- Obvious we are in a stock market correction.

- We’re not sure who our leadership will be coming out of the Election.

- We’re not even sure we’ll know after the election who will be the leader unless it is a landslide, one way or the other.

There are some things we can place in the “high probability” camp as investors.

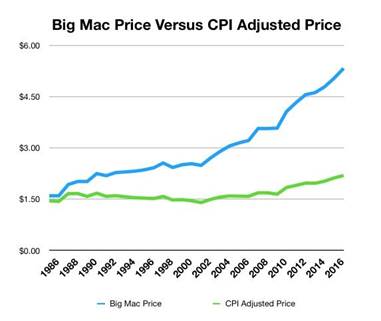

Fiat Money will continue to be printed in an effort to stave off depression – Inflation is easier to deal with and it allows the government to pay back “our” debt with cheaper dollars. What that means for you and me, is a loss of purchasing power.

3% to 5% real inflation (amount above ten-year treasury) for ten years is 30% to 50% loss of purchasing power. There is little doubt in my mind that “The Plan” of the Federal Reserve. Note current ten-year treasury is at 0.68% – “Real inflation” is not government figures as it has been doctored multiple times by both political parties. Watch what you are paying for rents, grocery food and restaurant prices for “real inflation”.

Sourced from D.H. Taylor newsletter

Of the four asset groups

- CASH –

- BONDS (Interest rate sensitive instruments)

- Equities

- Commodities (to include real estate)

Cash is trash as Ray Dalio has been saying. Unless of course the other three asset classes are worse….So we agree with Mr. Dalio longer term cash is trash but short term it is a necessary and useful asset to have if the majority do not have much.

Bonds are in the biggest bubble created by humans ever. A 38-year bull market started in 1982 when ten tear treasuries were above 16% and now are about 0.65%. Bond prices rise as interest rates decline. This has been a 38-year deflationary period in wages as we shipped jobs and manufacturing to China. Highest risk area of the market if the Federal reserve is successful in bringing back inflation – “The Plan”

Equities are a mixed bag. One can find bubbles or dirt-cheap value no matter what the situation. There are Tech stocks that will take 50 years to earn back your investment if you owned these companies privately and there are companies cash flowing so much free cash flow, that as a private company would return your investment in one to three years on the current price. At this time in the market we choose cash flows over Momentum.

Commodities are the poster child for an unloved out of favor asset class with the exception of precious metals and select types of real estate. Agriculture, Minerals and yes Oil & Gas are under attack by regulators & environmentalists. This creates bottlenecks in supply which in a growing demand (clean energy) world will drive up prices. Managements know the regulations and legal challenges with a left leaning administration. They will not invest in more supply and capacity in governments that don’t want them. Law of Human Nature. We saw this under the Obama war on fossil fuels. Little development of energy and mining. Therefore, we expect the same from a Biden Presidency. Even under a more friendly regulatory Trump led group, a weaker US$ and inflation is desired. This “is” the decade of inflation & commodities if governments around the world have their way. Precious Metals rally is the first wave that started in 2016. Bottle necks in Rare Earth Minerals, Nat Gas, Gasoline, Food and Rents will drive up prices. The bull market has started in this asset class but has five to ten years longer to run. Changes like this take decades.

- We like Mining stocks and minerals of all classes.

- We like Nat Gas in the fossil fuel area. We like green technology, but it is hardly at bargain prices.

- We like Bitcoin and Crypto Currency – digital currency is coming sooner than we as a nation expect – probably in early 2021. Massive fund flows are in the pipeline for this new asset class.

- We believe Blockchain is “the” next big wave of efficiency.

- We like special situations with low valuations and visible positive change events.

IN THE NEWS TODAY (one of our favorite P.M. stocks):

Motley FOOL 5 Stocks to Buy With $100 During a Market Sell-Off October 30, 2020

Fortunes are made by putting your money to work during periods of panic.

SSR Mining*

A stock market sell-off is the perfect time to consider putting $100 to work in gold stocks. While gold is often viewed as a safe-haven investment during times of uncertainty, current monetary policy and company-specific catalysts make SSR Mining (NASDAQ: SSRM) quite intriguing.

On a macro level, the Federal Reserve has been clear that it doesn’t intend to raise its federal-funds target rate for years. This means interest rates and bond yields will remain at or near record-tying lows for a while. Low yields, coupled with a ballooning money supply — a result of the Fed’s unlimited quantitative-easing measures to support financial markets — should pave the way for a higher gold price.

On a company-specific level, SSR Mining recently completed a merger of equals with Turkey’s Alacer Gold. The combined company should have the potential to easily top 700,000 ounces of gold each year, with an all-in sustaining cost of around $900 an ounce. This would work out to a cash operating margin of around $1,000 per gold-equivalent ounce.

Furthermore, SSR Mining is one of a small handful of gold stocks with a net cash balance. Considering the newly combined company expects $450 million in annual free cash flow through 2022, there’s a good chance a dividend or share buyback will be announced soon.

ALSO, IN THE NEWS:

Sibanye-Stillwater* racks up record Q3 core profit as operations recover

Oct. 29, 2020 Sibanye Stillwater Limited (SBSW)By: Carl Surran, Seeking Alpha News Editor

- Sibanye-Stillwater (SBSW*) says Q3 core earnings reached record levels, helped by higher metals prices, despite reduced production at its South African platinum mines.

- The company reports Q3 adjusted EBITDA nearly tripled to a record $922M compared with a year earlier.

LOTM Favored Ideas in the P.M. area include but not limited to:

SILJ $13.55 Junior Silver miner ETF

SSRM* $18.13

SBSW* $11.66

AU* $22.87

KRRGF* $2.423

GPL* $0.75

PAAS* $30.76

Could be many more… we suggest Closed End Funds and ETF’s for a broader reach into this sector.

-

Where Value meets Buy Signals!

Feel free to forward or recommend to others.* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()