The market rotates between rally phases and correction phases. Normally the rally phase is longer in time while corrections are shorter in duration. This can also be called Risk-on trades and Risk-off trades.

Risk-on trades would include Growth stocks, Crypto, most equity sectors like Bio-tech, Genomis, Semiconductors, and Emerging technologies suce as Cathie Wood’s ARK mutual finces. Risk-off trades would incorporate Precious metals (miners and physical metals) Consumer staples, Value stocks and high quality dividend paying stocks like Utilities and Pipeline companies. Ten-year and shorter Treasuries are also considered Risk-off trades.

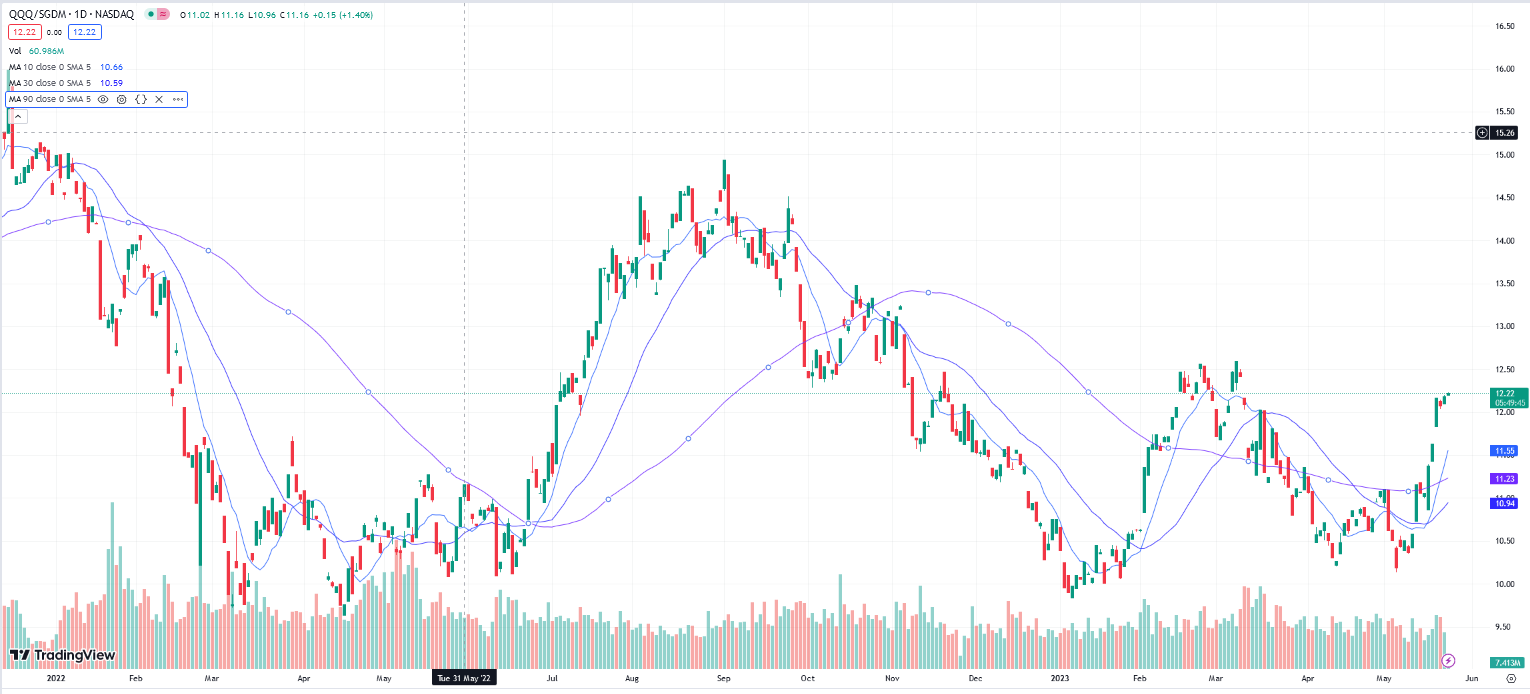

If we select a Risk-off asset like Physical gold or Large Cap Gold miners, we can divide that ETF into any number of Risk-on vehicles (like the NASDAQ 100) and come up with a ratio as to which ETF is outperforming the other. This is important to track as “The Market” is likely to be more volatile and shift from rally to correction phases for shorter periods of time (three to six month cycles) than it has in the past. Each phase can be very volatile in its moves within short time periods. Currently Risk-on is in favor, see chart below, for the NASDAQ 100 and Biotech/Genomic areas, and risk-off in areas, like gold and silver, are out of favor. The ratio above the moving averages is positive for Risk-on vehicles (numerator) and a ratio print below the moving averages is positive to Risk-off vehicles (denominator).

NASDAQ 100 (QQQ) dividend by Sprott Large Cap Gold Miners (SGDM)

We have added short (10-day), intermediate (30-day) and long-term (90-day) moving averages to the ratio as bench marks to help identify short and longer-term trends for the numerator and denominator of risk-on and risk-off vehicles.

It is easy to see the rotation into the NASDAQ 100 and out of the Sprott Large Cap Gold miners in the ratio measurement above.

Bitcoin:

Of note for Bitcoin is the following information:

Tether Made $1.48 Billion In Profit And Is Investing In Bitcoin: Implications For Crypto Investors.

Forbes, May 21, 2023.

The article suggests that USDT (Tether) will invest 15% of its profit into Bitcoin. The good news in this is Tether will be adding support to the Bitcoin bid. Remember Bitcoin has a limited supply of 21 million coins issues and never any more will be issued. There is bad news in the USA’s desire to slow or stop crypto use in the United States. Is that too strong a statement? Document leaked from Democrat law makers from the Democrat party is saying crypto is not in compliance with US Regulatory statutes yet Crypto is different than a security or currency and the SEC has not made rules to accommodate crypto other than Bitcoin.

Of note for Bitcoin is the following information.

The SEC has ruled Bitcoin is a commodity. Bitcoin is regulated and accepted. It is our contention that crypto is not a security. We readily agree that many crypto altcoins have no functional use factor and are sham or in the industry language, Shit-coins. These coins should be eliminated in time. The SEC is dragging it feet in making regulations to allow the existing US$ and Banking community time to catch up to this rapidly evolving new asset class. The purpose is not investor safety, but an issue of government control. Governments outside the USA are racing ahead of the USA with regulations. Talent is leaving the USA to stay on the leading edge of blockchain and crypto development. Galaxy Digital (BRPHF*) and Coinbase (COIN) are opening branches overseas and not in the USA. Being a growth vehicle. Bitcoin and crypto altcoins are a Risk-on asset class.

Cathie Wood also referenced last year’s dramatic collapse of crypto exchange FTX, saying it “proved the concept” of bitcoin

Grayscale Bitcoin Trust (GBTC) dividend by Sprott Large Cap Gold Miners (SGDM)

GBTC appease to be consolidating its strong Q1 ’23, Vs Risk-off assets and about to breakout again. LOTM views the above ratio between the Risk-on assets as represented by GBTC, as bullish formation favoring GBTC.

Biotech & Genomic Industry:

LOTM has recently been pointing out that Biotech and Genomic companies are starting rise out of their basing chart pattern.

Here is what the Global X Genomics And Biotechnology ETF (GNOM), look like in the Risk-on Vs Risk-off ratio pattern:

Natural Resources:

Accounts related to LOTM are positive and long on Natural Resource stocks long-term. The trend currently is lower. We expect to remain positive long-term but will likely back off our over-weight position. This is a frustrating time for Natural Resources, including gold and silver. We are convinced that the US Government needs to let inflation run above interest rates as a way to deal with the excessive debt in the USA financial system. The debt ceiling is an issue that could cause a volitle reaction until or when it is worked out. A number of analysts think a raising of the debt limit will cause a strong Risk-on rally.

We are and will remain over-weight in Gold Silver and Industrial metals as well as oil and gas but will slightly reduce our position to be involved in some of the Risk-on areas.

We like Blockchain and crypto as a new rapidly developing industry. It is going through the typical stages of a new technology. First, they ignore you, Then they laughed at you, Then they try to destroy you and Then they accept you. Bitcoin and Ethereum offer a better more efficient and faster system than we now have. Blockchain and Crypto are a Risk-on strategies. Strength in Bitcoin and Ethereum will come from outside the USA for a period of time. This strength will not stop because of USA regulatory actions. The movement is bigger than the USA.

Speaking of Oil & Gas above, here is an interesting new article on ExxonMobil, and a number of major oil & gas companies pushing back on ESG mandates – linked below.

- ExxonMobil, Shell Explode A Pair Of Energy Transition Myths, May 23, 2023 Oil Price

Also, Norway’s Decision To Step Up Oil Exploration Angers Climate Activists

If we are going to beat inflation in energy it will come from the supply side.

We are also beginning to work in the Biotech/Genetics area.

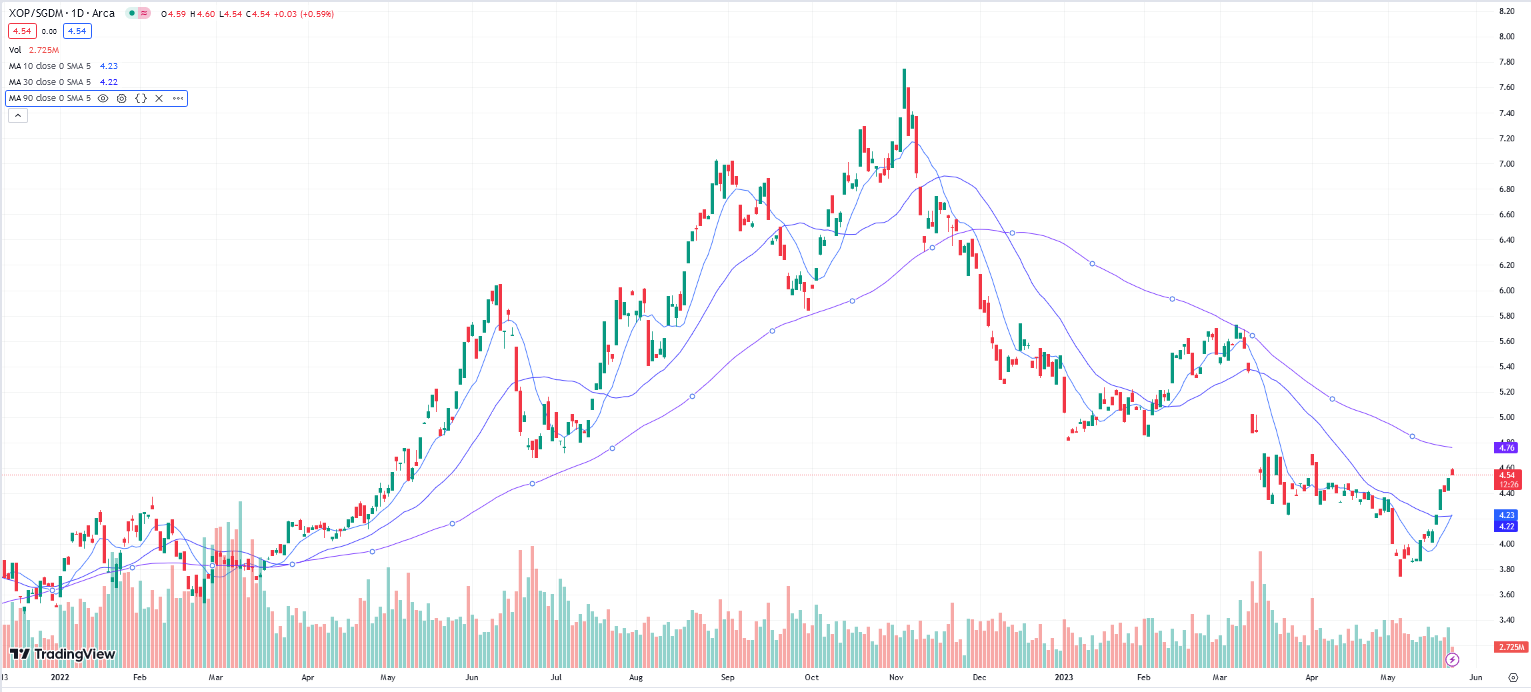

What about Oil & Gas to Sprott Large Cal Gold Miners at this time?

We used XOP, The S&P 500 Exploration and producers ETF

Oil & Gas is out-performing, in the very short-term timeline, large cap gold miners at this time. We have to get above the 90-day MA for us to consider this a long trend. This is still a bearish trend in Oil & Gas Vs Physical Gold long-term. We need to see daily price close the gap that happened four months back. The positive annual cycle in Oil ends at Memorial day each year.

How to use this Risk-on / Risk-off ratio:

I will give a couple of examples, as there are as many options are there are investors in the world. After that determine what works best for you and what is.

Traders: trade a allocated amount 100% risk on and zero for the Risk off side. Rotate to 100% Risk-off with the signals revers. This obviously is an all or none approach.

Investors: as a hedge might use this as a hedge Use your Risk-on vehicle when it is above the moving average you determine to use. Remember, you will never be perfect, but your odds of success increase in the market the more consistent you are with your methodology.

Hedging: Keep a set portion of your portfolio ready to shift to Risk-off investing. A suggested amount is 25% to Risk off when your signals are triggered. Risk-off could be a shift to one year Treasuries. It could be physical gold. Or Miners as a third suggestion. Keep in mind the more you want a safe haven hedge, the more conservative the Risk-off asset. Treasuries, less than twelve months, would be the most conservative option.

Note to subscribers: we will track this Risk-on / Risk-off Ratio for you on a regular basis. We are not promising we will update on a weekly basis, but we will monitor inhouse a couple times per week and let you know when we see a shift might be close.

At this time momentum favors being in Risk-on assets.

The best moving average for actively trading gold and silver miners is the share price crossing above or below the 30-day moving average. You will get some false buys and sells with the 30-day, but this seems to be the MA that is most responsive to large traders moving into and out of Precious Metal Miners. Good Luck!

For Actionable Stock Ideas, consider a subscription to Tom’s LOTM Blog.

LOTM Style – We are more a controlled speculator, than diversified investor or short-term trader. We allow 100% loss/risk on some purchases. Often, we dollar-cost-average into losing positions. Volatility is our friend, not something to be feared. We let our winners win, as much as possible. We do not like paying taxes. We love value, yet watch charts. Our goal is to find value stocks that might double in one to three-years.

See our website for our doubling to a Million$ game. We were playing this game of doubles before Patrick Ben-David talked about it. Ideas in this blog are highly volatile and only for use by those who are comfortable with high-risk, high-reward investments.

Written May 23, 2023, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()