 and $1.50 until the price of Physical silver breaks out. Then we expect a move towards $2.00. We still have a buy weakness feeling for Discovery.

MoneyGram (MGI)* This one really got dumped on last week.

In the LOTM: Ten Under $10 we are going to buy two Units of shares if the price is under $5.40. This will bring our total units held to Three.

To guess who the sellers were in September, I would say robotic algos reading the negative headlines, technicals and operational results. Also, momentum investors on the declining stock price and operating results. Who is going to buy? Value investors. There are one time, none recurring write-offs. The company is averaging $25 million per quarter in positive free cash flow. The company reduced interest expense by $10 million quarterly with a refinancing. The company has about $802 million in debt with about $100 million in positive free cash flows. Certainly, could be better but also not in any danger either. The company is all in in working with Blockchain and crypto. They are launching a new venture to be a bridge between crypto and Fait currencies. We are very excited about this. It is the involvement with Blockchain and crypto that draws us to MoneyGram. We believe the probabilities are high, MoneyGram will be purchased by a larger company in the future. Not sure on timing – could be years. In the mean time we think the share price to what the value of what they are doing and infrastructure in place is too low for the share price now. This is all napkin probability but a deep dive into the numbers will have many assumptions and projection that are guesses at best. Therefore, our napkin numbers are ok at this time. Short term we think the shares will revert to a mean price of $6.50 plus or minus $0.50. We will probably sell one of the three units at $6.50 (sell highest cost shares) and hold the other two units into 2022. Good fortune to all interested. Conference call Friday (linked here) was very enlightening. Made me very comfortable buying into such a sharp price drop, even if it goes lower.

Recon Africa (RECAF)*

We were pretty vocal in our positive reaction to the shares dropping in price below $4.00 and our interest in buying the drop. This was said in our daily email notices. We were nicely rewarded within the week as, the recovery price rally with the shares now at $5.22. We view this as part of a bottoming process. We do not expect more of a rally short-term but have high expectations for Recon over the next two years. A price between $10 and $15 would not be a surprise. There is potential for more short sale buying but that is impossible to predict. Our two to four year target is in the $25 to $35 dollar range if they are successful in developing their property.

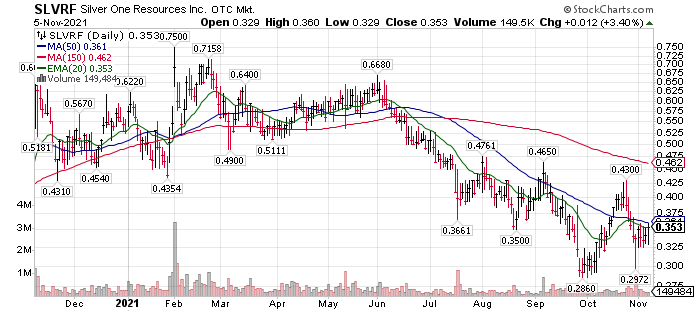

Silver One (SLVRF)*

We like Silver One and would add to the shares at the current price. They have a lot of work to do in proving up their properties, so we do not expect near-term price reaction based on operations. We are bullish on Silver Prices and believe we are in the take-off stage of an attempt to break out above $30 for the price of Physical Silver. In related accounts we will add to this position when we have funds to do so. Eric Sprott and Keith Neumeyer have holdings in Silver One. You don’t get better than that for experience in the metal mining business.

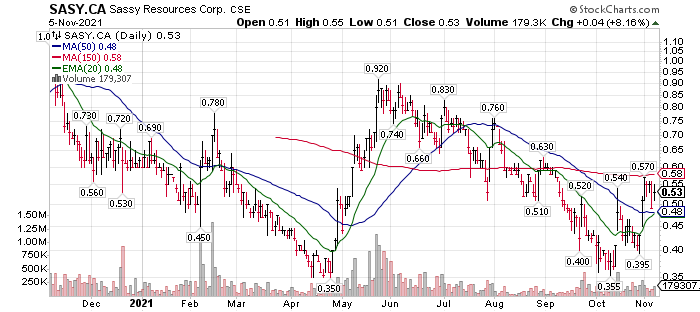

Sassy Resources (SSYRF)*

Sassy will spin out Gander Gold subsidiary as a stand-alone public company. The issuance is expected in the first quarter of 2022. It has been announced. It is our opinion that the value of the two companies will be higher in six months post the spinout, to be worthy of a purchase now. This distribution is why we bought Sassy.

Prices in the chart are in Canadian dollars

Happy wealth building!

Tom

You can Read, you can watch Videos, but nothing beats Personal Interaction for accelerated learning.

This game has levels of understanding that could take a lifetime of Trial and Error to learn.

Available for Coaching, Training or Mentorships

Contact LOTM For One-on-One consultations.

Rate: $150 per hour / Monthly Retainer, Lowers Rate

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()