Something to think about:

- Fundamental analysis is linear and measurable. A Science.

- Technical analysis is also linear and measurable. A Science.

- Behavioral analysis is emotionally based and non-linear. An Art form.

Behavioral analysis is a space between uncertainty and probability. The greater the uncertainty, the higher the fear factor. Throw some borrowed money into the financial recipe and fear causes an over-reaction to the down side. Borrowed money used in investing will be liquidated. This is called a Black Swan Event.

In considering Uncertainty in the market, balance uncertainty against Probability factors.

What are the probabilities of the stock market going away, an industry disappearing or a company/stock disappearing. All are possible. All are highly unlikely to happen. That is if you are in financially healthy companies, and the industry has a market place to sell to and you do not use borrowed money. The odds of surviving an Black Swan Event are quite high.

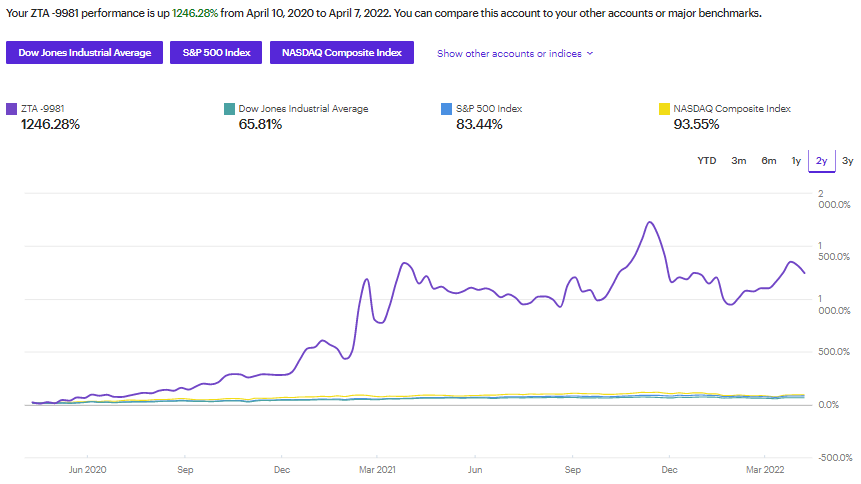

Imagine if the uncertainty goes away. Fear dissipates and optimism returns. A stock’s price can have a non-linear response and appreciate very rapidly. Faster and higher than “normal reality.” Throw in the return of borrowed money, no fear, in fact greed, and stock prices soar. This is the cycle of Fear to Greed and back to Fear. Wait we don’t have to imagine – we only need to look at what happened from March 2020 to a year later. See graph below.

Behavioral analysis, the art of behavioral analysis, presents the perfect buying opportunity for those without debt and without fear. Emotions are the non-monetary leverage that sets up the rapid compounding LOTM refers to as “Bending Time and Space.” There are other non-monetary leverage tools we can use as well, that don’t risk survival. We will discuss those later.

Proof positive: Black Swan event of March 2020 and the two years that followed, performance with no borrowed money. Do not fear Black Swan Events. They present your worm hole to greater wealth.

ZTA Partnership is an eTrade account managed by Tom Linzmeier / LOTM.

Black Swan events happen regularly in different markets, different asset classes or different industries.

Think of Volatility as your friend, your tool and your opportunity, allows you to “see” and welcome what others fear. Meditate on that please.

Instead of running and hiding from the idea of a Black Swan Event, be ready to greet it with open arms. Have your strategy and basket of tactics at the ready to jump into action when it arrives.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()