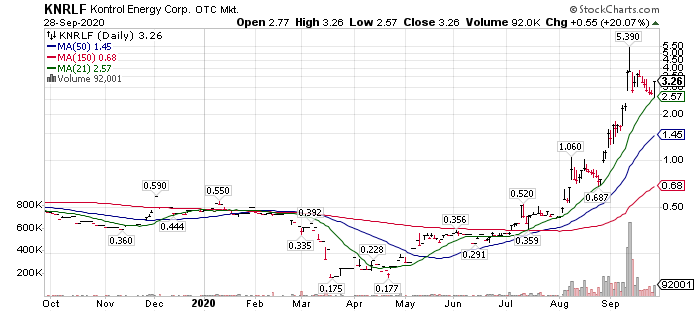

Kontrol Energy (KNRLF)* $3.25

Kontrol Energy has been a sizzling hot stock. Up 18.5 X since its low in March of $0.175. Over-priced?

- Certainly, from a performance perspective. 18 X rally in six months. Someone is taking money off the table.

- From a market cap perspective: Shares outstanding are, apx 30 million fully diluted. At $3.26 USD the market cap is about $97 million US.

- Revenue as of six months June 30 was US$3.75 million, down from US$5.6 million the previous six months. LOTM forward annualized Revenue for calendar 2021 is estimated between $7.5 million and $10 million.

- We will guess that there will be additional dilution from a secondary offering of 5 million shares. We also assume that there will be multiple secondary offering coming in the next one to three years.

- We assume Kontrol is a Development Stage company now transitioning to the Commercialization Stage company.

The above assumptions are estimates based on my personal experience in the microcap market space. They are without conversations with management. They are back of the napkin numbers. Energy put into something more detailed is wasted as the company is building rapidly and will likely suffer some stumbles and disappointments or successes that rapidly change on a quarter to quarter basis.

This is a speculative company. One that we feel is in an exciting market space. Smart Buildings – new and renovations. A new product in Kontrol BioCloud analyzer. A company that uses all the current technology available to them. Internet of Things (IoT) – AI – Cloud based software monitoring real time data accessible by smart phone. Working with building efficiencies in the areas of Energy, Lighting & Biohazard (BioCloud). We feel there is a green filed ahead of Kontrol and are very excited about their future.

We suggest a two to four-year holding timeline objective. Do not be afraid to buy on weakness – sell “some” on strength (25 to 40%) and continually work towards bigger and bigger positions bought on weakness. With a dollar cost averaging strategy of buying additional share on weakness, using the strategy above, our total return over three years goal would be 100% annually. Timing is critical – dollar cost averaging on weakness and selling some on strength requires paying attention – not passive investing.

In their pitch deck, available on the web site’s Investors page, they state their goal is to grow revenue to $100 million and sell the company. That could have been true at the moment they said, or an exit strategy stated for potential investors. It is hard to say. In any event, we would expect the company to be bought out at some point in the future.

The company does state that recurring revenue is about 30% or total revenue. Recurring revenue is always a welcome feature.

An exciting new product is their BioCloud analyzer for Bacteria and Viruses.

- It is appropriate for small and medium size rooms with three or more people.

- Target markets are classrooms, offices, airplanes, trains, buses, long-term care facilities and hospitals.

- Retail price is about US$12,000 per unit. No doubt that will decline with production increases.

- Production capacity is being scaled at 20,000 units per month capacity.

Full capacity projects an annual revenue run of a number too big to seriously consider for this discussion. That would be exciting, but we are not saying it will be. One day at a time. Here is a link to the September 23, 2020 press release. The company itself is not making any claims or projections as to potential revenue from BioCloud subsidiary. Link to media kit on BioCloud.

Accounts related to LOTM have a small position in Kontrol Energy. We are using the $100 million market cap as a top price we are willing to pay for the company at this time. Prices Under $3.00 per share are our buy-in targets goals for accumulating shares.

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()