The market is in a bit of a mixed performance zone.

Rally? Correct? Most likely muddle along with out a strong trend.

- Growth stocks have corrected but investors are not sure it they want to continue the rotation to Cyclical / Value stocks or if the correction is deep enough, they should be buying back into growth.

- Cyclical especially Nat Gas and Oil, have had a great rally started to sell of but then heard that Saudi Arabia would hold production cuts to June. We like Nat Gas but think most of the rally is behind us for now. We would be buyers in this area but very selectively and on price weakness.

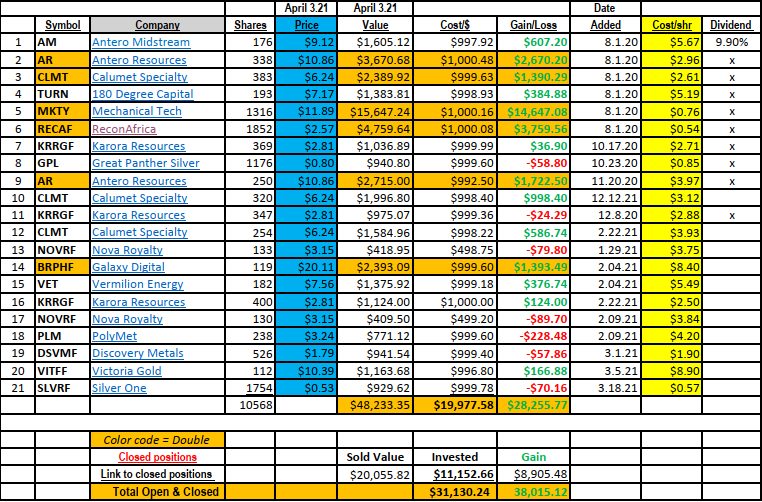

The B/S/Hold is my personal opinion on my thoughts of the share price. I don’t have strong motivation about aggressive buying unless I say Buy outright. I like gold miners a lot at this time. We like Blockchain related companies MKTY, Galaxy (table above) and not mentioned ARGO Blockchain (ARBKF) $3.20. we would prefer to buy on weakness should it happen. We are avoiding investments in specific crypto currencies like bitcoin. Our reasoning is that Blockchain is so big we want exposure to the Blockchain universe and not limit ourselves to crypto which is only a sliver within Blockchain.

Silver miners are fine as well.

Silver miners are not as cheap on a valuation basis as gold miners. We like then anyway. Silver will benefit from advancement in silver applications in electric vehicles, electronics and solar. Demand for silver is out running supply and will for years forward. The current turn-up in gold miner’s price, seems directly related to ten-year and longer government paper. The bond rally and gold rally likely related to weakening interest rates.

The chart below (TLT), is the twenty to thirty-year Treasury bond prices. The recent price action in government bonds suggests a flattening of interest rates. Gold miner prices are running in advance of bond prices in the interest rate conversation.

The small bottoming formation in March, and now April, appears to have triggered the emerging rally in metals. Perhaps in growth stocks as well. It is too early to say that a continuing weakness in interest rates will continue or not. It would certainly be a positive for the economy and commodities in general. Weakening interest rates have historically been positive for stocks as well.

In accounts related to LOTM we continue to dollar-cost-average into the miners and crypto related stocks as our primary focus.

Risk Management:

Our risk management strategy is to dollar-cost-average into names we like. The deeper any market sell-off might become, we sell entire positions and re-invest into the strongest “company” core positions to weather the storm. When the market rebound happens, we hope the concentrated core positions act as a price springboard, and our account value recovers faster than if we maintain a diversified portfolio in a buy and hold risk management strategy.

Most of our positions held in LOTM related accounts are not marginable. By design or by happen stance, we have very little borrowed money in the market. Sudden market sell offs, will likely be connected to debt or margin, so consider this in your risk management strategy. Risk management only works if you implement it before the Risk Event happens. Be proactive and consider what could go wrong as well as what we hope goes right.

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()

Hi Tom just wondering what your thoughts are on the secondary announced by MKTY are. I find it positive.

Thank you