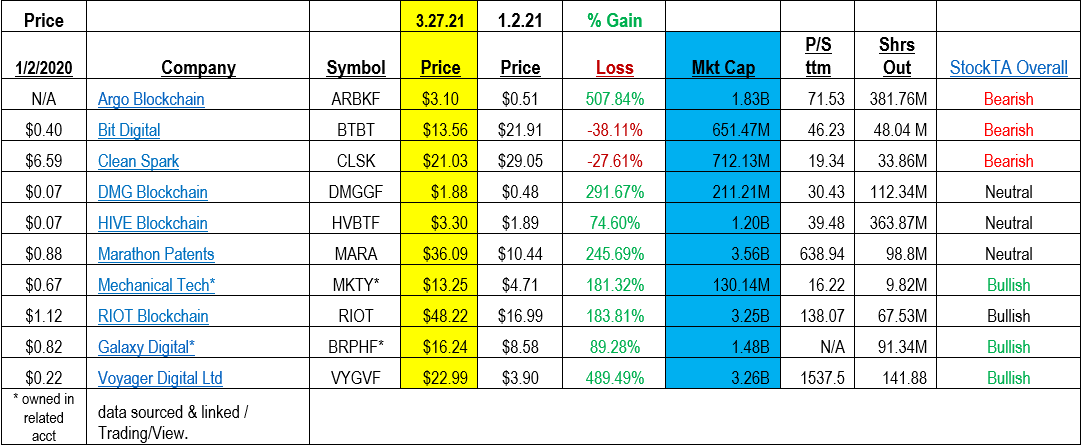

We currently own two the companies above. Mechanical Technology (MKTY) and Galaxy Digital (BRPHF)

We are looking at them more from a business model and fundamental analysis perspective than technical analysis.

Our belief is that pure crypto miners are highly dependent on the upward price trend of crypto assets (currencies). As such, they are equally vulnerable to declining trends or government regulation on the products they create. We do not like that vulnerability. While we might buy the pure crypto miners as a trade, we are not likely to own them as core positions.

Our strongest interest is in Blockchain development. Blockchain of which crypto assets are a part of, is a multi-decade growth opportunity. Our focus on stock selection is more on Blockchain exposure and possibly crypto mining being a part of that Blockchain exposure. MKTY and Galaxy fit that definition well. MKTY is building out Alt-energy, Micro-data centers supporting Blockchain app development and MKTY also does Crypto mining. Galaxy Digital is involve in Crypto asset management, Mining, Investment banking for the Blockchain industry and Venture capital for the Blockchain industry. We feel both have survivability and a unique position in this new industry called Blockchain.

Both MKTY and Galaxy have earnings reports out in the next two days.

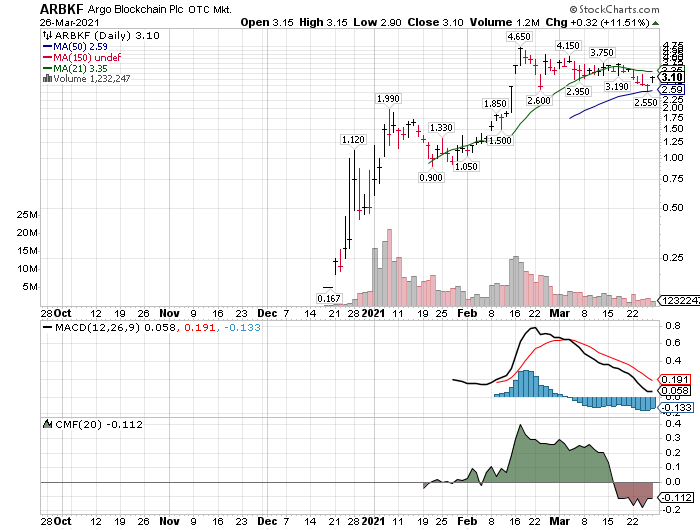

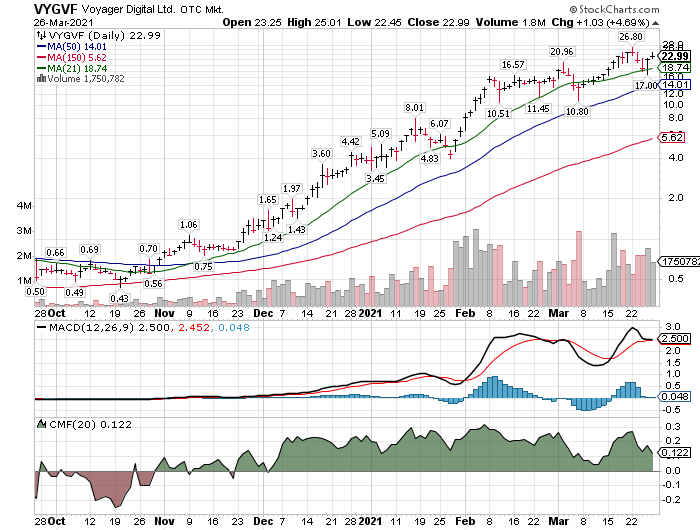

Others we like are Argo (ARBKF), Hive (HVBTF), Clean Spark (CLSK) and Voyager (VYGVF). While they may or may not do crypto mining, they have broader Blockchain business plans than the remaining companies. If you have reason to believe otherwise, we are interested in your opinions. It is difficult to stay on top of all development at each of the companies.

Our least favorite, is Bit Digital (BTBT). Too much of their operation is in China. We think the risks are too high with uncertainty around government attitude towards Bitcoin. In addition, the cost & availability of power in general, appears volatile. Rain for Hydro seen unstable as well as government diverting electricity to other uses, is a variable we do not have present in other companies. It is my understanding, Bit Digital is attempting to diversify away from China as a geographic location.

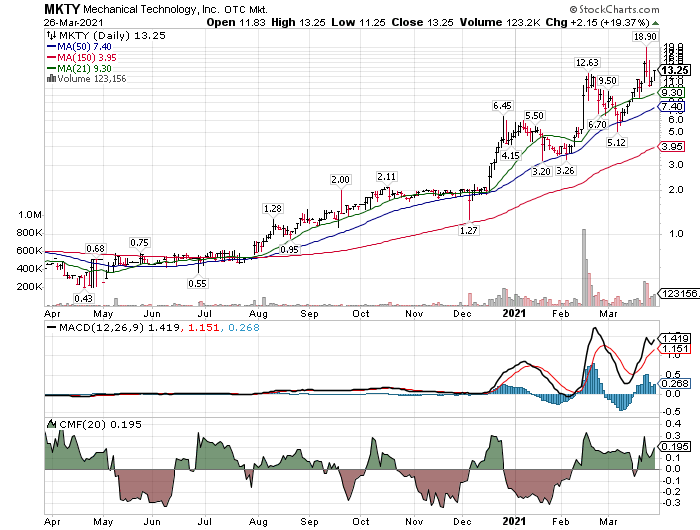

Some Charts:

Still bullish but note that this is a very thinly traded stock so technical charts can change in an instant. Earnings out this week.

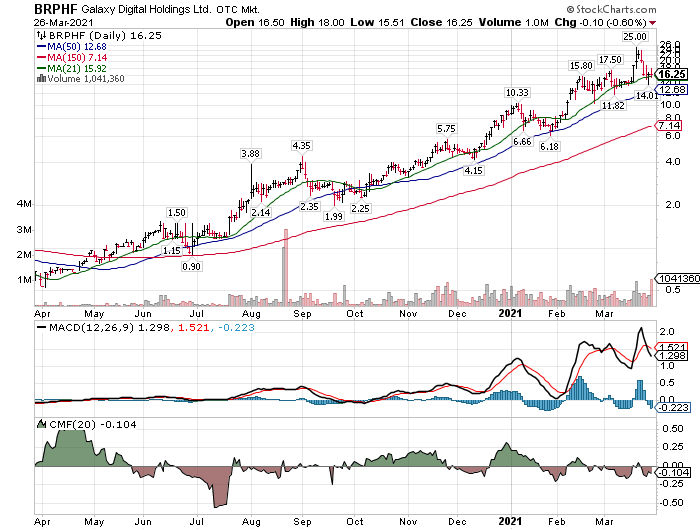

Very bullish chart. We expect strong news in its earnings announcement. MACD would suggest a hold rather than aggress buy or sell. CMF is also in a neutral position. Earnings out this week.

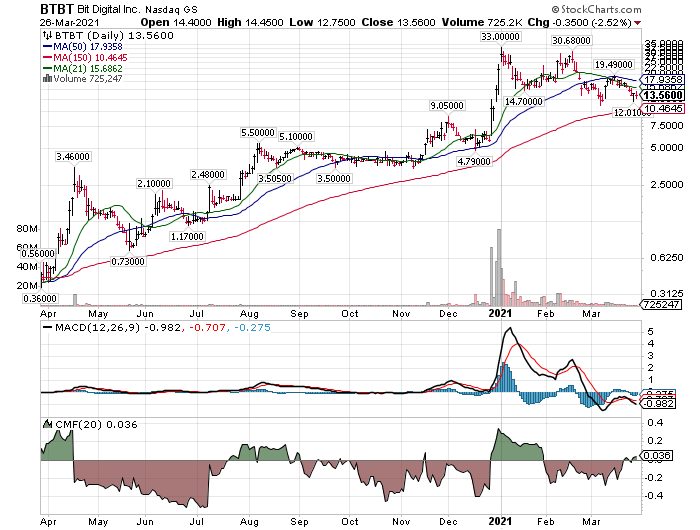

The price is at a support level, but my instinct is leaning towards a break on support. MACD is having trouble showing any upward lift and CMF is neutral at best. Market weakness or industry weakness would add to downward pressure.

We like the bounce off the 50-day moving average. Possible, over-sold from $4.65. We would consider Argo a core holding prospect so would accumulate slowly with additional shares bought as long as the price holds above its 50-day MA. For us it would be an initial position so we would likely not use a stop loss. Rather we would let the stock fall – base and accumulate as the price and moving averages show a basing pattern. Then we would become more aggressive in our buying.

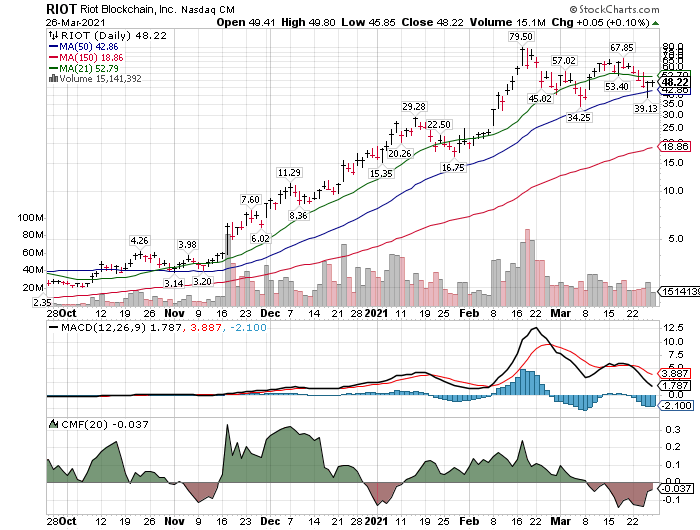

RIOT is above its 50-day MA a positive. Possibly consolidating the $3.00 to $79 move. WOW, what a move. A move like that could take a long time to consolidate. RIOT is not what we consider a core holding but a trading stock. Therefore, as a trading stock, we lean heavily into following MACD. Currently MACD is in a down-trend so we would not buy at this time but wait for MACD to do a positive cross-over. CMF is not showing a lot of excitement of accumulation – neutral at best.

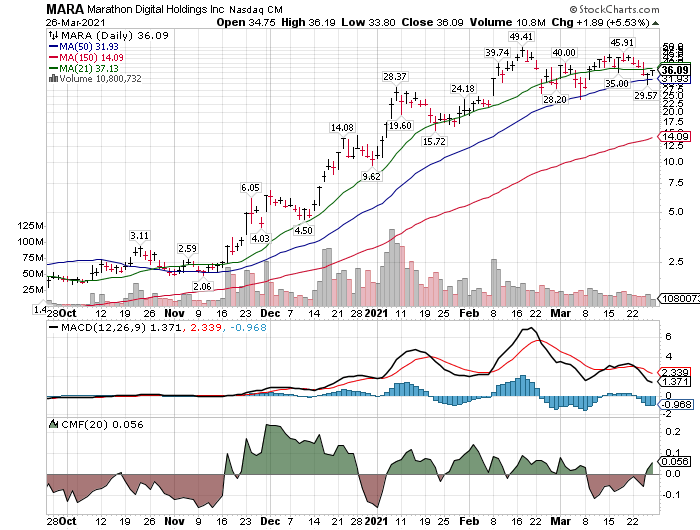

Similar comments on MARA as on RIOT. Only difference is actual price comment. Great move – Likely take a long time to consolidate or fundamentals to grow into its valuation.

Strongest chart of the bunch. $0.50 to $22 is a strong move. Great move! We would consider Voyager a core holding but we do not own it yet. We will probably not buy Voyager unless we get a strong break below it 50-day moving average. Many things to like here, but it appears the stock is running ahead of its fundamentals. We are too much of a value hound to stretch for buying at this price difference – price vs fundamentals. MACD is a bit tired. Let’s see how April develops. This could be “up” for quarter-end window dressing and “fall” in April when that isn’t so important to someone’s reporting. April could bring some profit taking.

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()