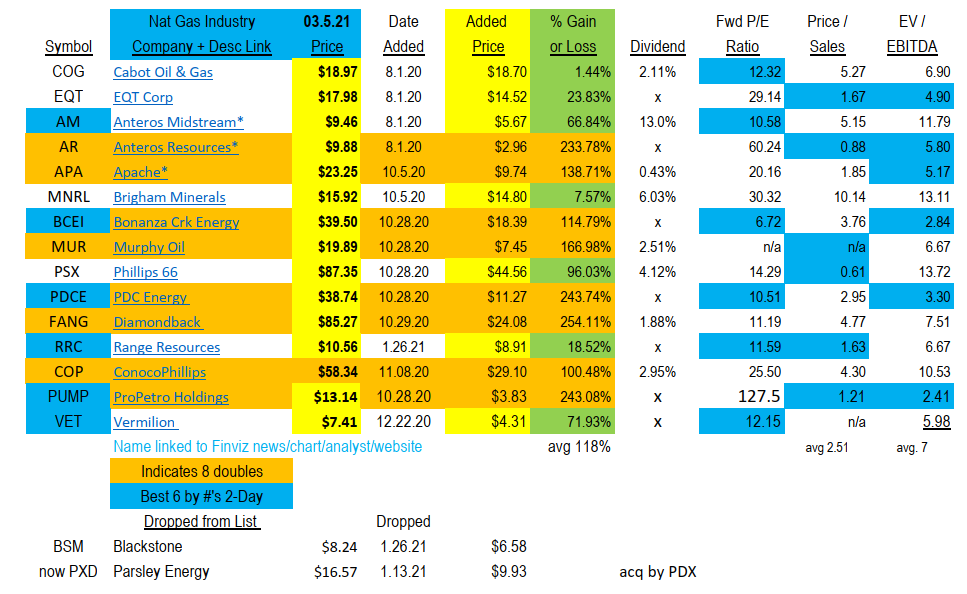

It does not get much better than this. The move is not completed at this time, but it certainly isn’t as attractive as when NO ONE was interested in the sector.

We looked for great values at steep discounts. We wanted to work the timing aspect and tried but let’s be real – Timing is a trend following practice. We were hunting Great Values and weren’t too focused on the Timing.

Our underlying confidence was in the commonsense fact that one cannot move to the green technology of Solar and Wind without an intermediary step. It’s either you had have a better Battery technology or Alternative power source when the sun does not shine, or wind does not blow. That’s Nat Gas and this fact isn’t going to change any time soon.

We consider most of the names above as a hold at this time. We still want to own the commodity asset group. It is still the cheapest asset class. We would be more aggressive in our next “Best Industry Selection”.

EQT

One name we’d be aggressive in buying is the largest Nat Gas company in the USA – EQT Corp. They are the industry leader for a reason. They are good. The P/E ratio is not as low as some others because they made two late 2021 acquisitions. They need time to digest and integrate these companies. The share price is still at a very attractive price in our opinion. They did what smart powerful leaders do in industry times. They buy assets cheap when the market prices them cheap. Just like you want to do.

AM

AM is still attractive for those looking for an above average 13% dividend. They have the cash flow to continue the current payout.

AR & RRC

Leveraged companies but appear fine with Oil above $50.00 a Barrel.

We are working on the next industry best deals list: GOLD MINERS

Training, Coaching & Mentoring available

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()