Hi Everyone,

I’d like to share with you a comment at Briefing.com and another from Kitco News, concerning money movement in the market and LOTM strategy.

Money is rotating from Growth to Value. The peak on growth stocks with no or low profits was February 2021. It is not “all” growth stocks being sold. It appears to be Growth stocks with little or no cash flows. Growth Stocks with fat profit margins are still ok and desirable to own – We think this fat profit margin pack of stocks are being led by Crypto Miners and companies that have accelerating growth and profits as a result of adopting Blockchain Technology. See Goldman Sachs comment in LOTM email #26 from Monday. That is part of the LOTM theme, so we are happy to be in the right place at the right time.

We are interested in buying “some’ of these fallen growth stocks as a bottom fishing opportunity. This is a high volatility game with time lines uncertain as to recovery in share values. We will move slowly and are still working on identifying 8 to 10 names we are comfortable with. StoneCo (STNE)* is one we started buying. Mentioned in our LOTM Daily emails. We are not looking for returns in the next three to four months but thinking the next cycle out. The shares are around $17 down from $95 last February.

Sector rotation can be a very profitable game within the Market of Games. Usually, one is way too early or entering late in the game. Much of this “timing’ depends on how you are emotional wired between instant gratification or delayed gratification. There is no right or wrong in my saying that. It is only said to harmonize you personally with your market strategy. Good Day to all. Tom

[BRIEFING.COM] The S&P 500 increased 0.2% on Tuesday, overcoming an early 0.7% decline, as investors continued to rotate out of growth stocks into value stocks.

The Dow Jones Industrial Average rose 0.5%, while the Nasdaq Composite (-0.5%) and Russell 2000 (-0.2%) closed lower but off session lows.

The underperformance of the small-cap Russell 2000 indicated the rotation was predominately in the large-caps. The S&P 500 energy (+3.0%), financials (+1.6%), and real estate (+1.1%) sectors rose between 1-3%, while the information technology (-0.2%), consumer discretionary (-0.6%), and communication services (-0.4%) sectors closed lower.

Growth stocks were pressured by another increase in long-term interest rates and by a disappointing earnings reaction in Zoom Video (ZM 206.64, -35.64, -14.7%), which fell nearly 15.0%. The Russell 1000 Growth Index declined 0.4% (-1.7% in two days), versus a 0.6% gain in the Russell 1000 Value Index (+1.1% in two days).

The 10-yr yield increased four basis points to 1.67% (+13 bps in two days), and the 2-yr yield also increased four basis points to 0.61% after flirting with 0.66% intraday. The U.S. Dollar Index fell 0.1% to 96.48.

Higher oil prices ($78.38, +1.61, +2.1%) provided the fuel for the energy stocks after the U.S. announced plans to release 50 million barrels of oil from the Strategic Petroleum Reserve over several months. China, India, Japan, South Korea, and the UK are also expected to tap into their oil reserves.

WTI crude futures initially fell on the news, but quickly rebounded on the recognition that Bloomberg reported yesterday that the U.S. was planning to announce this today and that OPEC+ warned it could reconsider output increases as a response. Oil prices were also down 10% since Nov. 10, further signaling the news was already priced in. LOTM note: we are seeing some selling and profit taking in Energy stocks. Suggest focusing on Natural Gas stocks as it is regionally sourced for best prices – less threat from Russia and OPEC – while oil is international and easier to transport than Nat Gas. If you have been around a while, I have no doubt you share the concern of the childlike thinking of our leadership on energy and defense policies. It does make it easier for us in investment decisions, however. Gotta think positive. We like EQT Corp (EQT)* / Vermilion (VET)* and Anteros Midstream (AM)*.

Additional Thoughts on Money Flows for 2022:

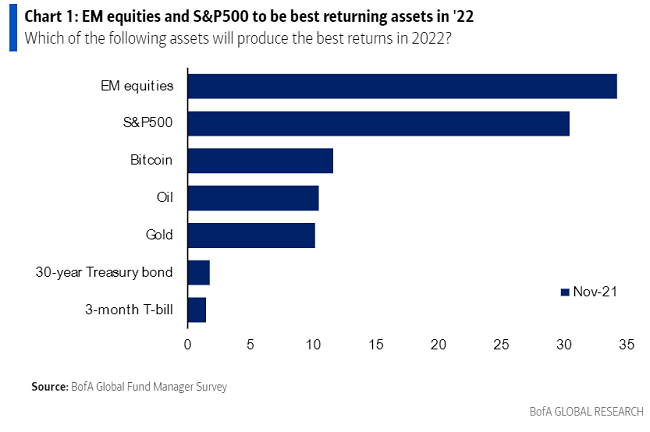

- Seems Bank of America is looking towards Emerging Markets (EM) as one of the best places to have money in 2022.

- South Korea is country with growth plus sub 10 and even sub 5, Price to Earnings Ratios.

- StoneCo (STNE)* mentioned above is a PayPal like company from Brazil and a step into the Emerging Market area.

Bitcoin shines brighter than gold and oil in 2022 – Bank of America Fund Manager Survey Neils Christensen Tuesday November 23, 2021, Kitco News

Full story linked in the headline.

Written November 24, 2021, edited November 29, 2021, by Tom Linzmeier, editor, LivingOffTheMarket.com

Building Wealth – one day at a time.

Available for Coaching, Training or Mentorships

Contact Tom through the LOTM website or by email

Rate: $150 per hour / Monthly Retainer, Lowers Rate

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()