Soluna 9% preferred is an interesting speculation. It is very difficult to suggest buying the shares as there could be events beyond the company’s control that cause Soluna, the company, to go through bankrupcy. Personally I still hold a cup half full view for Soluna Holdings.

Soluna has been through multiple problems not of their making for the past twelve months. A lesser management team would not have made it through this period alive. Yes, Management could have avoided some of this by being a bit more pro-active in raising money when the stock was in double digits . They were a bit too optimistic in their business outlook and did not want to dilute shareholders, of which they were the largest. Looking back, the adage, “Raise money when you can, not when you need to,” comes to mind. It was a judgement call. They judged wrong because of events outside their control that were not foreseen.

What were those events?

- A Bitcoin price crash, their primary product.

- A number od crypto exchanges going out of business from May of 2022 to FTX in October of 2022.

- An energy sur-charge put in place by the Tennessee Valley Authority (TVA), that Soluna could not pass along to their tenant.

- A ten (plus or minus) month delay by ERCOT (Electric Reliability Council of Texas) for the approval for the electrification of Dorothy 1. This robbed Soluna of expected and needed cash flows.

- As a result of negative cash flows Soluna was unable to meet to maturity dates for loan due dates.

Management met the challenges and now is projecting positive cash flow within the next six months. It did cost management (as the largest shareholder) and public shareholders through the dilution of stock issued at very low prices. If we were to criticize the management, it would be for not raising money when they could have instead of when they had to and not doing a much better job in communicating with shareholders the challenges along the way. No doubt there is a counter argument to why they did what they did, and the why and when, they did it. We live in a litigious society and keeping your mouth shut is sometimes hard, but necessary. All this does not matter. Let’s not dwell on the past but look to the future. We are where we are.

I stayed with the idea ownership of Soluna because of my assumption that there is a vast green field opportunity in front of Soluna’s Batchable Data Center business model powered by wasted energy as a power source. I did sell shares of Soluna on its historic rally and rebuilt a position in Soluna common and preferred over the past six months. The green field opportunity is big enough, I trust in the probability that someone would step forward to work with Soluna. This is what happened. The coin could have flipped the other way as well, and someone might have chosen to try to push the company into bankruptcy and buy Soluna through the court system. The key here was in doing this, the buyer might lose the intangible people network of opportunities that Soluna management had built. Having said this, I hope I never get into this situation again but …

So that brings us to Soluna Holding’s 9% cumulative Preferred. Soluna is not paying the dividend, but it is cumulative. This means they owe the dividend to the preferred shareholder even though that are not currently paying the dividend. There is no maturity on the preferred so there is no due date to cause the company a debt due maturity deadline. The annual dividend owed is $2.25 per year per share. With the share price of the preferred at $2.00, that is more than 100% per year accumulating. Unless there is a voluntary renegotiation of some kind between the company and shareholders, I don’t see a legal path other than a bankruptcy for Soluna to not owe the dividend. As in 2022, there are possibilities of unforeseen events that might happen in the future. This could cause an unwanted bankruptcy. Therefore, the 9% Preferred is high risk and speculative. At $2.00 per share cost that is your max risk. 100% of the $2.00 investment. The upside is $2.25 divided by $2.00 – 112.5% annually in cumulative dividend and the potential to see the price rise to $15 dollars. That would return the price of the preferred to a 15% annual yield. No one can give you assurance that this will work out positively. For full disclosure, accounts related to LOTM own both the common shares and the preferred shares. We are talking our book.

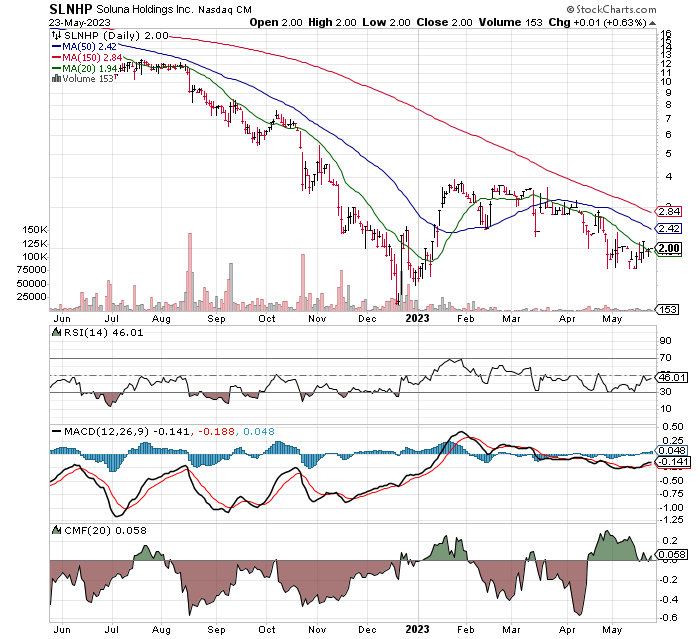

I am sharing the chart pattern for the 9% preferred above to show that there is some accumulation happening in the preferred shares though it is not showing up in the price of the preferred shares. One has to look at the three indicators below the chart to see slightly larger share purchases than there are share sales. The safe thing to do is wait for more positive news, or the price to get above the longer-term moving average at $2.84.

For current owners of the preferred, a tax strategy might be to accumulate shares at the current price, wait more than the 30-day wash sale rule and then sell the higher cost shares for a loss. Preferably the sale is on price strength. You have six plus months to execute the sale for a loss and still take the loss in 2023. If management executes as they suggest they can, we expect cash flow positive news within the next six month window. In doing this way, you maintain the position and harvest the tax loss for the benefit of 2023 tax year. This is a glass half full view for Soluna. From experience in working with investors over four decades, if one sells the higher cost shares first with the intent of buying a new, lower cost basis shares after the 30-day wash sale rule, few ever buy back in. Human nature.

Please excuse my lack of proof reading prior to sending. My only weak excuse is that it is my stream of consciousness style of writing combined with the desire to get information out as soon as possible.

Available for Coaching, Training or Mentorships

Contact Tom through the LOTM website, email or text.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()