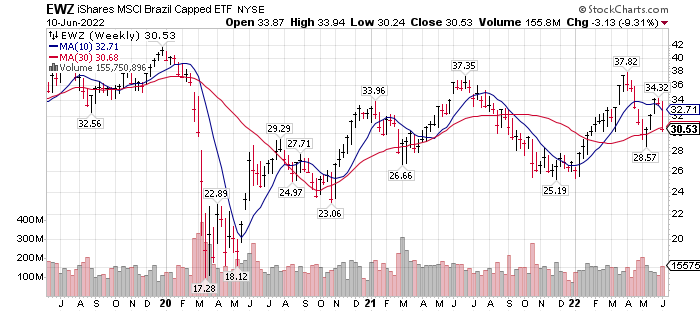

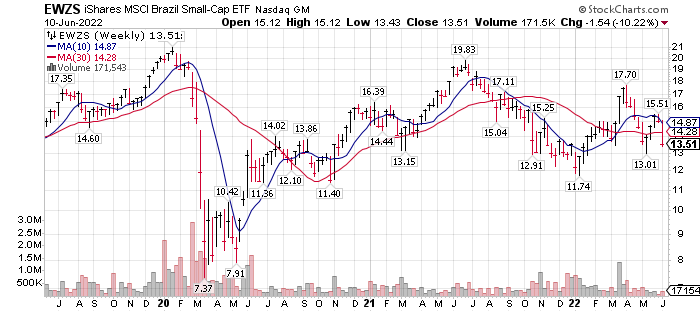

- Brazil ETFs: EWZ – EWZS

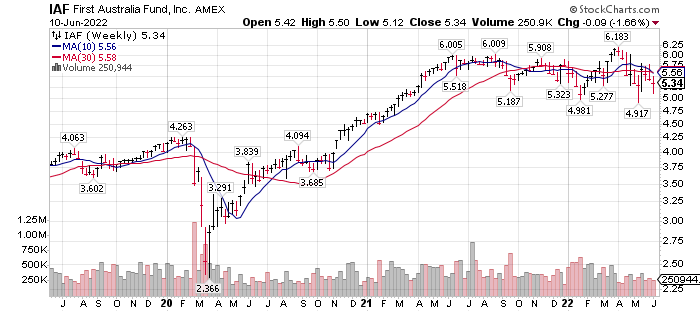

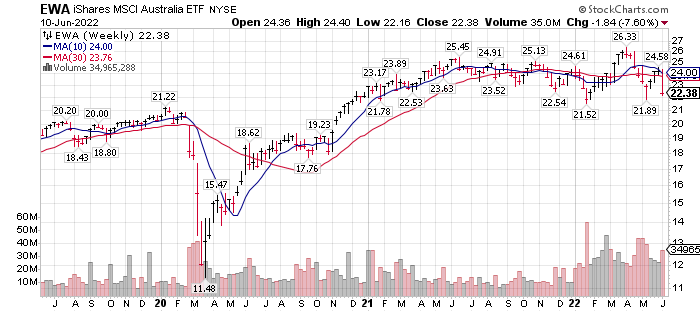

- Australia Investments: IAF & EWA

The countries above are dynamic emerging economies in the Commodity Era. Brazil and Australia are strong in Natural Resources. The world has entered a period of growth driven by the transition to clean energy sources. The transition from fossil fuels will take decades. There is strong desire by some individuals, organizations and governments to make this transition in the next ten to fifteen year. It is not going to happen.

The amount on minerals, such as copper, lithium, nickel and silver, is not available to supply the quantity of needed requirements. Introducing new mines in itself could be ten to fifteen year process. This is before and production comes from new supplies.

EXAMPLE OF DURATION FROM DISCOVERY TO PRODUCTION:

PolyMet (PLM) $2.89, a company in northern Minnesota, is a top five global asset resource in copper and nickel. The project has been in the permitting stage for 18 years. They still have three to four-years of finalizing the remaining lawsuits and building out the property for production. This is after the Minnesota DNR, the state of Minnesota and the National EPA regulatory agencies have all approved the permitting process. 20 of 24 lawsuits have currently been settled. All 20, settled lawsuits were won by PolyMet. The four that remain, are minor suits and are expected to be won by PolyMet. After the final lawsuit is won, it will still be two to three years to build out the property to do the production of Copper and nickel. I use this as an example of the time needed to follow the laws protecting the environment and providing minerals for a clean new economy.

LOTM COMMENT on PLM: Given a three to five-year buy and accumulate period, we find PolyMet an attractive investment. The probability of a double or more rally in price happening at any time in this three to five-year period is very high. The current Biden Administration has declared the PolyMet resource, of National Strategic Importance.

Brazil and Australia are key players as sources of minerals for the clean energy build-out. This means strong currency, trade balances and economies for these two countries. Perhaps for decades. In this new commodity / resource driven world, minerals will be an important source of prosperity.

IAF* – a mutual fund, 25% banks and 25% Mining portfolio in Australian companies. Pays an 11.4% annual dividend.

Australia has a positive trade balance; the banks are healthy, and the mining industry is doing great with a globally low valuations. Each country has slightly different cultural traits. Australia payout is about 50% of earnings. This is about double the payout rate of public companies in the USA.

EWA the largest Australia by Market Cap ETF.

The stock market has a relationship with the direction of and the rate of change of interest rates and inflation. Generally speaking, low or falling interest rates and low or falling inflation rates result in better performance from stocks.

Inflation movement is more important than interest rate movement when it comes to the stock market.

Inflation Rates in Australia:

Interest Rates In Australia:

Brazil was the first country to start raising interest rates. In early 2021 interest rates were 2% in Brazil and today they are 12.75%. Inflation was as high as 12% – rising from 2% in early 2020. It appears that Brazil could be one of the first countries to begin seeing a falling inflation rate. This would be Bullish for the equities market as well as the countries bond market and currency. Globally inflation will be strong for five to ten years and Brazil has the natural resources to benefit from international sales of these commodities.

June 15th Brazil will have the opportunity to adjust interest rates again. I am not going to guess what they will do however it appears that the interest rate and inflation cycle is peaking. A positive event for investors.

Trading Economics thinks there will be modest hike higher.

EWZ – the largest ETF by Market Cap for Brazil.

Our purpose here is to introduce you to Brazil (and Australia above) so you can begin the process of familiarity about what we see as an opportunity. Small initial positions can be started but only if you agree to a dollar cost averaging process of accumulation. We will follow up in the charts in the future when we see shorter term trading opportunities. Keep in mind that wealth is gained by accumulation share positions and held over a three to ten year period. The dollar cost averaging allows you to buy more shares when the stock is lower priced . This assumes a similar amount invested each time. To be blunt trading is for entertainment unless you are a full time trader or use algorithms to do your trading for you.

EWZS is an ETF for small cap companies in Brazil.

Inflation Rates in Brazil:

Interest rates in Brazil.

Brazilian Real Vs US Dollar:

To date, some accounts related to LOTM have started purchasing IAF* as an income idea. We believe it is a good long term position where a (future) weaker USD will help and having 25% of the portfolio involved in Mining companies, a play into our “Decade of Commodities” theme.

Written June 12, 2022, by Tom Linzmeier, editor, LOTM

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()