Does Nat Gas and Oil go the way of Coal in the United States?

Georgia Senators determine the Fate of Oil and Gas in the United States:

At the end of last week, the US Democrats had a majority in the House of Representatives. President-elect Joe Biden is likely to take his oath and become the forty-sixth President of the United States on January 20. The last link in the chain that would allow for a clear sailing of the Democrat’s political agenda is a majority in the Senate. As of the end of last week, Republicans held fifty seats and Democrats forty-eight. Two seats remain outstanding. If Democrats capture those contests (both are in Georgia), they win the majority as Vice President-elect Harris would have the tie-breaking vote. Andrew Hecht – Seeking Alpha

We like the valuations and the prospects for recovery in the Oil & Gas sector. Vaccines are expected to roll out in December and Q1, 2021 which would pull us out of the Covid driven economic slump.

What could go wrong for an Oil & Gas recovery? If the two senate seats go Democrat in the Georgia run off Jan 5th. Then President-elect Biden could, move to reinstated Obama era type regulations related to the war on fossil fuels. He would have a majority in the House and a 50/50 Democrat / Republican split in the Senate with the tie breaker going to the Vice President. In addition, the Democratic Platform states an intent to defund oil & gas subsidies.

We would expect firming in the Fossil fuel stock prices for about a month. Then weakness going into year end and the Vote in Georgia on Jan 5th, 2021. At that time, we would expect price action in the direction of the vote. Republican majority and Oil & Gas prices rise – Democrat wins two seat and the senate id dead-locked and we would expect to see a selloff in fossil fuel stocks.

We are doing buying in the sector but also hedging a bit by selling call options on the positions ahead of the Jan 5th vote.

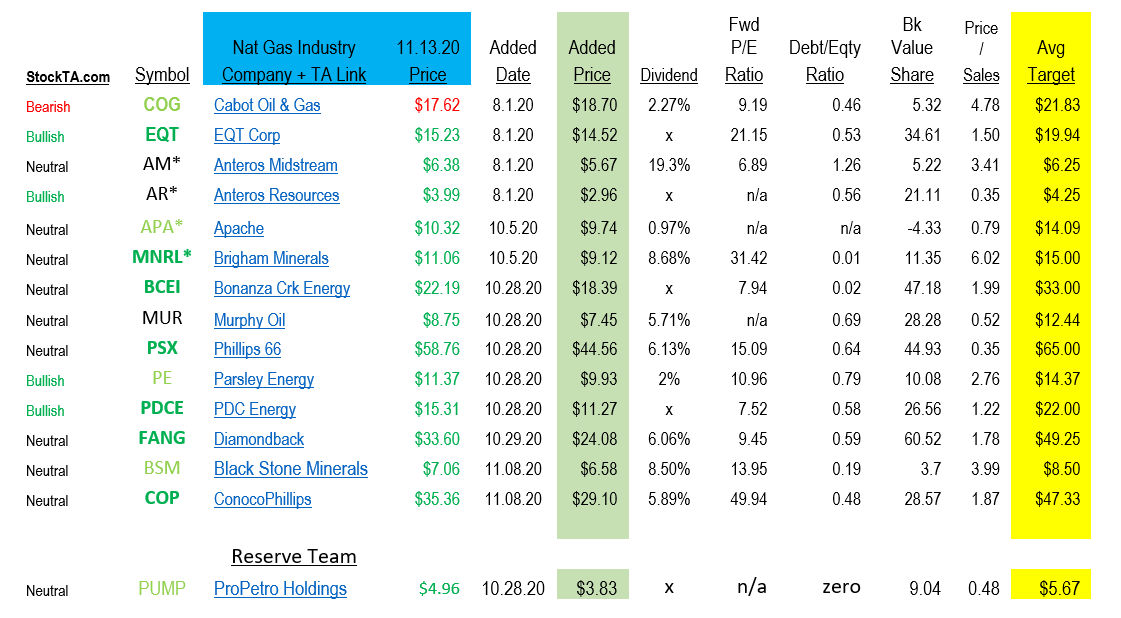

Column 1 Is the technical analysis while column 2 (symbol) is analyst’s opinion, usually fundamental analysis.

Chart above:

- Five Level Coded Buy/Hold/Sell Ranking:

1) StockTA.com: Technical “Overall” Opinion – Name linked to complete Technical Opinion

2) Analyst Strong Buy: Symbol bold and green

3) Analyst Buy: Symbol bold & pale green

4) Analyst Hold: Symbol black

5) Analysts Sell: Symbol red

Target prices and analyst’s opinion sourced from www.TipRanks.com

Technical opinion sourced from www.StockTA.com

Fundamental numbers sourced from www.Finviz.com

Reserve team: was meant for monitoring, but the price performance has been great in one week.

- For dividends we like FANG, AM, PSX & MNRL

- For appreciation we are in or looking at AR, APA, FANG & BCEI – look at the technical opinion and the analyst opinion for opinions from two different views – Fundamental and Technical. Most it not all are trending towards technical buy signals. January 5th is an important date for the industry.

- Our Least Favorite now is BSM. In spite of being having very low debt level, they also have very low cash – and have assets for sale. This will make their rebound into higher Oil and Gas prices lower and slower. We may drop then from the list but will wait for our adjustment closer to year-end.

For daily or near daily notes from LOTM simply send us an email and put Daily Notes in the subject line. There is no charge. Money@LivingOfftheMarket. com

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()