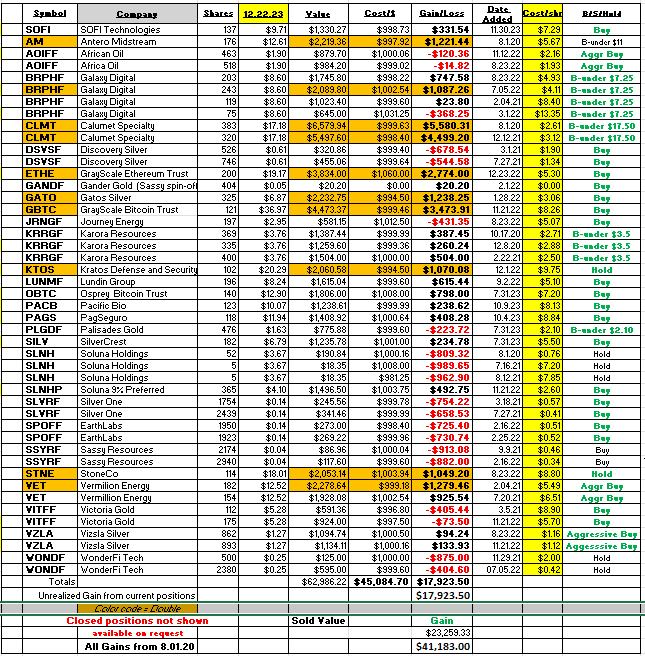

Account Summary:

Starting Date August 1, 2020

Cost of current investments: $45,084.70

Unrealized current holdings gain: $17,923.50

Realized gains from start date: $23,259.33

Total Realized and Unrealized Gain: $41,183.00

This will be our last public posting of Ten Under $10 for the Double, coordinated with real time release. Future postings for public sharing will have a three month delay from subscriber release.

Over-all Style of working the market at LOTM Summary:

Deep Value with High Potential

- Our holding periods tend to be six-months to three-years.

- We buy a core positions and trade around these core positions. We buying weakness & selling partial positions into upward moves in our core positions.

- We working to increase position size until we exit. We tend to scale out in a reverse dollar-cost-averaging / harvesting methodology.

- Our goal is 100 percent return over three-years for core positions. 30% annually is our goal. Obviously, we don’t always hit that goal.

- Volatility is high as we don’t use stop losses and own concentrated positions. We use Dollar-Cost-Averaging in and out of positions as a risk management tool.

- We attempt to allow winners win and grow gains beyond 100%

- We look to buy Value when media tells everyone how bad the industry or sector is. We are definitely contrarians. We shop the garage sales!

- We use no stop-loss discipline other than 100% of each “equal dollar” investment. Consider adding your own stop loss policy. For LOTM’s system to work, we much cap our loss (for us 100%) while letting our winners grow beyond 100% gain. Consider how to modify this approach with what works for you. Happy to discuss this with you personally.

- We prefer long-term capital gains over short-term trades.

- We have more patience than most.

The stock market is a device for transferring money from the impatient to the patient – Warren Buffett

At LOTM, our style of working the market is that of a speculator. As a speculator, our account will be volatile because we are do not manage a “portfolio” for “stability.”

We not gambling, investing or trading. We use probabilities based on our experience, knowledge and understanding of the market, various industries and companies we own.

This does not mean we will always be right or perform in a timely manner. It means we seek out “a” probability of being right.

As speculators and accepting volatility, we attempt to out-perform the market over-time through a narrow and concentrated approach, whereby the probability of success is on our side, but where the timing of performance and volatility in the market is the largest uncertainty.

Tactic: If an investment position drops in price, we try to buy more rather than sell. In bear markets, we often reduce the number of positions held to provide the cash needed to buy more shares in our highest conviction holdings. We will tax manage the account in selling the higher cost shares while buying lower price shares and still be in conformity with the wash sale rules.

Volatility: As a speculator, our account is concentrated in very few investments. It is not a portfolio of diversified holdings. When the investment positions drop in price, the account value can and will drop dramatically. The draw-down in prices on the account holdings are an “opportunity” to buy more shares (increasing the position size) and lowering our cost per share. One needs conviction in what you own to work this program.

When the prices of the few positions owned recovers in price, The account value can spring forward because we have bigger positions at a lower cost basis. This process increases leverage without borrowed money. In this way the account acts like a coiled spring releasing. The drop in account value allows us to “coil the spring.” We do this by adding funds or reducing positions to buy more shares of our highest conviction holdings at cheaper prices. This is a recognized risk management approach called “dollar-cost-averaging.” We are “volatile” because of the non-diversified nature of the speculator strategy. We view volatility as our friend and an opportunity to coil the spring. This approach to the market is not for the majority of people.

The act of coiling the spring is part of our strategy and a tactic involved in speculating in the market.

Hence, high volatility for us is “normal” and sets up an opportunity to recover faster and higher.

In the investment management world, ARK ETF funds and founder Cathie Wood are the best examples of using this style of management.

In the commodity world, Rick Rule and Eric Sprott use similar methods of “speculating.” This is not a new style of working the market, but not one often shared or taught. Rick Rule and Cathie Wood are the most outspoken about this method of how they manage stock positions in the market.

The Ten Under $10 for the Double is our core display of what works in applying this process of a management system that works. We look for undervalued ideas that might double or more within our six month to three year timeline. It is the system, however that makes for long-term profits. We start with the idea that we risk up to 100% of a single investment. To compensate for the 100% risk, we have to let our winners keep winning above 100% gains. In this way we build a stable of winning companies that but require that we let winners run to pay for ideas that fail.

We have had some big losers in the Ten Under $10 since we started sharing in August of 2020. The bear market of 2022 in gold and crypto hurt. We have also had enough big winners that have compensated for those big losers.

We are profitable overall. We are confident the system works but its success is in Multibagger stocks we let run.

The average return for stocks, over the life time of the stock market, is between 8% for large caps and $12% for small cap stocks. Small Caps tend to be more volitle than large caps. We can live with volatility and the returns we seek. Not many others can. Question yourself, and ask if this is for you?

We have a track record in the Ten Under $10 selections that starts August 1, 2020. No stop losses were used. Ten Under $20 for the Double, Aug 2020 to December 24, 2023 is linked here.

Speculating is a more concentrated approach to the market than investing.

It is therefore more volatile than what most investors consider acceptable.

Speculators embrace volatility as presenting opportunities.

Investing and speculating is a probability game.

“Understand what you own, why you own it, and the risk you are taking in owning it!”

“You know, we think diversification is—as practiced generally—makes very little sense for anyone that knows what they’re doing…it is a protection against ignorance.” – Warren Buffett.

The stock market is a device for transferring money from the impatient to the patient – Warren Buffett

Written December 26, 2023, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()