- Stagflation – rising interest rates and declining economy.

- Charts and comments on Oil, Nat Gas, Silver and Gold

- Brazil is set up for a market rally

- Try a one month trial to LOTM and get our just released, Ten Bagger List

Do you realize the price of oil has risen 33.7% since June of this year? How do we beat inflation when oil is this strong? We could increase production of oil here in the USA, we, the USA, has plenty of oil & gas. The choice of Fed Chair J. Powell is to increase unemployment instead. This was stated in a recent Powell media comment. Stagflation is the result.

Most inflation is driven by the cost of energy. The high variable cost in food production and delivery is the cost of energy.

Natural Gas appears to have based and is ready to rise in price:

This three-year chart of Silver shows a massive reverse head and shoulders. Link to related story and provided here. Chart provided by the Market Sniper, Francis Hunt.

Physical Gold has consolidated its rally from late 2022 and appears ready to start a new leg higher.

What Assets Do Well In Stagflation? By Daniel Di Cerbo – Feb 2023. Article linked here.

Knowing what assets do well in stagflation can stop the bleeding when the markets are messy. A standard strategy won’t work when inflation is high, unemployment is rising, stocks are underperforming, there’s interest rates hikes from the Federal Reserve and other central banks, and the global economy looks headed for a tailspin.

Here’s what you need to know about where to invest during stagflation, slowing economic growth, and rising interest rates.

Real assets like property provide the most significant buffer against volatility in the stock market during stagflation because people need housing regardless of what the economy is doing. Rental prices have been shown time after time to keep up with inflation.

Gold, energy, and raw materials all outperformed during the 1970s stagflation. Real estate was another safe haven that allowed investors to continue building wealth through the 1980s, 1990s, and today. Follow the link above for the rest of the article.

LOTM Comment: While agreeing with the article’s summation, it seems that real estate has already run up over the past two years. This was fueled by low interest rates and excess money from the Covid flush. Since the average person buys Real Estate based on monthly payments, the near tripling of mortgage rates over the past 18 months, has taken many of the middle class, out of the real estate market. Since cities and states need revenue, it is probable that property taxes are going higher as well. If you apply the fact of 3% mortgage rates rising to the average mortgage rate in the USA of 7.45% today, one could mathematically justify a 30% to 50% decline in prices to accommodate the. Therefore, we look to non-real estate hard assets and commodities (Bitcoin as non-commodity hard asset) as places to hide out and profit. The big factor now is how deep a recession we might have. Some say no hard landing and others say the economy will fall off a cliff in the next few months. Negative view on Real Estate by George Gammon, A Grim Warning To ALL Homeowners linked here. 26 minutes in length.

BRAZIL: Another way to beat stagflation is to invest in countries and companies of those countries who have a better inflation outlook that we do, and who are commodity producing countries. Brazil is such a country and is showing up on many macro asset managers buying list. Inflation is at 4.61%, up from a June reading of 3.16%. The high on inflation in Brazil was 12% back in early 2022. Interest rates are much higher, currently 13.25%, however and “should” hold inflation in check.

Once inflation stabilizes and interest rates decline one expects the Brazil stock market to move higher. Brazil is loaded with minerals and fossil fuels. Remember the formula for higher share prices: Inflation down + interest rates down = Higher stock and bond prices. Brazil’s stock market is in position for a move higher.

Try a one month subscription to LOTM and get our List of Potential Ten Baggers in the Exploration Mining Industry. You will receive twelve exploration companies who have well known management teams and seasoned investing backers. All have market caps under $49 million and all are under $0.25 USD a share. Do not pick one stock, as the company risk and liquidity risk is not worth that exercise. Buy a basket of five to ten names and be patience. This is for both risk management and the impact of a lottery style return. We are targeting 5X to 10X from some of these names. Some might fail but the winners will more than make up for it. This is ”the” most undervalued area of the stock market at this time. The mining industry is priced at historic low valuations when compared to the price of physical metals. The industry is very healthy, so industry valuations are an anomaly in pricing.

In addition, we will include our top seven picks from junior miners whose market caps are between $213 million and $850 million. These companies were priced under the $50 million market cap three years ago. These junior exploration companies made their “Big Discovery” in 2020 through 2022 and though they are trading at a much higher valuations than the list of twelve, they are at a significantly discount from their high prices eighteen months ago. Great values all.

Sign up today and you’ll have out list for to review this weekend and be ready for Monday morning. If you have not noticed, many silver stocks popper in price this past week.

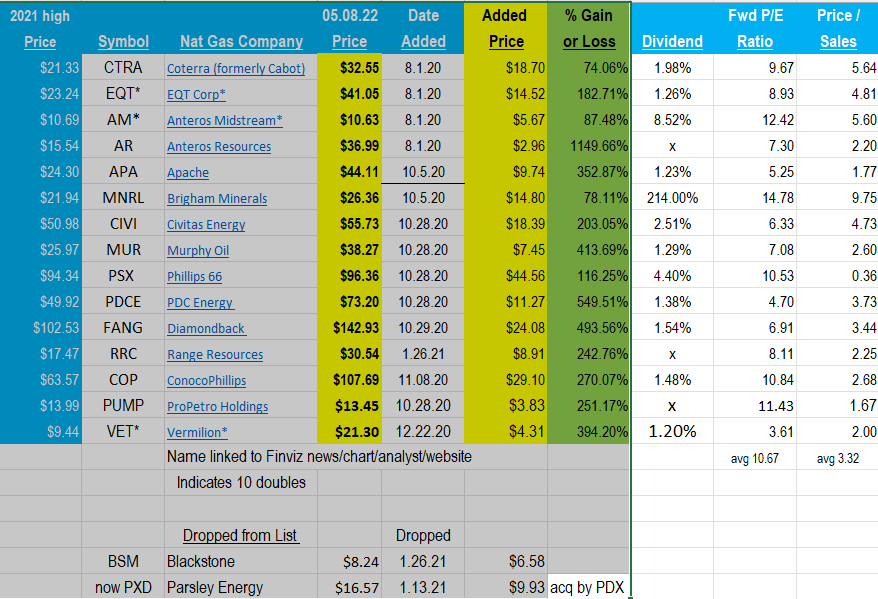

We did this same exercise with the Natural Gas industry in 2020. The returns were excellent. All 17 stock picks were profitable. 12 of the 17 names were up more than 100%. Here are the results after holding the positions for approximately 21 months:

This is a photo image, so the links do not work from the company names to Finviz.

Returns like this only happen were you buy companies or industries when no one else wants them. All these Nat Gas companies above, were very healthy but unloved. The asset management crowd hated them in August through November of 2020 but absolutely loved them from December forward. Who was it that said, “Buy your straw hats in Winter?”

Recent comments on Silver from respected analysts:

Silver is the Trade of a Generation, Most Undervalued Asset on the Planet: Andy Schectman Sept 15, 2023

I Fully Expect Silver Price to Rise More Than Gold as Market Collapses: David Morgan Sept 1, 2023

I Changed My ENTIRE Prediction On silver price Here’s Why! Rick Rule Last Warning Sept 14, 2023

Michael Oliver: Silver’s Long Consolidation Is Over Sept 13, 2023

For Actionable Stock Ideas, consider a one month trial subscription to Tom’s LOTM Blog.

LOTM Style – We are more a controlled speculator, than diversified investor or short-term trader. We allow 100% loss/risk on some purchases. Often, we dollar-cost-average into losing positions. Volatility is our friend, not something to be feared. We let our winners win, as much as possible. We do not like paying taxes. We love value, yet watch charts. Our goal is to find value stocks that might double in one to three-years.

See our website for our doubling to a Million$ game. We were playing this game of doubles before Patrick Ben-David talked about it. Ideas in this blog are highly volatile and only for use by those who are comfortable with high-risk, high-reward investments.

Written September 15, 2023, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()