I would like to share something with you that has more impact on you through example, rather than intellectual discussion.

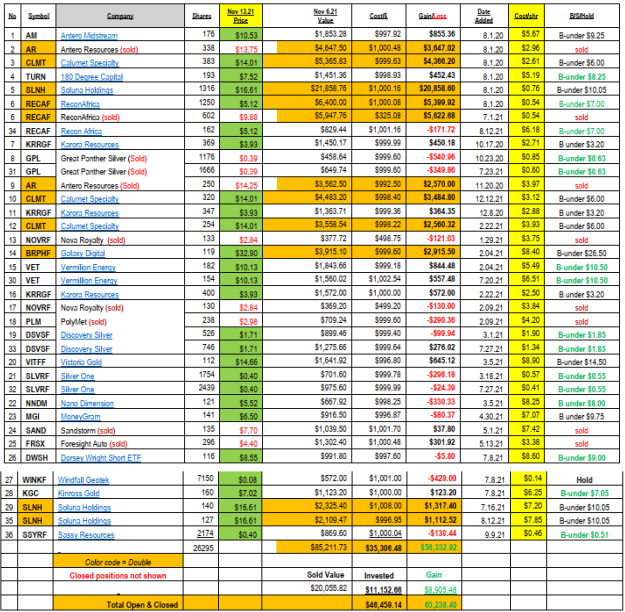

- I’d like you to look at the cost of each of the stocks below – cost meaning the dollars invested not the price. Note that I have stayed around $1000 for each one. So simple question for you. How much could I lose in each purchase? Answer is obvious – $1000 or my total investment, right? So that is my maximum stop loss – 100% of that position. If I choose to have a tighter stop-loss, you could choose a 50% stop-loss or 30% or perhaps a fundamental reason that changed from the time you originally bought. Limited losses. No matter what.

- So – about the winners. Let your winners run right? You have heard it many times. Below is a visual of what it can look like. The one winner we closed out completely and did not return to, Anteros Resources (AR), would have continued winning – if we had not closed it out. We bought AR at $2.96 – sold it at $13.75 – but today it is $19.36. We did not follow the adage, “Let Your Winners Run” fully. We never know how high the price can go. Another way to think of this is to Allow Yourself to get LUCKY!

Quick Comment on some Names above:

- MoneyGram (MGI)* We tried adding two units to the portfolio above, but we put in a limit to buy at $5.40 or lower. We did not get the trade. We really though we would but the share price did not stay down. Insider were aggressive buyer above $5.40 as shown in LOTM email #17. The stock is still not expensive. We will probably add to MGI in related accounts, but will stick with the limit mentioned previously for adding more positions for the Double-Double, Under $10 portfolio.

- Soluna Holdings (SLNH)* I mentioned on a chat board that with management is predicting $120 million to $140 million in EBITDA by Q4 2022. If SLNH trades at 6 X forward EBITDA of $120 million – the lower end of management’s comment, and Bitcoin stays at around $45,000 and assuming 20 million shares outstanding (more than today but likely less than by Q4 2022) we get a $36 dollar per share price. 6 x 120 million dividend by 20 million shares is $36. I personally think that could be called conservative.

- Kinross (KGC)* will remedy its short-term operational problem (rebuilding a processing mill following a fire) in this Q4 2021. Looking forward, we expect revenue to ramp, producing excellent comps at a time we think gold and silver prices will be rising. This environment will draw attention to Kinross – a top ten global mining company.

- LOTM related accounts added to Vermillion (VET)* on this $2.00 pull back. Expect a dividend in Q1 2022, already announced, expanding free cash flows that will pay down debt, possibly have a share buy-back and a special year-end 2022 dividend was mentioned by management if all goes well. Trailing P/E is under 3 as this is written.

- Sassy Resources (SSYRF) will spinout its Gander Gold subsidiary as a standalone public company. This was announced to be a February 2022 event. Let’s see. We believe the two companies will trade at a higher valuation than Sassy alone today. Both are exploration companies and therefore years away from revenue. Strictly a speculation on the higher valuation after the spinout.

Author, Tom Linzmeier, editor LivingOffTheMarket.com November 15, 2021

Life was meant to be Your Adventure

Lead, Follow or Get Out of the Way

Available for Coaching, Training or Mentorships

Contact Tom through the LOTM website or by email

Rate: $150 per hour / Monthly Retainer, Lowers Rate

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()