- Dow Holdings to benefit from Germany’s Nat Gas problem.

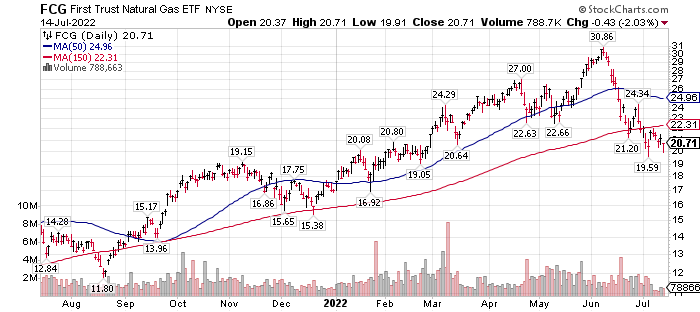

- Nat Gas ETF, First Trust Nat Gas ETF

- Top LOTM Nat Gas picks.

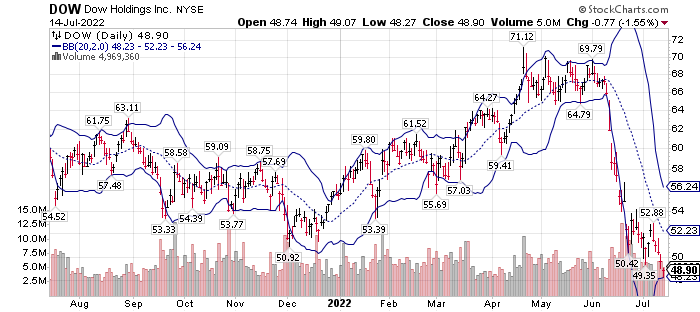

One year chart of Dow Holdings with Bollinger Banks:

Dow Holdings has collapsed in price in a six week period. It is pricing in a recession. Yes, I believe we are heading into a recession. Is a liquidity crunch coming? It is certainly possibly we could have a liquidity crunch.

The world is crazy at the moment. Bank runs in China. Government over-throw in Sri Lanka. Germany running out of energy – to the point of possibly no heat this winter. All three are results of asinine government policies. You can google it up. You can’t make this stuff up. No one would believe you.

Germany and Sri Lanka went all in on the World Economic Forum’s “Green Movement” without thinking or doing a cost benefit analysis. They bought into to our global leadership from the intellectual elites who have no real world practical experience but have strong emotional or agenda driven views. In China’s case, it is thought to be criminal elements (possible corruption) who took control of a number of rural banks and transferred money into their pockets. Again, inept government regulation that did not detect (or care) the problem until it was too late. We can do better, I hope. We are where we are so how to make a buck from the situation.

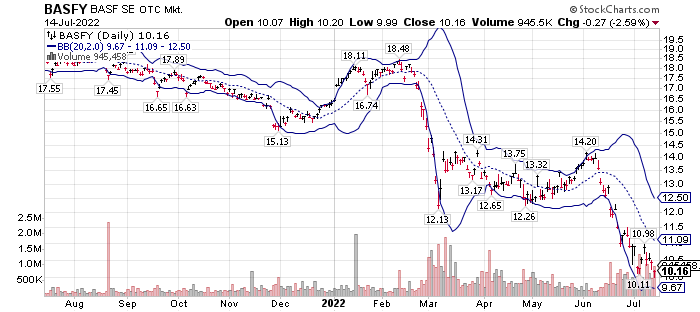

Surface info on Dow Chemical. Dow has access to Nat Gas from North America at cheaper prices than competitor BASF in Germany can access. Simple supply dynamics says BASF’s cost of goods sold will be higher than Dow. This is a pricing advantage for Dow in a world of rising prices. It is possible that BASF will be asked by its government to close its operations this coming winter so the public can have heat this next winter. It is possible that BASF will not be able to “Make Products that Make Other Products Better.” Again, to Dow Holdings’ advantage.

Dow’s trailing P/E ratio: 5.33

Dow’s dividend rate: 5.73% – always love it when dividends are higher than Trailing P/E ratio!

Dow’s Return on Equity: 39.7%

Dow’ Gross Margin: 20%

Yes, it is probable that Dow’s earnings will be lower next year. We are heading into a recession after all. Does anyone not know this. What everyone knows, ceases to be of much value in the market.

The world cannot lose a Dow or BASF without becoming uncivilized. We need both to survive. Therefore, it is highly unlikely either would have issue that would cause them to disappear.

BASF presents a wonderful upside price opportunity – in the future. At this time there are many more unknown variables in BASF’s world than there are in Dow’s world. So, look at accumulating shares of Dow now. Dow benefits from BASF’s high cost of goods, and BASF’s possible unknown variables. Wait to leg into a position in BASF in the future.

Chart of BASF with Bollinger Bands;

A broad brush approach to investing in Nat Gas is through a Nat Gas ETF – First Trust Nat Gas (FCG),

Considering that Nat Gas is expected to be in short supply, one might consider the pull-back in the ETF above, as an opportunity.

In a recent email, we noted that LOTM’s top two picks in Oil but primarily for Nat Gas production are EQT Corp (EQT)* $36.12 and Vermilion Energy (VET)* $18.99

While anything can happen, we believe the pull-back in Nat Gas related stocks is a buying opportunity for this coming winter’s heating season.

Written July 14, 2022, by Tom Linzmeier editor www.LivingOffTheMarket.com

Key Words; #naturalgas #eqtcorp #vermilionenergy #dowchemical #dowholdings #stocks #valuestocks #etf

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()