- Visual Weakness in the Dow Jones Average rolling to S&P 500 and finally to NASDAQ 100

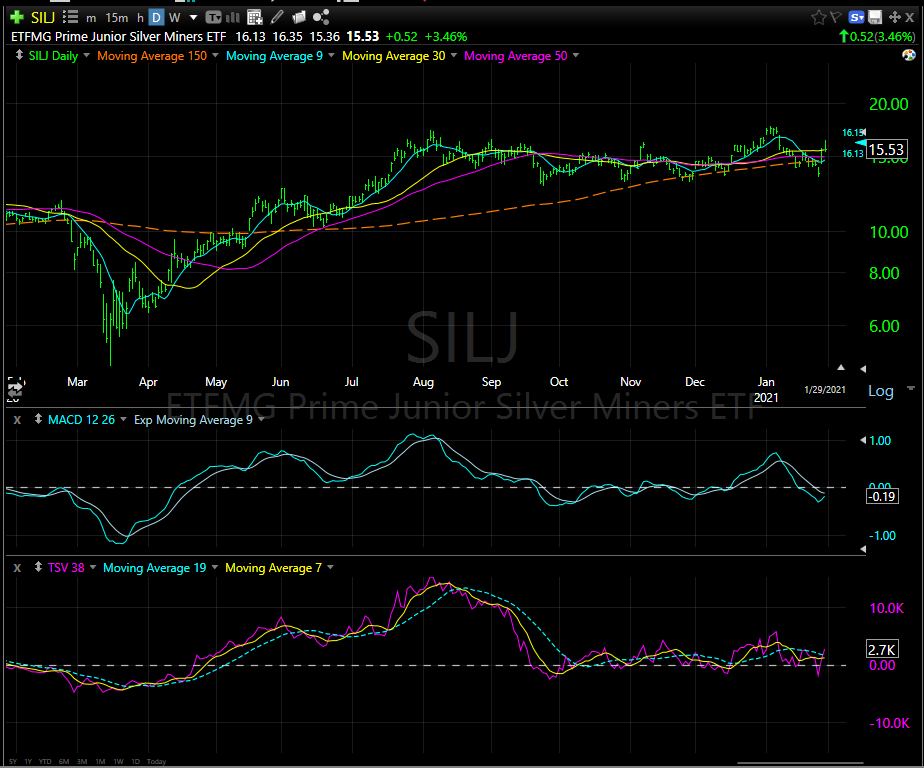

- Visual charts on Gold and Silver Junior minors

- Visual chart of Grayscale GBTC as representative of Bitcoin.

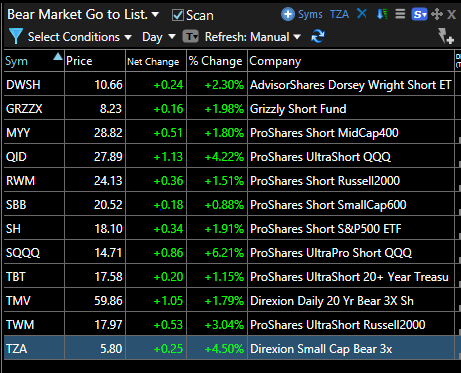

- Inverse ETF’s that would benefit from a falling market.

Of the three major indices, The Dow Jones Averages is the weakest. Its price is below its 50-day moving average. MACD (Moving Average Convergence Divergence) and Time Segmented Volume (TSV) are all weak and dropping. It we have a lower opening and continued selloff on Monday we would expect a reflex rally on Tuesday. We would use that rally to buy inverse ETF’s for a continued sell off later in the week – If you are so inclined.

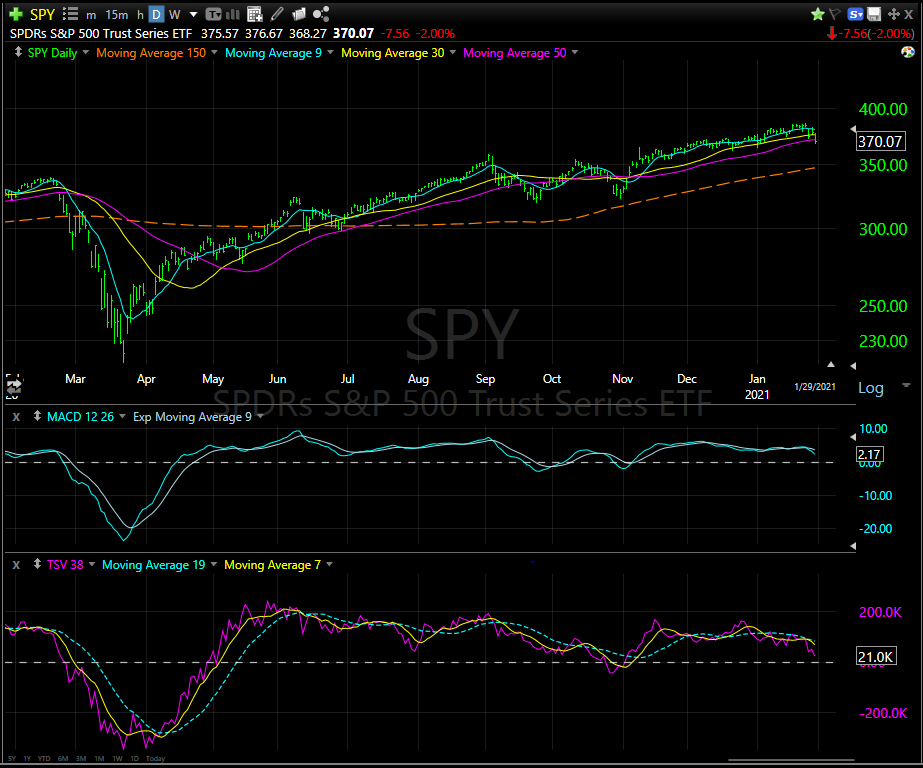

S&P 500 is trading just below is 50-day moving average. It is not as damaged as the Dow Jones Average but that might be because it is following instead of leading the way down. We would be careful and assume it is heading lower rather than Hoping it will rally. MACD and TSV indicators are weaker than the actual SPY price. Not a healthy signal.

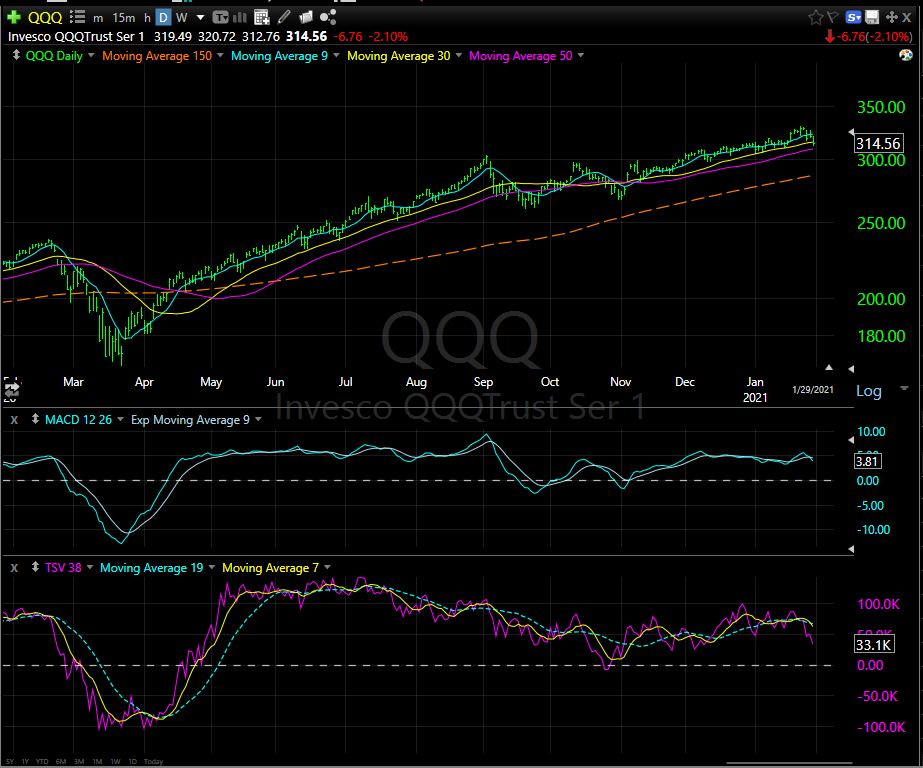

NASDAQ 100 – The big Tech company index is still holding above it 50-day moving average and would not give a sell based on Price Crossing MA at this time. MACD and TSV are, like the S&P 500, weaker than the price of the QQQ. Some accounts related to LOTM own SQQQ* the inverse ETF for the QQQ ETF.

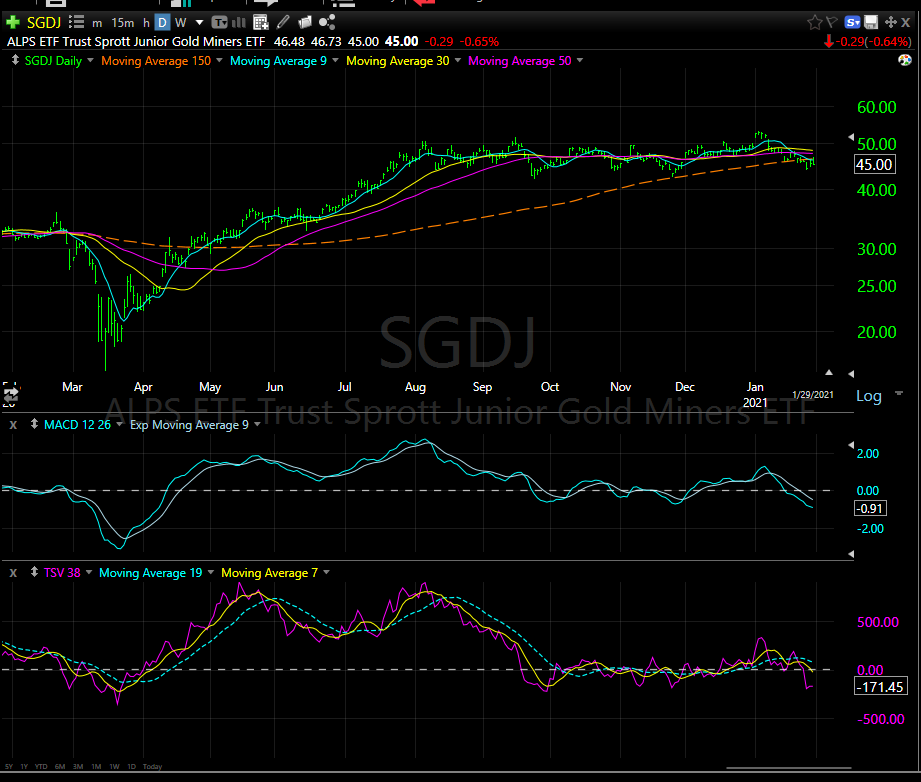

Since we are not trading physical Gold or Silver, we will work with what we prefer to trade. In the case of Gold and Silver we like the Junior miners in each group.

This sentence is under the discussion about stock: SGDJ for gold we like the ALPS ETF Trust Sprott Junior Gold Miners. We are disappointed to see this index is weak as well. We thought we might be able to rotate from equities into this trust as a counterweight, to the general equity market. These companies in the trust are on average doing very well with all in sustaining costs between $1,000 and $1,100 and end product sales about $1,850 for the third and fourth quarters – Free Cash Flows (FCF) at these companies are between $750 and $850 per ounce. That is really strong. So fundamentally speaking, this sector is among the best cash flow generators of all equity stocks.

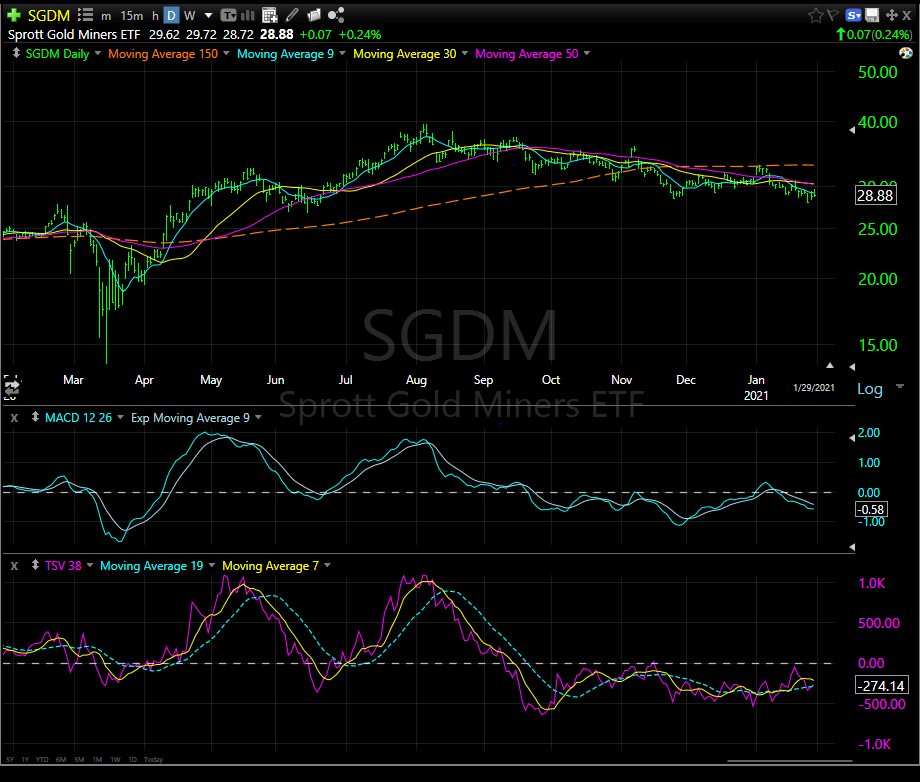

Below is the SGDM – Large Cap Gold Miners – also a Sprott ETF product.

I was not going to look here but because I was surprised at the Small Cap Gold miners being weaker than I thought, I wanted to see what the Large Cap Gold miners looked like. Still weak but one could see the potential for a bottom but certainly not on a buy signal yet. TVS has turned positive. This is an accumulation / distribution indicator. Therefore, being under accumulation is a positive reading. The share price is in the middle of trying to form a shallow saucer bottoming chart pattern – but it is early, and one could not say it is on a buy signal. MACD is no help as it is in a declining pattern but worth watching. Since TSV is positive we would consider it a second positive if MACD has a positive crossover. The stock price of the SGDM is close to it 50-day MA so it would not take much to get all three indicators, positive. Now I an speaking as a Technical Analyst. As a Fundamental commentator I would say buy anything in gold and silver – the profit margins are GREAT! No indication that physical prices are going down.

This is the best chart of the groups we have presented. SILJ* – Junior Silver Miners ETF. The price is above the 50-day moving average and strong the last three days when the general market has been weak. TSV is trying to get a positive trend going and MACD while negative would go positive with two to three positive days next week. Fundamentals are strong for silver miners. There are rumors that the millennial bull market raiders are targeting AG and possibly silver as a target. That would certainly put some spark into silver but operationally, silver miners are doing well and are too cheap.

Grayscale Bitcoin Trust GBTC* – The trend is up, and it looks like a correction in a strong upward trend, but early next week we should know for sure. Related accounts to LOTM own GBTC. We consider it a new asset class with about a trillion-dollar asset value, and major institutions like Fidelity, JP Morgan, PayPal, Square, Micro Strategy, Goldman Sachs and Mass Mutual buying shares and creating products involving cryptocurrency.

This chart reading is similar to the Junior silver miners above. TSV trying to go positive but could fail. MACD showing some bounce but still negative. The price action related to its 50-day moving is quite nice. Shows some snappy price bounce off its 50-day. We will know next week. LOTM is taking a long term accumulate position in Bitcoin related products. If trading, we suggest following some of the trading crowd at TradingView and Bitcoin.

Listed below are Inverse ETFs or fund that are short the market. Explore and see what might fit your style. Inverse ETFs were created to be traded and have reasons why you do not want to buy and own.

Prices are Friday Jan 29, 2021 close

LOTM is not a market timer, yet we would be foolish to not be aware of market cycles. One never know how deep the corrections will be or how or high the rally phases will be.

At our core, we are position investors. Position investors, by our definition, means that we take positions and manage the share size of those positions to grow with the core companies held. Our goal is to grow our asset value of each company held and expand share/percent ownership. We work on minimizing taxes while growing asset values with core companies’ over-time.

We attempt to use market weakness to increase our share positions in the companies we consider core positions.

Since we are small in financial size, we keep out core position holdings owned between three to five company positions.

Let positive energy, freedom of thought, speech and religion fill your creative spirit

and provide leadership to the rest of the world!

Contact us if interested in Training, Coaching or Mentoring

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()