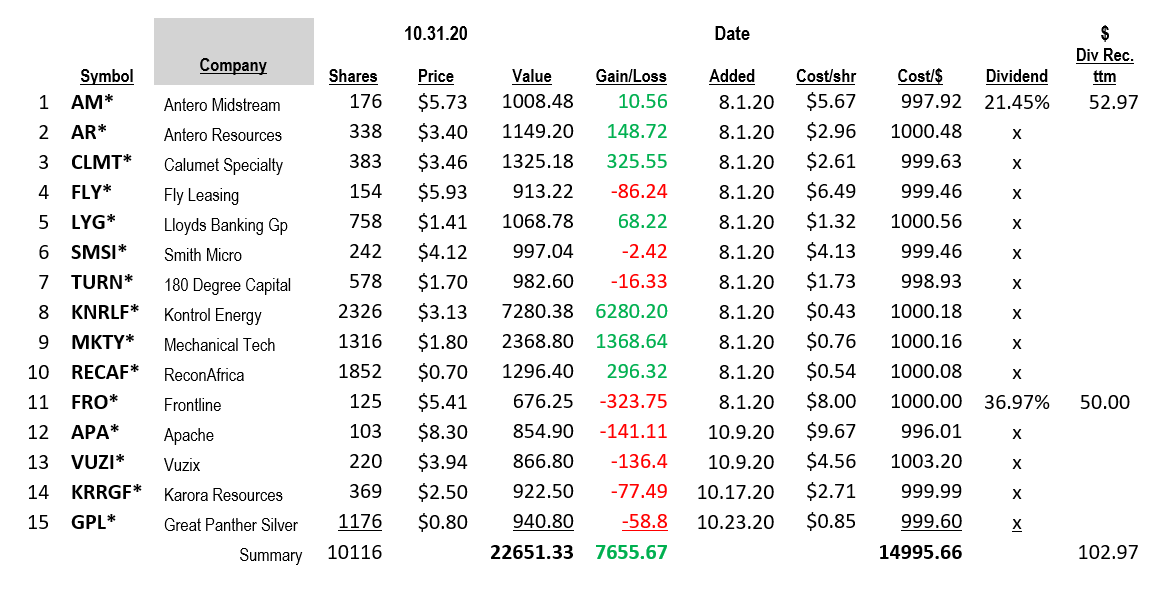

Market took a big correction this week. Our positions came down like everyone’s.

We have a position or two we will sell on a rally.

A possible candidate is FLY. Further research into the Airline industry suggest that lease rates were being negotiated lower even before Corona-19 Virus. Probably more so since the Communist China Corona Virus arrived. It is beginning to look like too much swimming against the current with no visible catalyst to resolve the issue. We do not suggest buying or adding to this position.

A second possible candidate for trimming is Lloyds (LYG)*. We like the opportunity in LYG, however the two candidates for higher valuations are higher interest rates and stable housing values in England. Not sure how soon that will materialize. On the technical side – the shares are perking up having traded above $1.50 this past week. Lloyds is the third largest bank in England and largest mortgage loan originator in England.

The remaining positions we are comfortable dollar cost averaging into to build share position.

-

Where Value meets Buy Signals!

Feel free to forward or recommend to others.* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()