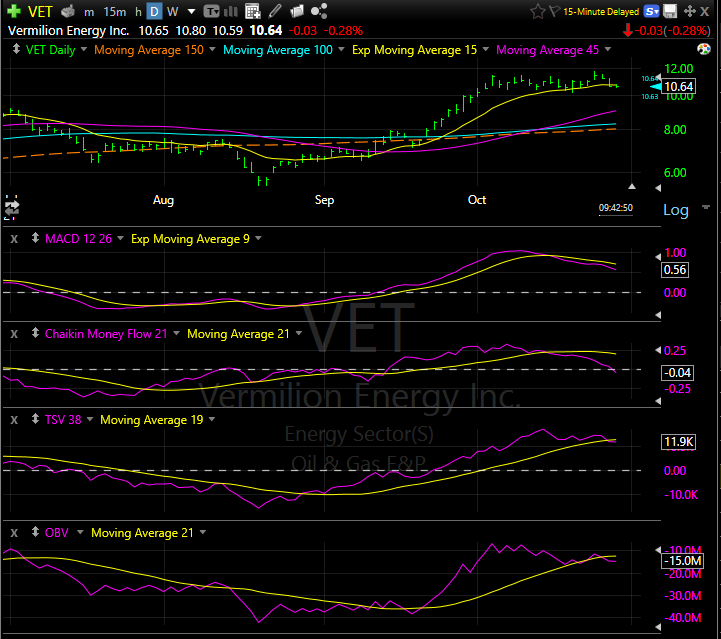

Chart source: TC2000

Vermilion (VET)* $10.68 – A LOTM: Ten Under $10 position

Stock specific but related to the Oil & Gas industry.

Momentum is still on the bullish side but pretty much across the sector we are seeing some fatigue. This is a chart of Vermilion (VET) $10.68 I really love what is going to unfold at the company but in the short term it looks like the shares are going to pull back. The company is solid financially, international in diversification and “one day” is going to reinstate its monthly dividend. Vermilion could pay a dividend now from current cash flow perspective, but it still has a goal of debt reduction. When they do pay a dividend, I anticipate it to be in the $0.10 a month area.

In the short term, you might consider selling out of the money calls against the shares to bring in some cash.

The further this stock might fall below $10, the more aggressive we would buy.

In the LOTM: Ten Under $10 grouping we will hold and add on weakness below $10.

By Tom Linzmeier, Editor, LivingOffTheMarket.com October 28th 2021.

You can Read, you can watch Videos, but nothing beats Personal Interaction for accelerated learning.

This game has levels of understanding that could take a lifetime of Trial and Error to learn.

Available for Coaching, Training or Mentorships

Contact LOTM For One-on-One consultations.

Rate: $150 per hour / Monthly Retainer, Lowers Rate

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()