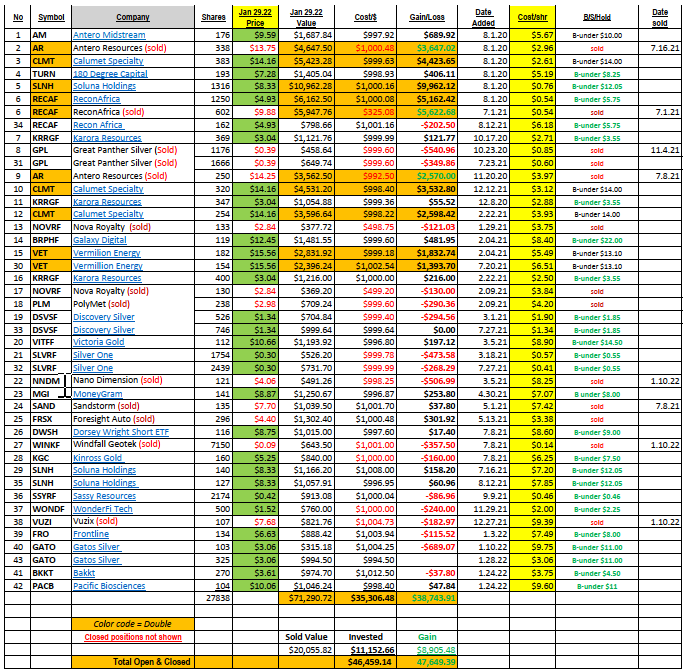

LOTM: Ten Under $10 comment Jan 29, 2022

GATOS Silver: Lots of price drama this week. The share price dropped from about $10 to Fridays close of $3.06. We are impressed by the drop mainly because we not that impressed by the news. Yes, it was a shock. And yes, we are uncertain of the ultimate outcome. The company stated that reserves were overstated – possibly by 50%. The adjustment will not be known for six to eight months. In addition to the reserve downgrade, a number of brokers downgraded the shares from out-perform to under-perform. The fall in price triggered margin selling. At $3.00 all margin related to the shares has to be 100% paid off. That tough situation and acts like a magnet drawing the share price to the $3.00 area where the stock needs to be fully paid for.

Production for the fourth quarter of 2021 was a record. Production for 2022 is forecast to be 15% higher than 2021. Therefore, we can say operations are strong and not impacted by the drop in reserves. The company has explored about 20% of the property under the mineral claim. Since this is a high mineralization district, it is possible that the 80% unexplored could set up a positive surprise based on the current valuation and further exploration.

Without knowing more, we project the shares are too cheap. Current forward P/E at Finviz is projected at 2.87. The news does not appear to impact current operations other than cost of lawsuits from the ambulance chasers.

Market cap at Finviz is $250 million. Lots of E&D miners with higher market caps than that.

In real accounts and in the model account we are doubling our initial dollar investment position. Initial position in LOTM Ten under $10 for the Double was $1004.25 at $9.75 plus another $994.50 at $3.06 gives us an average cost of $4.28 on 428 shares. Later we might sell the higher cost shares for a loss and take the tax subsidy to help lower the cost in the remaining shares. This is actually an easy problem to work out of because the drop is SO BIG! Thank you, stock market gods, for the opportunity.

Calumet Specialty Products (CLMT) opposite situation than Gatos. The shares are up nicely from our original cost. We have three buys – the first was $2.61. We added twice more to the position at $3.12 and $3.93. Total shares bought in the program here are 957 with a current price of $14.16 for a position value of $13,565.28. Total invested was $2996.25.

Over the weekend there was a very nice write up on Seeking Alpha suggesting management was hinting at much higher share price to come that could be between $34 and $64. The company initiated a tiny monthly dividend of $0.01. LOTM believes that penny can grow to 10 to $0.15 per quarter over time. Cash flow is expected to increase dramatically as the Great Falls refinery comes online. Hold or buy more.

Evaluating Calumet’s Apparent Conservative Equity Valuation

Jan. 28, 2022 – Seeking Alpha Article linked here…

Summary

- Calumet management’s $64 stock valuation estimate seems conservative.

- We expect the increase in the price of crude oil to become supportive of RND production.

- A level of proof still remains for the new RND business. We view this a minor issue with the technology proven elsewhere. (follow link above for full story)

We also added Bakkt (BKKT)* $3.61 and Pacific Biosciences (PACB)* $10.25 to LOTM: Ten Under $10 recently. These are (were) high flying growth stocks that have fallen from favor. BKKT reached a high in November 2021 at $50.80 and PACB reached a high of $53.69, in February 2021. The valuations appear quite reasonable at the current levels. Management and ownership is excellent.

BKKT is a spinout from the Intercontinental Gp (ICE) – owner of multiple trading exchanges including the New York Stock Exchange. ICE retains a majority ownership in BKKT. BKKT mission is to bring digital asset (crypto) conversion features and cold storage to the traditional banking/finance system. You could not have better partners than MasterCard (MA), Google (GOOG), and Fiserv (FISV). These are BKKT’s partners. Recently having come public, cash on hand for 2022 is not an issue. We have to wait for the Q4 numbers to get more details.

BKKT had $9.1 million in revenue and a $28.8 million net loss in Q3 2021. Bakkt is projecting revenue of $224 million excluding transaction-based expenses in 2022. This is higher risk as the company has negative cash flows. We like the drop from favor. Ownership and partners Bakkt has are near impossible to duplicate. Hence, we are saying this is a great franchise.

TipRanks has a $7.00 price target on BKKT.

Pacific Bio has a similar fall from grace as BKKT.

PacBio develops comprehensive solutions for scientists that propel the field of genomics, improve science and research, and create positive impact globally. More on what that actually is linked here. Basically, PACB produce equipment and software for identifying genes.

I do not find their website very helpful in presenting the company, but it might be me too. The top management is from Illumina. The current market cap is about $2.3 billion. PACB a story stock, so we would average in at higher prices on good news more than we would average down into the share price on weaker prices. TipRanks has a $30 price target from Analysts in the last 90 days, so we are going with the over-sold aspect of the price action. We’ll likely trade this one rather than be a loyal owner.

Kinross Gold (KGC)* $5.25. 2022 is expected to be a very strong revenue year for Kinross. The Great Bear acquisition add valuable reserves and long-lived assets to Kinross. We suggest adding more share to Kinross if you own them and initiating a position if you don’t own them. LOTM is very bullish on the metals for 2022 & ’23. We have no problem being over-weight this sector. Kinross is the fifth largest Gold miner in the World. The market has priced in the feeling that Kinross over paid for Great Bear and that is additive reason for the recent lows. With the revenue number moving aggressively higher in 2022, we feel it is a good time to buy or add to Kinross for a low risk trade or longer term holding. A rising gold price could make this price look very opportunistic.

The Market:

It has been a brutal sell off especially in growth at any price stocks. There is a rotation in low p/e ratio companies. We think this will continue. Never the less we are feeling out way into some fallen angels like BKKT and PACB as well as companies in the FinTech sector like StoneCo STNE)* and PagSeguro (PAGS)*.

Last week was exciting and even breathtaking. Likely the market action was short-term climatic. We expect to see high prices across the board next week. We are not sure if this signals a market bottom, however.

Good luck to all!

You can Read, you can watch Videos, but nothing beats Personal Interaction for accelerated learning.

This game has levels of understanding that could take a lifetime of Trial and Error to learn.

Available for Coaching, Training or Mentorships

Contact Tom through the LOTM website or by email

Rate: $150 per hour / Monthly Retainer, Lowers Rate

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()